Creating customer risk segments using a decision table

5 Tasks

35 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to its customers. The bank already uses a customer's credit score to determine their suitability for a credit card.

The bank now wants to implement suitability rules that prevent high-risk customers from receiving credit card offers. These new suitability rules require customers to be divided into risk segments that range from AAA to CCC. The risk segments are determined based on the customer's Relationship length in days, and by their credit score.

Only customers that belong to certain risk segments are suitable for a credit card.

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Decisioning Architect | DecisioningArchitect | rules |

The risk segments are determined by two parameters:

- Relations of customer with bank – Value available in the Relationship length in days property of the customer data model.

- Credit score – Score determined by the Determine Credit Score scorecard.

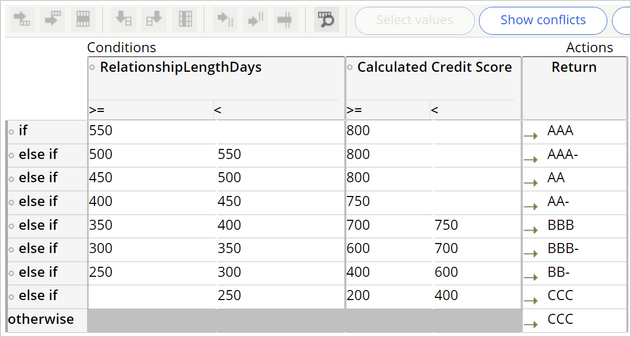

The following table describes the risk segmentation:

|

Condition |

Risk Segment |

|

If Relationship length days is greater than or equal to 550 and Credit score is greater than or equal to 800 |

AAA |

|

If Relationship length days is greater than or equal to 500 and less than 550 and Credit score is greater than or equal to 800 |

AAA- |

|

If Relationship length days is greater than or equal to 450 and less than 500 and Credit score is greater than or equal to 800 |

AA |

|

If Relationship length days is greater than or equal to 400 and less than 450 and Credit score is greater than or equal to 750 |

AA- |

|

If Relationship length days is greater than or equal to 350 and less than 400 and Credit score is greater than or equal to 700 and less than 750 |

BBB |

|

If Relationship length days is greater than or equal to 300 and less than 350 and Credit score is greater than or equal to 600 and less than 700 |

BBB- |

|

If Relationship length days is greater than or equal to 250 and less than 300 and Credit score is greater than or equal to 400 and less than 600 |

BB- |

|

If Relationship length days is greater than 250 and Credit score is greater than or equal to 200 and less than 400 |

CCC |

|

If Relationship length days and Credit score falls in any other range |

CCC |

Your assignment consists of the following tasks:

Task 1: Create a decision strategy to determine customer credit scores

Create a decision strategy and import the DetermineCreditScore scorecard rule to determine customer credit scores.

Task 2: Create a decision table

Create a decision table that implements the bank's risk segmentation requirement in accordance with the table above.

Task 3: Ensure that customers in the BB- and CCC risk categories are not eligible for credit cards

Amend the decision strategy to ensure that customers in a given risk category are not eligible for offers. Ensure that customers in the BB- and CCC risk categories are ineligible for credit cards. Customers from all other risk segments are eligible.

Task 4: Test the strategy for different customers

Verify that customer Barbara is eligible for a credit card, while Robert is ineligible. Use the information in the following table for verification:

|

Customer |

Relationship length days |

Credit Score |

Eligible |

|

Barbara |

364 |

700 |

YES |

|

Robert |

339 |

550 |

NO |

Task 5: Amend Next-Best-Action Designer's eligibility criteria for the Credit Cards group.

Amend Next-Best-Action Designer's suitability criteria for the Credit Cards group as follows: credit cards are suitable for all other risk segments except for customers belonging to risk segment BB- and CCC.

Task 6: Confirm your work

Log in as Barbara and Robert to see who is eligible to get the credit cards.

Challenge Walkthrough

Detailed Tasks

1 Create a decision strategy to determine customer credit scores

- On the exercise system landing page, click Launch Pega Infinity™ to log in to Pega Customer Decision Hub™.

- Log in as a decisioning architect:

- In the User name field, enter DecisioningArchitect.

- In the Password field, enter rules.

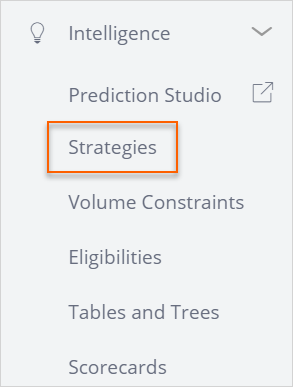

- In the navigation pane of Customer Decision Hub, click Intelligence > Strategies to open the Strategies landing page.

