Leveraging a churn prediction

3 Tasks

25 mins

Scenario

U+ Bank uses AI to determine which credit card offers to show to customers on its website. The bank wants to reduce the number of clients that leave the bank by leveraging a prediction that aims to calculate the churn risk. The predictive model that drives the prediction is based on the historical data of the bank’s customer base. The bank wants to show the potential churners a retention offer instead of a credit card offer.

As a decisioning analyst, your task is to create an engagement strategy that leverages the churn prediction. Next, you configure the Next-Best-Action Designer to decide between a credit card offer and a retention offer based on the outcome of the churn prediction.

Use the following credentials to log in to the exercise system:

|

Role |

User name |

Password |

|---|---|---|

|

Decisioning Analyst |

CDHAnalyst |

rules |

Caution: This challenge requires specific artifacts. Ensure that you click Initialize (Launch) Pega instance for this challenge to get the correct exercise system.

Your assignment consists of the following tasks:

Task 1: Edit the RetentionStrategy to implement the new applicability rule

In Pega Customer Decision Hub™, modify the skeleton RetentionStrategy to accommodate the following applicability rule: a retention offer is applicable for customers who are high risk to churn. The strategy should have a component (named, for example, High Churn Risk), which outputs the incoming strategy results if the customer is high churn risk. Otherwise, the component should not output results.

Note: Use the PredictChurnPropensity prediction to determine if a customer is likely to churn.

Task 2: Configure the Next-Best-Action Designer

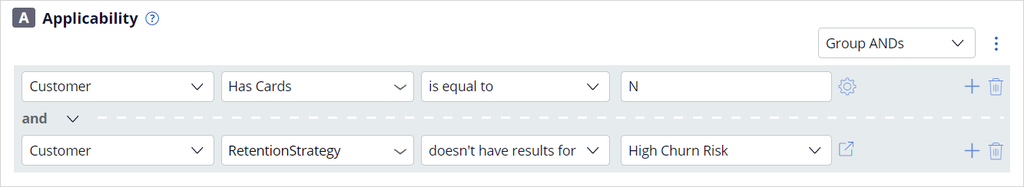

Configure the engagement policies with the newly created engagement strategy as group-level applicability rules. Ensure that the following rules are implemented:

- Retention offers are applicable for customers who are at high risk of churn.

- Sales offers are inapplicable for customers who are at high risk of churn.

Note: Retention offers are under the Retention business issue, in the ExtraMiles group.

