Analyzing the impact of applying engagement policies

2 Tasks

20 mins

Scenario

U+ Bank is currently cross-selling on the web by presenting various credit cards to its customers. The business wants to present more personalized offers to its customers. To achieve this outcome, in the last quarter, the business applies various Eligibility, Applicability, and Suitability conditions on Actions.

The bank wants to analyze the results of these changes to see the impact of applying the applicability and suitability conditions. They also want to identify underserved customers.

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Next-Best-Action Designer | DecisioningArchitect | rules |

Your assignment consists of the following tasks:

Task 1: Analyze the impact of applying applicability and suitability conditions

Analyze the impact of applying engagement policies by exploring Impact Analyzer results and answer the following questions:

- What is the value lift and engagement lift that results from applying applicability and suitability conditions for the Credit Cards group in the last quarter?

- What is the average value per impression after you apply all engagement policies versus applying only eligibility conditions for the Credit Cards group in the last quarter?

Task 2: Analyze the current customer engagements using Value Finder

Create and run the Value Finder simulation for the Grow issue and Credit Card group. Use the SampledCustomers_Inbound data set as the audience.

Then, inspect the result of the simulation by answering the following questions:

- How many customers received relevant actions, and how many received low-propensity actions?

- Above which propensity is an action considered relevant for a customer?

- Which Applicability rules cause issues because customers receive no actions? Can you make applicability conditions less restrictive?

Challenge Walkthrough

Detailed Tasks

1 Analyze the impact of applying applicability and suitability conditions

- On the exercise system landing page, click Pega InfinityTM to open Customer Decision Hub:

- Log in as a Decisioning Architect:

- In the User name field, enter DecisioningArchitect.

- In the Password field, enter rules.

- In the navigation pane of Customer Decision Hub, click Discovery > Impact Analyzer to open Impact Analyzer.

- Question: What is the value lift and engagement lift generated by applying applicability and suitability conditions for the Credit Cards group in the last quarter?

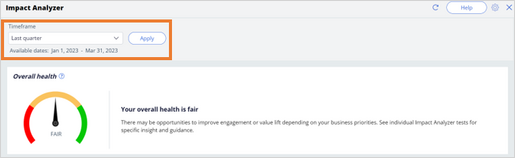

- In the Timeframe list, select Last quarter, and then click Apply:

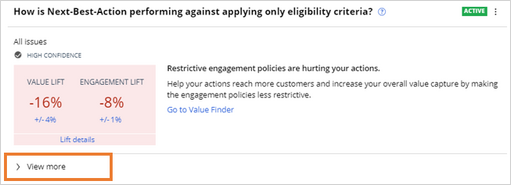

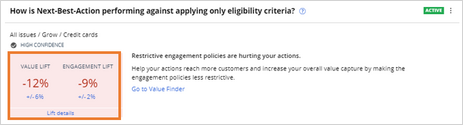

- In the How is Next-Best-Action performing against applying only eligibility criteria? experiment widget, click View more:

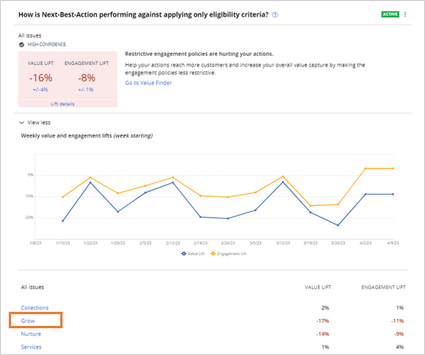

- In the All issues section, click Grow:

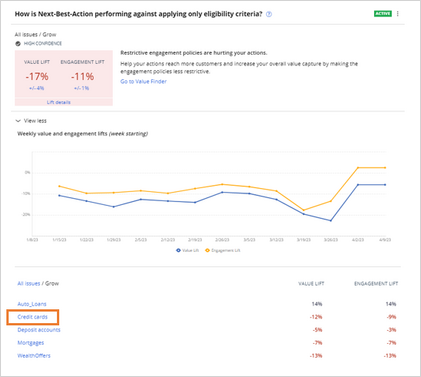

- In the group list, click Credit Cards:

- Check the percentage values for the Value Lift and Engagement Lift:

Note: The values of the value lift and engagement lift percentage might vary depending on the instance you are using.