- On the Strategies landing page, in the upper right, click Create > Start with new canvas to begin creating the strategy.

- On the Create Strategy landing page, in the Strategy Record Configuration section, in the text box field, enter Risk Segmentation.

- In the Strategy Results class area, in the Business issue list, select Grow.

- In the Group list, select CreditCards.

- Optional: In the Development branch list, select [No branch].

- In the Context section, in the Apply to field, enter or select UBank-CDH-Data-Customer.

- In the upper right, click Create and open to edit the open the canvas of the strategy.

- On the canvas, right-click, and then select Enable external input to enable external inputs.

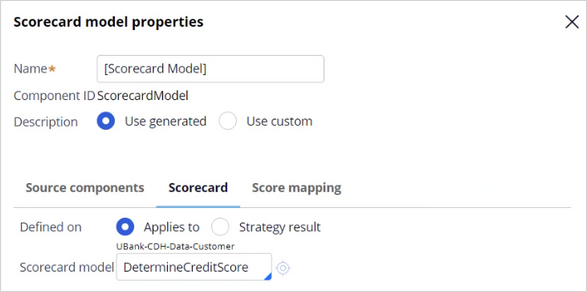

- On the canvas, right-click, and then select Decision analytics > Scorecard model to add a scorecard model component.

- Right-click the scorecard model component, and then select Properties.

- In the Scorecard model properties window, in the Scorecard model field, enter or select DetermineCreditScore.

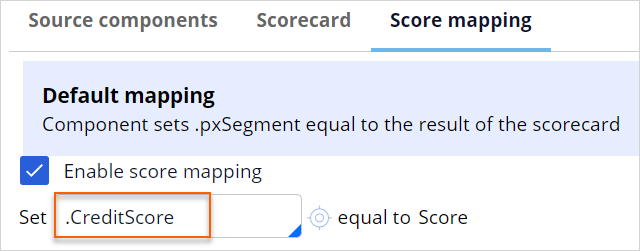

- Click the Score mapping tab to enable score calculation.

- Select the Enable score mapping check box.

- In the Set field, enter or select .CreditScore.

- Click Submit.

2 Create a decision table

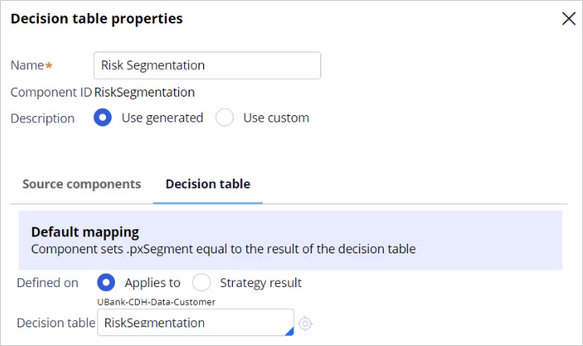

- On the canvas, right-click, and then select Business rules > Decision table to add a Decision table component.

- Open the Decision table component properties.

- In the Name field, enter Risk Segmentation.

- Set the Decision table value to RiskSegmentation.

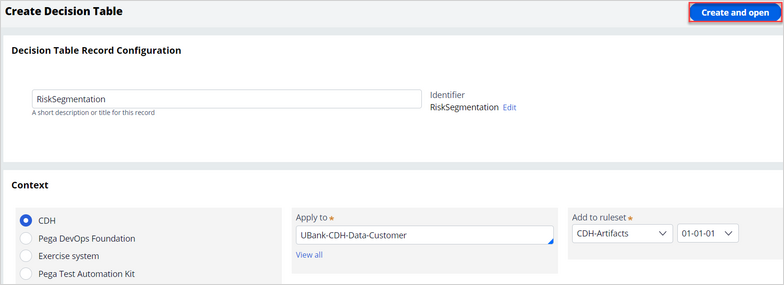

- To the right, click the Open icon to create the decision table.

- On the Create Decision Table page, change the Apply to class to UBank-CDH-Data-Customer.

- Click Create and open.