Task 3: Confirm your work

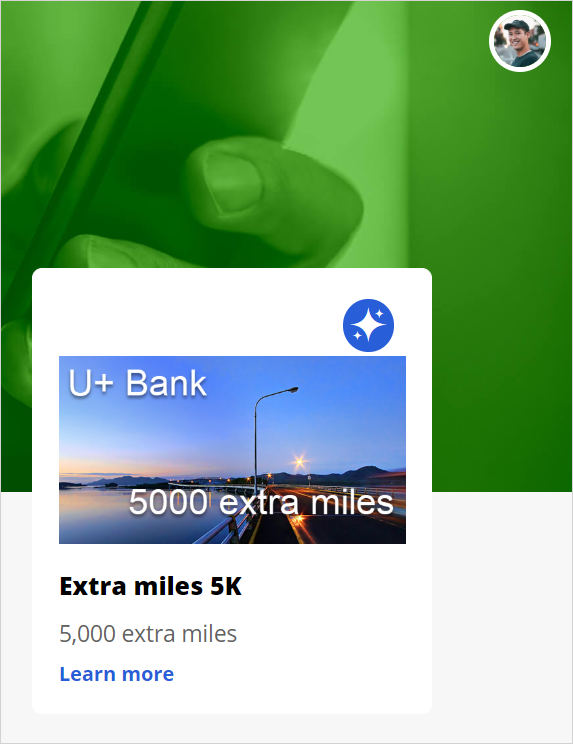

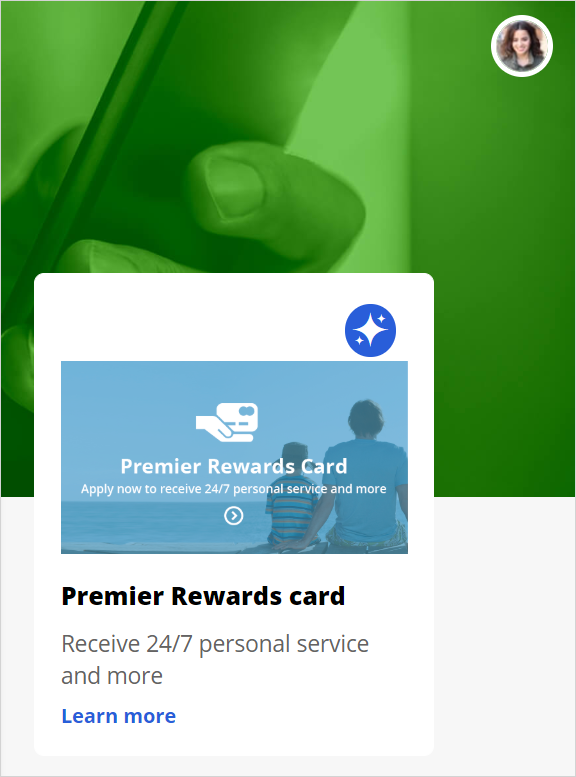

On the U+ Bank website, verify that customer Troy, a customer who is predicted to churn soon, is presented with a retention offer. Verify that customer Barbara, a customer who is expected to remain loyal for now, receives a credit card offer.

Challenge Walkthrough

Detailed Tasks

1 Edit the RetentionStrategy to implement the applicability rule

- Log in as a Decisioning Analyst with user name CDHAnalyst and password rules.

- In the navigation pane on the left, click Intelligence > Strategies.

- Search for and double-click RetentionStrategy.

- Check out the strategy.

- Right-click the canvas, and then select Enable external input.

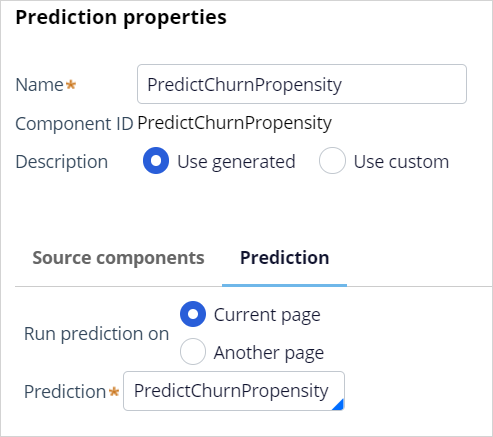

- Right-click the canvas, and then add a Prediction component.

- Right-click the component, and then select Properties.

- Select the PredictChurnPropensity prediction; the Name field is auto-populated.

- From the Arbitration category, add a Filter component.

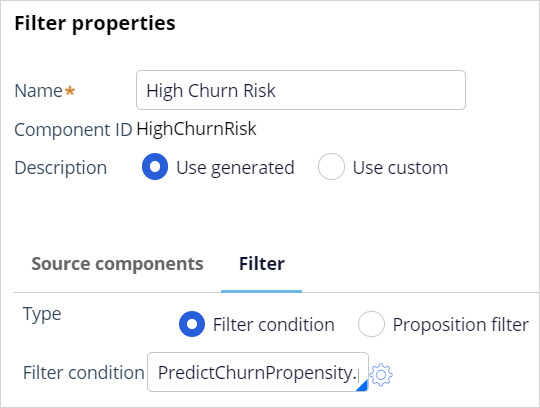

- Right-click the Filter component, and then select Properties.

- In the Name field, enter High Churn Risk.

- In the Filter condition field, enter PredictChurnPropensity.pxSegment=="Churn". Do not copy-paste, as some punctuation marks are not correctly recognized.

- Click Submit.

- From the Enrichment category, add a Set property component.

- Connect the Set property component to the Prediction component.

Note: The Set Property component provides the required input data for the prediction and can be used to set parameterized fields.