- In the Timeframe list, select Last quarter, and then click Apply:

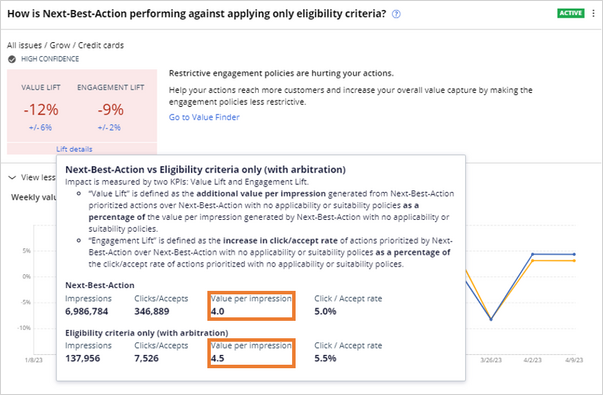

- Question: What is the average value generated per impression after you apply all engagement policies versus applying only eligibility conditions for the Credit Cards group in the last quarter?

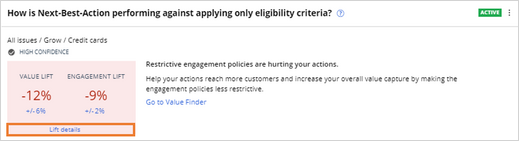

- In the How is Next-Best-Action performing against applying only eligibility criteria? experiment widget, click Lift details:

- In the Lift details window, check the average value generated per impression for Next-Best-Action and for Eligibility criteria only (with arbitration):

Note: In this case, the Value per impression is higher for Eligibility criteria only (with arbitration), which might suggest that the engagement policies are too strict. The results might vary depending on the instance that you are using.

- In the How is Next-Best-Action performing against applying only eligibility criteria? experiment widget, click Lift details:

2 Analyze the current customer engagements using Value Finder

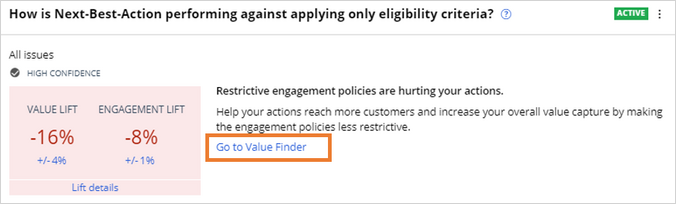

- In the How is Next-Best-Action performing against applying only eligibility criteria? experiment widget, click Go to Value Finder:

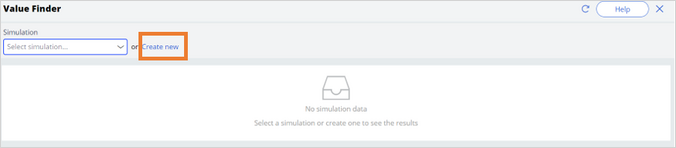

- On the Value Finder landing page, click Create new to create a new simulation:

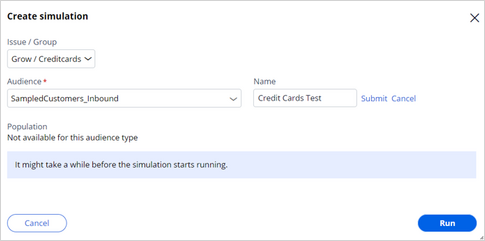

- In the Create simulation dialog box, configure the following information:

- In the Issue/Group, select Grow/Creditcards, and then click Apply.

- In the Audience list, select SampledCustomers_Inbound.

- In the Name field, click the Edit icon,enter Credit Cards Test, and then click Submit.

- Click Run to run the simulation.

The following figure shows the completed Create simulation dialog box:Note: In the current environment, the simulation run can take between 3 and 5 minutes. Wait until you see that the simulation status is completed.

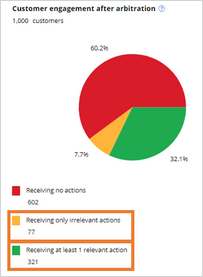

- Question: How many customers received relevant actions, and how many received low-propensity actions?

- In the Customer engagement after arbitration pie chart, check the number of customers in the given categories:

Note: In this case, the number of customers who received relevant actions is 321, and the number of customers who received low-propensity actions is 77. However, the results may vary depending on the instance you are using.