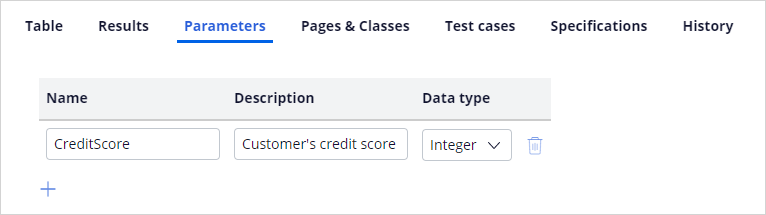

- Click the Parameters tab and enter the following details:

- Name: CreditScore

- Description: Customer's credit score

- Data type: Integer

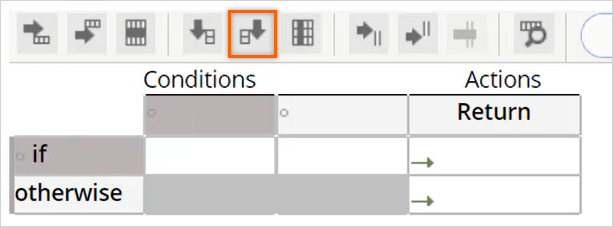

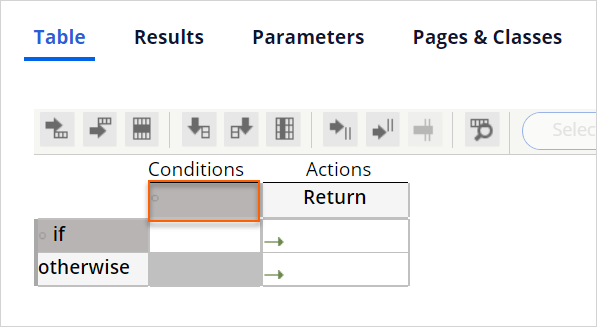

- On the Table tab click the first cell in Conditions column to edit the decision table.

- In the tool bar, click Insert column After to add another column.

- In the Conditions column, click the first cell to select the first Property.

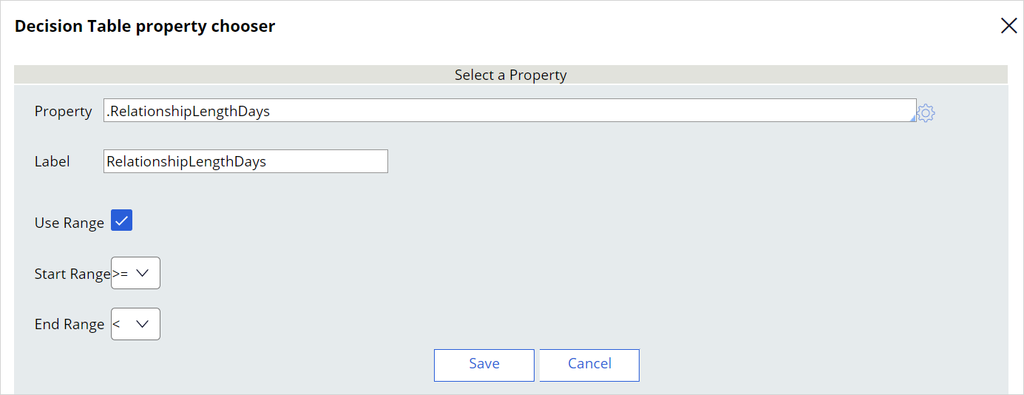

- In the Property field, enter or select .RelationshipLengthDays.

- In the Label field, enter RelationshipLengthDays.

- Select the Use Range check box.

- Select < from the End Range list.

- Click Save to return to the Table tab.

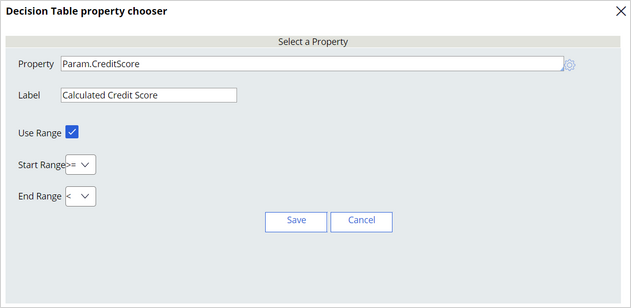

- In the Conditions column, click the second cell, and then enter the following information:

- In the Property field, enter Param.CreditScore.

- In the Label field, enter Calculated Credit Score.

- Select the Use Range check box.

- Select < from the End Range list.

- Click Save to return to the Table tab.