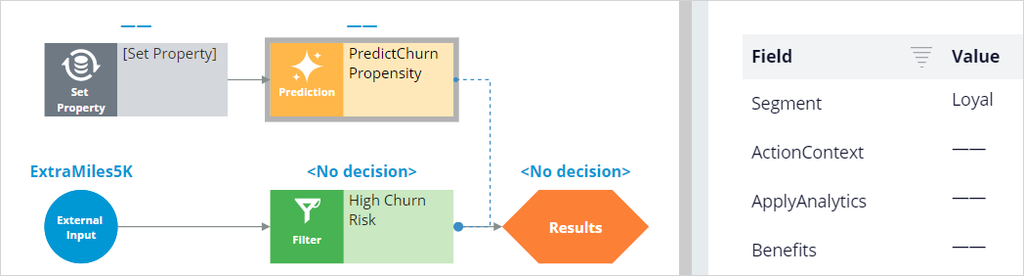

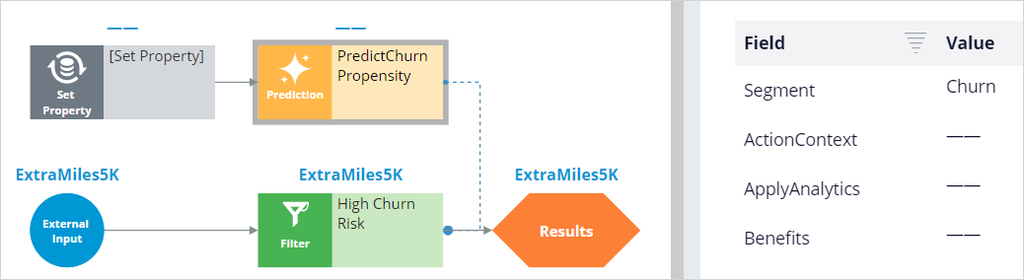

- Connect the External Input to the Filter component, and the Filter component to the Results. The strategy should resemble the following image.

- In the upper right, save the strategy configuration.

- On the right, click the arrow to open the Test run panel.

- In the Setting section, enter or select the following information:

- Data transform: Barbara

- For external inputs use strategy: RetentionOffers

- Click Save & Run.

- Ensure that the Results component does not contain a retention offer.

- On the canvas, click the Prediction and confirm that the segment for Barbara is Loyal.

- Repeat steps 14 and15 for Troy, and confirm that the segment for Troy is Churn.

- Ensure that the Results component contains a retention offer for Troy.

- Check in the decision strategy with appropriate check-in comments.

2 Configure the Next-Best-Action Designer

- In the navigation pane on the left, click Next-Best-Action > Designer.

- Click the Engagement policy tab.

- In the Business structure section, click the ExtraMiles group.

- Click Edit.

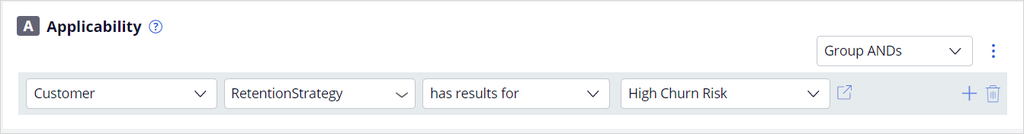

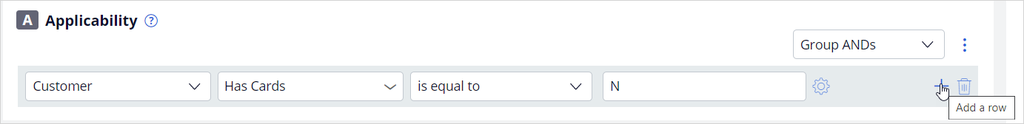

- In the Applicability section of the engagement policy, click the Add icon to add an applicability condition.

- In the first list, ensure that Customer is selected.

- In the second list, in the Strategy section, select RetentionStrategy.

- In the third list, ensure that has results for is selected.

- In the final list, select the High Churn Risk strategy component.

- Save the configuration of the ExtraMiles group.

- In the Business structure section, select the CreditCards group.

- Click Edit.

- In the Applicability section of the engagement policy, click the Add icon to add a new applicability condition.

- Save the configuration of the CreditCards group.

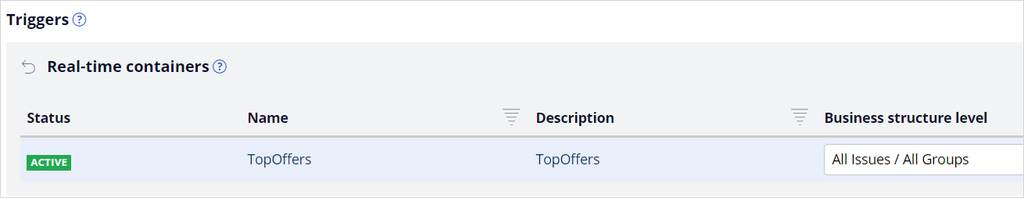

- In Next-Best-Action Designer, click Channels to configure the website integration.

- Click Edit.

- In the Triggers area, in the Real-time containers section, in the Business structure level column, select All issues / All groups.

- Save the Channels configuration.

3 Confirm your work

- On the Customer Engagement & Analytics landing page, click U+ Bank to open the website.

- On the main page of the website, in the upper right, click Log in to log in as a customer.

- Log in as Troy, who has a high churn risk, and verify that a retention offer is displayed.

Note: Allow some time for the offer to display. Subsequent offers are displayed immediately.

- In the upper right, click on the profile icon and log out.

- On the U+ Bank website, log in as Barbara, who is expected to remain loyal, and verify that a credit card offer is displayed.

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?