Using a scorecard for action-level suitability

Archived

3 Tasks

20 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to its customers. Due to the credit limits of each card, the business wants to include an additional suitability criterion:

- Rewards Plus and Premier Rewards are suitable only if Credit score > = 400.

The credit score value is available in the data model, and external process populates the value in a nightly batch. However, the credit score is not computed for every customer.

As a result, the business already implemented a scorecard rule, Determine Credit Score, which computes the credit score of a customer in case the score is not available.

Use the following credentials to log in to the exercise system:

|

Role |

User name |

Password |

|

Decisioning Analyst |

CDHAnalyst |

rules |

Caution: To reuse the exercise system from a previous challenge, first complete the Using a scorecard for group-level suitability challenge. Otherwise, click Initialize Pega or Reset Instance in this challenge.

Your assignment consists of the following tasks:

Task 1: Create a new Suitability strategy to implement the Action-level Suitability criterion

Rewards Plus and Premier Rewards are suitable only if Credit score > = 400.

The credit score value is present as a customer property, but it is not computed for every customer. You must use an existing scorecard rule, Determine Credit Score, which computes a customer’s credit score in case the score is not available.

Note: You can use the Credit Score decision strategy as a starting point for the new strategy, which already imports the right Scorecard.

Tip: To check if a customer property is set, you can use the PropertyHasValue() function.

Task 2: Define the Engagement Policy with the newly created strategy

Define the engagement policy with the newly created strategy as an action-level suitability rule.

Task 3: Confirm your work

Log in to the U+ Bank website as John and verify the offers.

Use the information in the following table for verification.

|

Customer |

Credit Score |

Results |

|

|

Rewards Plus Card |

Premier Rewards card |

||

|

John |

350 |

N |

N |

|

Arnold |

400 |

Y |

Y |

Note: When testing the strategy, use the RewardsPlusAndPremier strategy for external inputs. This strategy outputs both Rewards Plus and Premier Rewards actions.

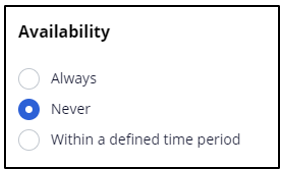

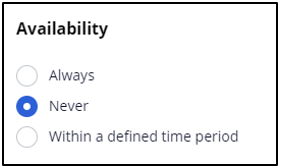

Note: Arnold is eligible for all four credit card offers. If you want to to see the effect of the changes for Arnold, you must disable both the Standard Card and Rewards Card offers, as these have higher priority. To disable an offer, in the Details section of the Offer landing page, mark the availablity as Never.

Challenge Walkthrough

Detailed Tasks

1 Create a new Suitability strategy to implement the Action-level Suitability criterion

- Log in as Decisioning Analyst with user name CDHAnalyst and password rules.

- In the navigation pane on the left, click Intelligence > Strategies.

- Click Credit Score to open the decision strategy.

- In the upper right, click Check out.

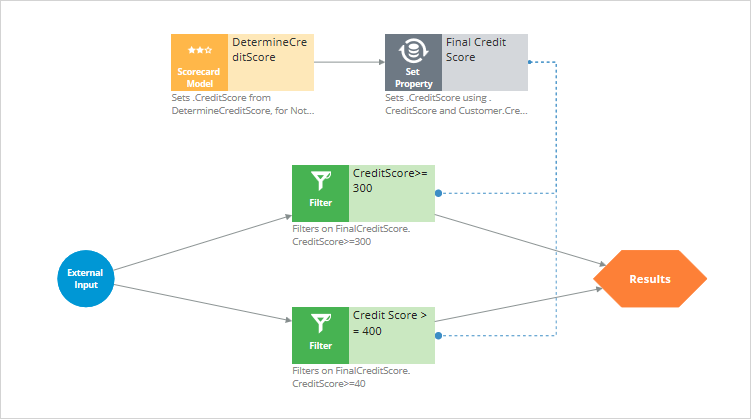

- On the canvas, click DetermineCreditScore, and then select Properties to open the scorecard component and enable the score calculation.

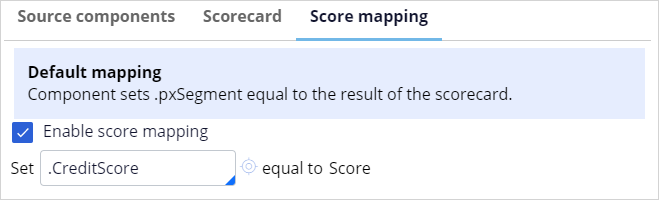

- Click the Score mapping tab.

- Select the Enable score mapping check box.

- Set the score to a strategy property CreditScore.

- Click Submit. Now you have the credit score from the Scorecard component, but this should only be used if the CreditScore property is not set.