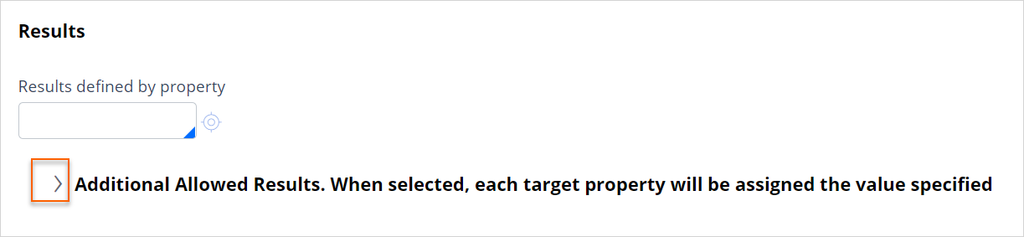

- Click the Results tab.

- On the Results tab, expand Additional Allowed Results. When selected, each target property will be assigned the value specified.

- In the Result field Enter AAA.

- Click the Add icon to add the next result.

- Repeat step 15-16 to add the results AAA-, AA, AA-, BBB, BBB-, BB-, and CCC.

- Click Save.

- On the Table tab, click Check Out.

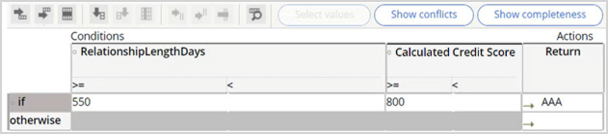

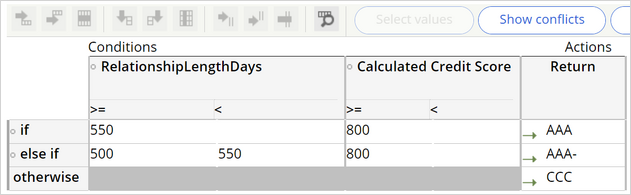

- In the if row, enter the following values:

- Relationship Length Days >= 550

- Credit Score: 800

- Return: AAA

- Click the Insert Row After icon and add an else if row. Enter the following values in the else if row:

- Relationship Length Days range: 500 - 550

- Credit Score: 800

- Return: AAA-

- Enter the following eligibility conditions and return values:

- In the upper right, click Check in to save the decision table.

- Enter appropriate Check in comments. For example, Decision Table created.

- Click Check in and close the decision table.

3 Ensure that customers in the risk category BB- and CCC are ineligible for credit cards

- In the Decision Table properties window, click Submit to save the configuration.

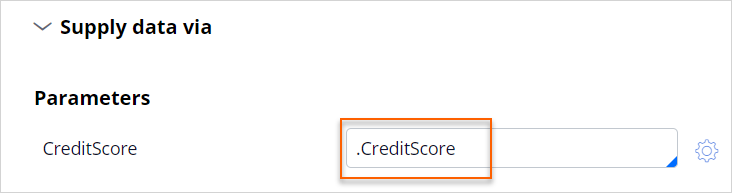

- Open the Decision Table properties window again to see the Supply data via section.

- Expand the Supply data via section and set the CreditScore parameter to .CreditScore.

- Click Submit.

- On the canvas, connect the Determine Credit Score component to the Risk Segmentation component.

- On the canvas, right-click, and then select Arbitration > Filter to add a filter component.

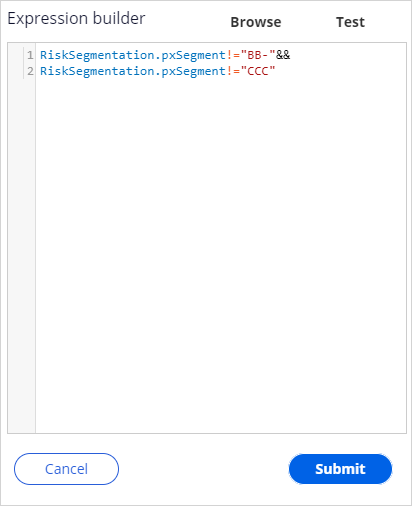

- Right-click the Filter component, and then select Properties.

- In the Name field, enter Low Risk.

- Open the Expression builder to define the condition as RiskSegmentation.pxSegment!="BB-"&& RiskSegmentation.pxSegment!="CCC".

- Click Submit.

- Click Submit to close Filter properties dialog box.