- In the Customer engagement after arbitration pie chart, check the number of customers in the given categories:

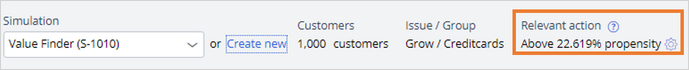

- Question: Above which propensity is an action considered relevant for a customer?

- In the Simulation details, check the propensity above which the action is considered relevant:

Note: In this case, the propensity above which the action is considered relevant is 22.619%. However, the results may vary depending on the instance you are using.

- In the Simulation details, check the propensity above which the action is considered relevant:

- Which Applicability rules cause issues due to which customers receive no actions? Can you make applicability conditions less restrictive?

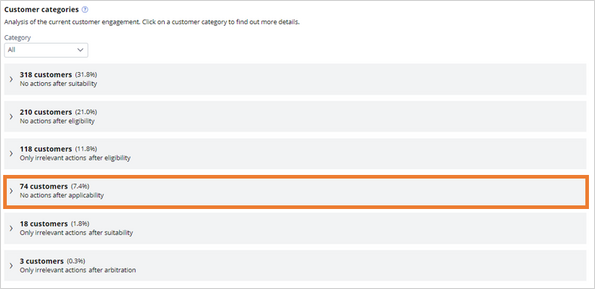

- Open the No actions after applicability category:

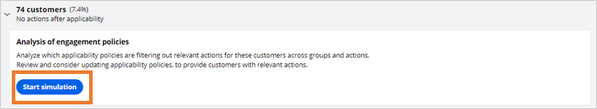

- Click Start simulation to begin a detailed simulation:

Note: In the current environment, the simulation run can take between 2 and 3 minutes. Wait until you see that the simulation status is completed.

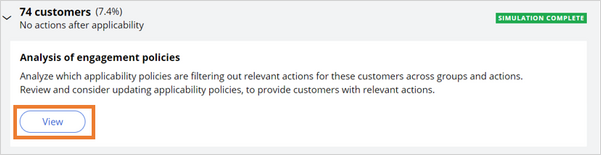

- When the simulation run is complete, click View:

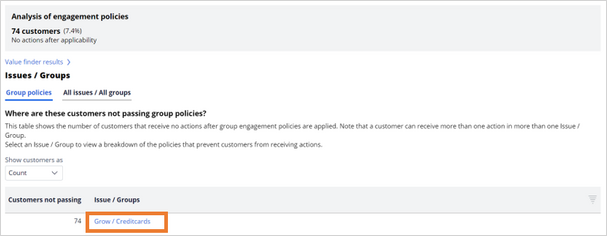

- In the Analysis of engagement policies tab, click Grow/Creditcards:

Note: The Customers not passing column shows how many customers do not pass the engagement policies stage.

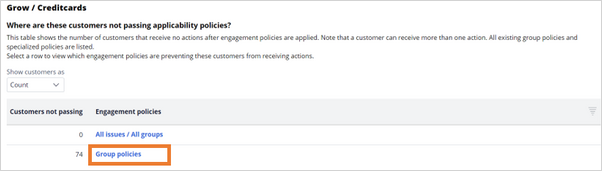

- In the Where are these customers not passing applicability policies tab, click Group policies:

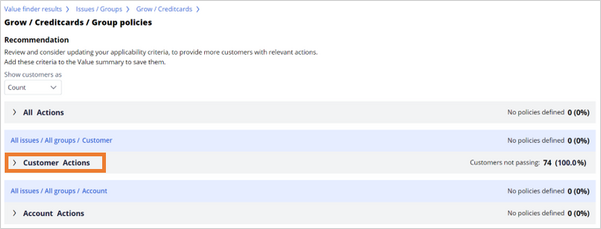

- In the Group policies section, expand the Customer Actions section to see the details about the engagement policies:

Note: In this case, 74 customers do not pass the applicability condition, which checks that the customer should not have any credit cards. Can you make applicability conditions less restrictive? Ultimately, this determination is a business decision. If the business thinks that customers can receive certain cards offers in combination with other offers, then this global group-level condition can be less restrictive.

- Open the No actions after applicability category:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?