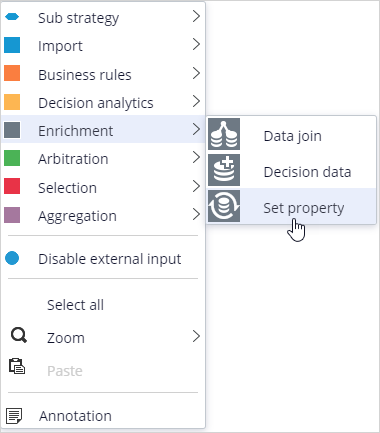

- On the canvas, right-click and select Enrichment > Set property to add the component.

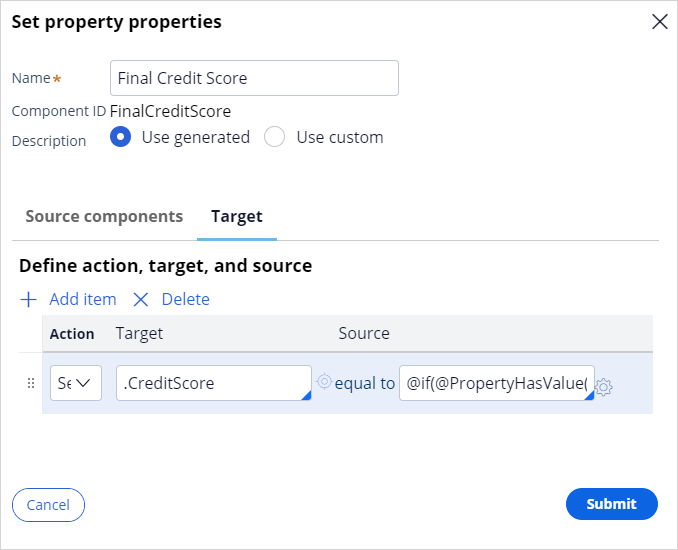

- Right-click the Set property component, and then select Properties to set the CreditScore.

- In the Name field, enter Final Credit Score.

- Click Add item.

- In the Action list, select Set.

- In the Target field, enter or select .CreditScore.

- Open the Expression builder to define the condition as if(PropertyHasValue(Customer.CreditScore), Customer.CreditScore, .CreditScore)

Note: Set the CreditScore to either the available CreditScore value from the customer data data model or the value computed by the scorecard.

- Click Submit.

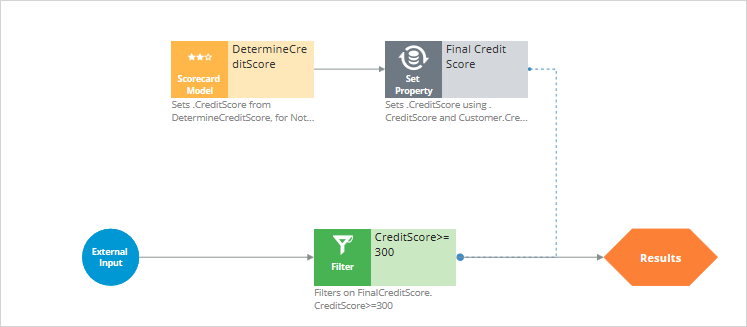

- Open the Filter component properties to modify the filter condition.

- Open the Expression builder to define the condition as FinalCreditScore.CreditScore>=300. A blue dotted line is added to the canvas that connects the Filter and Set property components.

- Connect the Scorecard Model component to the Set property component.

- On the canvas, right-click, and then select Arbitration > Filter to add the component.

- Right-click the Filter component, and then select Properties to enter the following information:

- In the Name field, enter Credit Score >= 400.

- Open the Expression builder to define the condition as FinalCreditScore.CreditScore>=400

- Click Submit.

- Connect the External Input to the Filter component.

- Connect the Filter component to the Results.

- Click Check in to complete your strategy modifications.

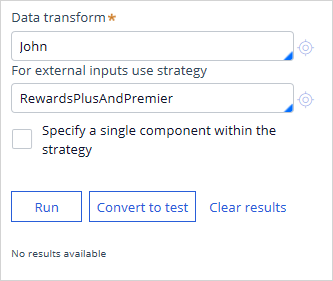

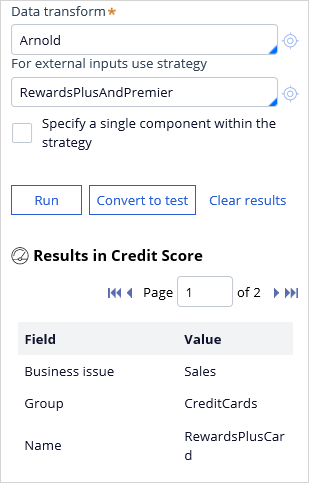

- On the canvas, select the Set Property component and enter the following information to test the strategy:

- Data transform: John

- For external inputs use strategy: RewardsPlusAndPremier

- Click Save & Run to verify the results of the scorecard

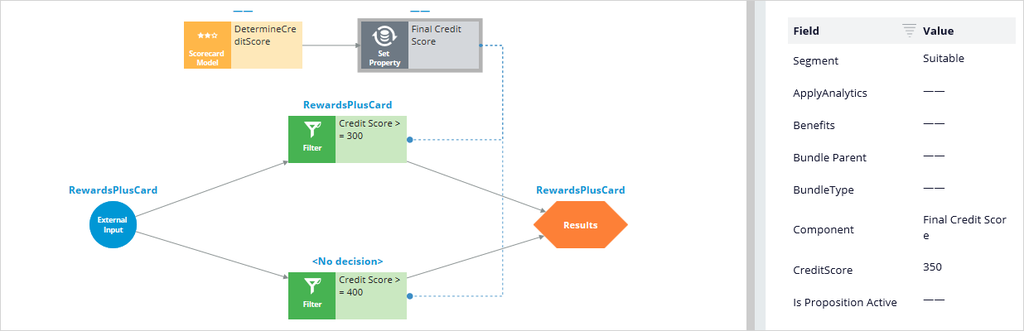

- On the canvas, click Filter (Credit Score > = 400) and notice that the strategy does not output any results.

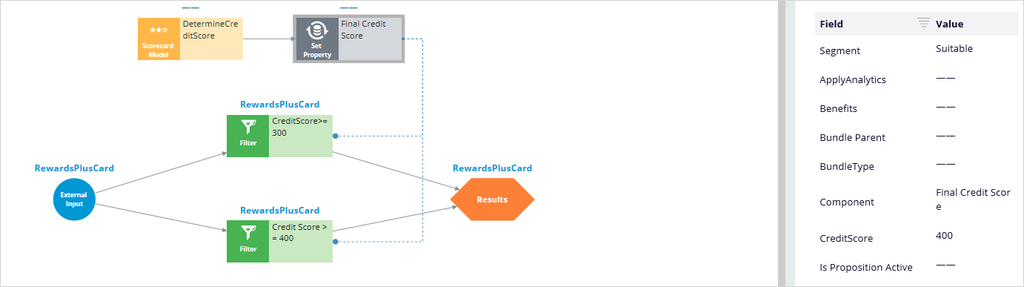

- Repeat steps 15 and 16 and check the results for the Arnold data transform.

- On the canvas, click Filter (Credit Score > = 400); notice that Arnold is suitable for both the Rewards Plus and Premier Rewards card offers.

2 Define the Engagement Policy with the newly created strategy

- In Customer Decision Hub, in the navigation pane on the left, click Next-Best-Action > Designer.

- In Next-Best-Action Designer click Engagement policy to access the engagement policies.

- In the Business structure, click the CreditCards group.

- Click Edit.

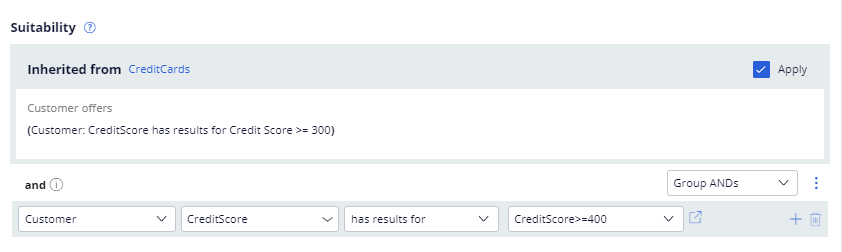

- In the Offers section, click the Rewards Plus card to define the action-level suitability condition.

- Click Engagement policy.

- Click Check out.

- In the Suitability section of the engagement policy, delete the existing action-level suitability rule for the Rewards Plus card.

- In the first drop-down list, click the down arrow.

- In the list, select the Strategy > Credit Score.

- Ensure that has results and for Credit Score >= 400 are selected.

- Click Check in to save the action-level suitability rule.

- and then close.

- Repeat steps 5-13 for the Premier Rewards card.

- Click Save.

3 Confirm your work

- On the Exercise System landing page, click on U+ Bank to open the website.

- On the website main page, in the upper right, click Log in to log in as a customer.

- Log in as John, and then verify that he is not suitable for the Rewards Plus or Premier Rewards card offers.

- Optional: Check the results for Arnold.

Note:

Arnold is eligible for all four credit card offers. If you want to to see the effect of the changes for Arnold, you need to disable both the Standard Card and Rewards Card offers, as these have a higher priority. To disable an offer, in the Details section of the Offer landing page, mark its availability as Never.

If you test for Arnold, be sure to re-enable the two offers after.