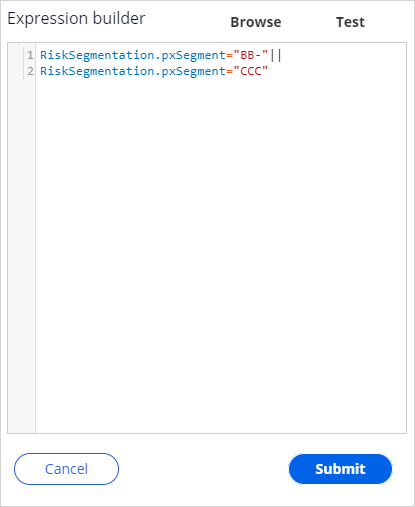

- Add another Filter component.

- Right-click the Filter component, and then select Properties.

- In the Name field, enter High Risk.

- Open the Expression builder to define the condition as RiskSegmentation.pxSegment="BB-"|| RiskSegmentation.pxSegment="CCC".

- Click Submit.

- Click Submit to close Filter properties dialog box.

Note: A dotted line connects the Risk Segmentation decision table component to the Filter component.

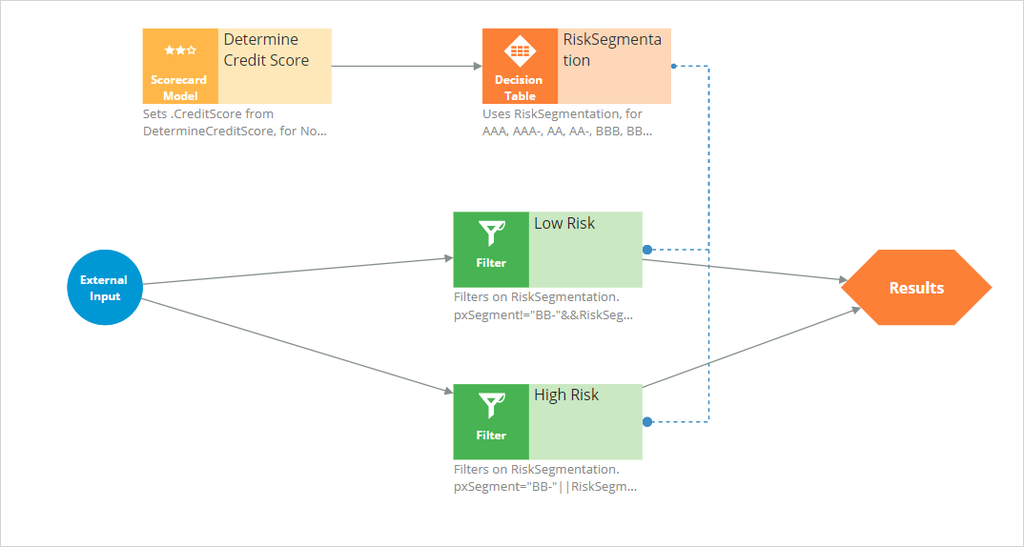

- Connect the External Input to both Filter components and then the Filter components to the Results. The strategy should look like the following image:

- Save the strategy.

4 Test the strategy for different customers

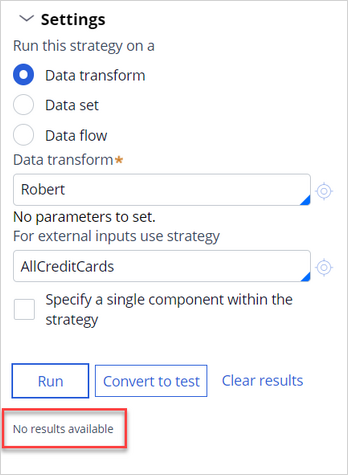

- Open the test panel to the right of the strategy.

- Double click on the canvas to center the strategy.

- Expand Settings.

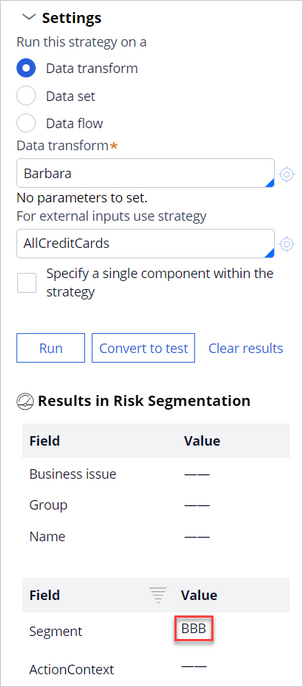

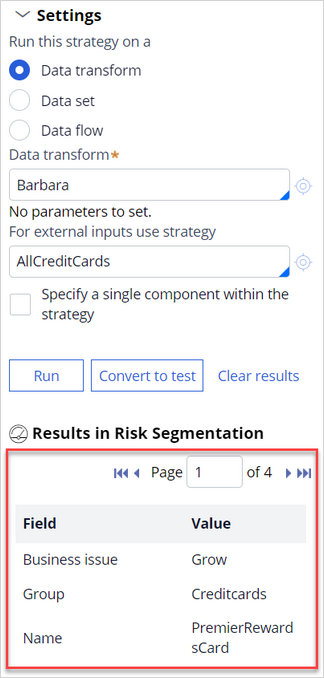

- In the Data transform field, enter or select Barbara.

- In the For external inputs use strategy field, select AllCreditCards.

- Click Run.

- On the canvas, click the Risk Segmentation component, and then verify that the decision table classifies Barbara in the BBB risk category.

- Click the Low Risk Filter component and confirm that Barbara is eligible for the credit cards.

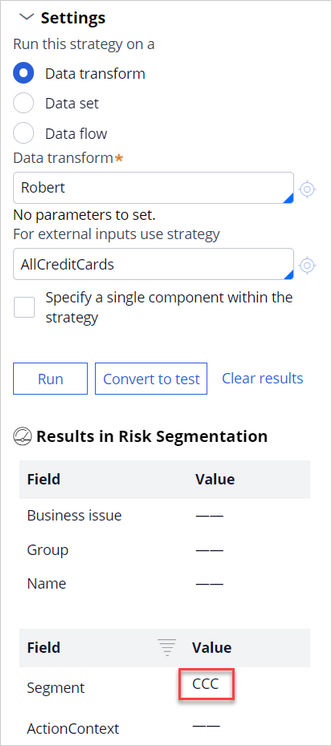

- Repeat steps 4 to 8 to verify that Robert is categorized in the CCC risk segment and is ineligible for any of the credit cards.

- Add the decision strategy as a relevant record so that it can be used as an eligibility strategy in the Next-Best-Action Designer.

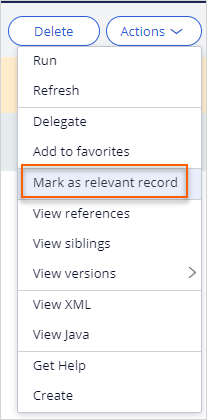

- In the header of the strategy canvas, click Actions > Mark as relevant record to use the decision strategy in an engagement policy in Next-Best-Action Designer.

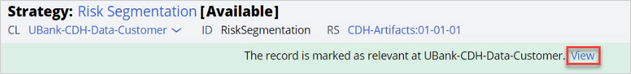

- In the Mark as relevant record success banner, click View to launch the Application: Inventory page.

- Scroll to find the Risk Segmentation strategy.

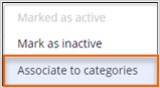

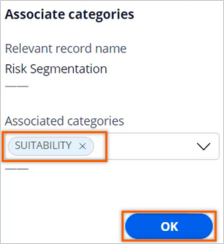

- Click the More icon, and then select Associate to categories.

- In the Associated categories list, select SUITABILITY, and then click OK.

- Close the Application Inventory page.

- In the header of the strategy canvas, click Actions > Mark as relevant record to use the decision strategy in an engagement policy in Next-Best-Action Designer.

- Close the Strategy page.

5 Amend Next-Best-Action Designer's eligibility criteria for the Credit Cards group.

- In Customer Decision Hub, click Next-Best-Action > Designer.

- In Next-Best-Action Designer, click Engagement policy to access the engagement policies.

- In the Business structure, under Grow issue, click the Credit cards group.

- Click Edit.

- Expand the All actions section.

- In the Suitability section, click the Add icon to add a new row.

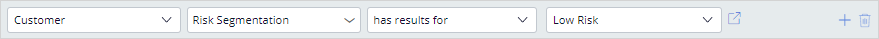

- In the first drop-down list, ensure that Customer is selected.

- In the second drop-down list, click the down arrow.

- In the list, select Strategy > Risk Segmentation.

Note: If the new strategy is not displayed, log out of Pega Customer Decision Hub, and then log back in.

- Ensure that has results for Low Risk is selected in the next two drop-down lists.

- Click Save.

Confirm your work

- On the exercise system landing page, in the upper left corner, select the Application Switcher and click U+ Bank icon to open the website.

- On the website main page, in the upper-right corner, click Log in to log in as a customer.

- Log in as Barbara, and then verify that she is eligible for card offers.

- Log in as Robert, and then verify that he is ineligible for any card offers.

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?