Predicting fraud

Introduction

Pega Process AI™ lets you bring your own predictive models to Pega. Use predictions in case types to optimize the way in which your application processes work and to meet your business goals. Learn how to use a predictive fraud model to effectively route suspicious claims for closer inspection.

Video

Transcript

This demo will show you how to use a predictive fraud model in a case type to route suspicious claims to an expert.

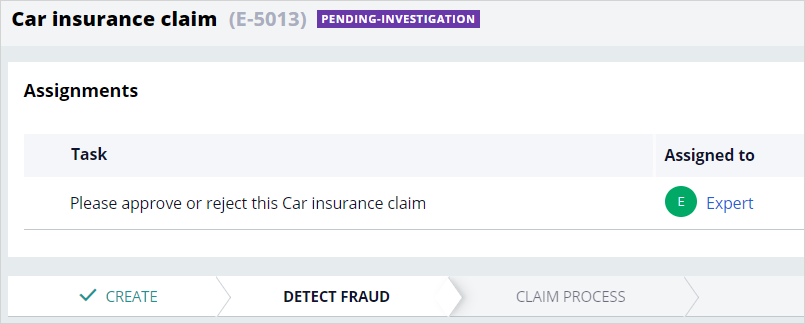

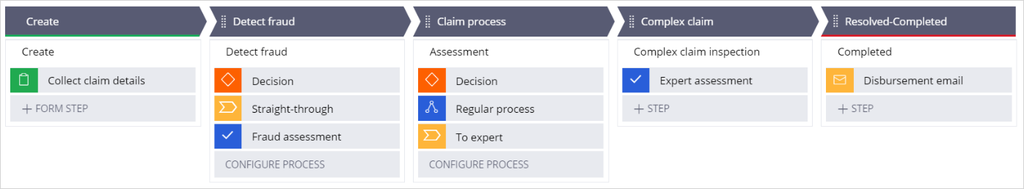

U+ Insurance uses Pega Platform™ for case management. The life cycle of the case type that processes incoming car insurance claims contains a fraud detection stage, a regular process stage, and a complex claim process stage.

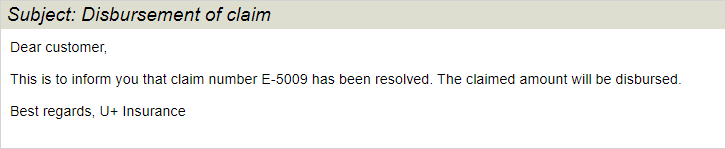

When the case is resolved, the claimant receives an email that communicates the decision.

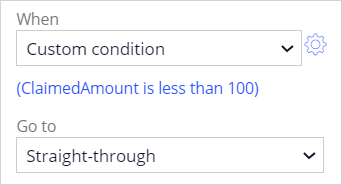

The decision step in the Detect fraud stage routes cases with a low claimed amount for straight-through processing.

A set percentage of claims with a high claimed amount is routed to an expert for fraud assessment.

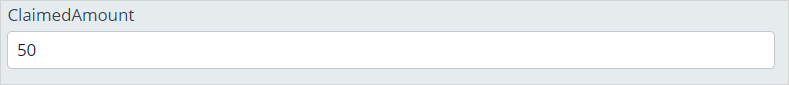

Consider this car insurance claim. The claimed amount is 50.

The claim qualifies for straight-through processing as the claimed amount is below the threshold. The case is automatically resolved, and the claimant receives an email that states that the claimed amount will be disbursed.

A fraud expert inspects a set percentage of cases with a high claimed amount.

After approval, the system routes the case to the regular claim process.

U+ Insurance wants to improve the effectiveness of fraud detection by using a predictive model that calculates the fraud risk of each claim.

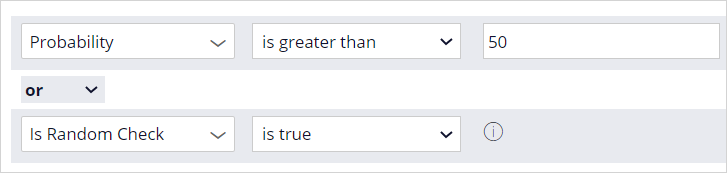

The business requirements are that claims only qualify for straight-through processing if the fraud risk score is very low, while all claims with a high fraud risk score are inspected by the fraud expert. The routing of randomly selected cases to the fraud expert must remain in place to create a control group.

The data scientist team of U+ Insurance has developed a fraud model on the H2O.ai platform and has validated the model against historical data that the company captured.

The system qualifies a claim as abnormal if the probability of fraud exceeds the threshold; otherwise, the system classifies the case as normal.

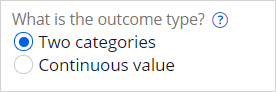

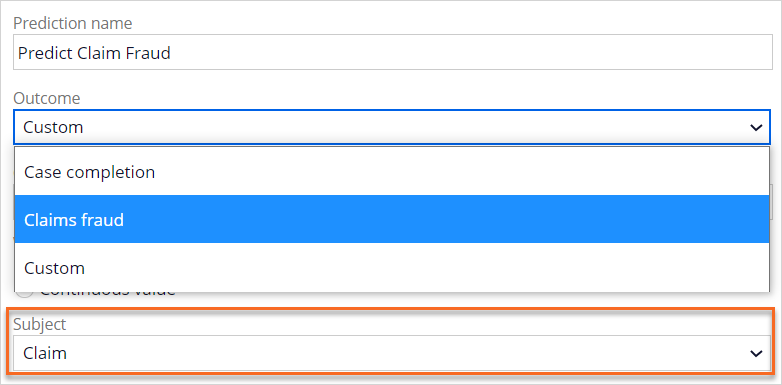

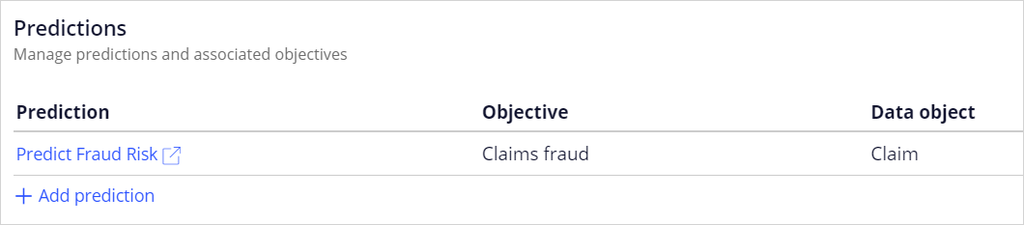

To implement the fraud model, you create a new case management prediction. You can create a custom prediction that can forecast binary or numerical outcomes.

For fraud detection, Process AI provides an out-of-the-box template. The claim is the subject of the prediction.

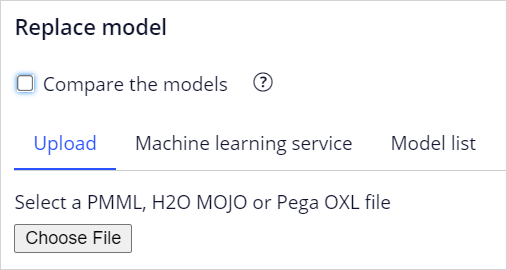

A placeholder scorecard initially drives the prediction.

When the predictive fraud model replaces the scorecard, the prediction is ready for implementation in the Car insurance claim case type. You replace the placeholder with a machine learning model, a scorecard, or a field that contains a precalculated score. You can upload a machine learning model as a PMML or H2O file. Alternatively, you can connect to online machine learning services.

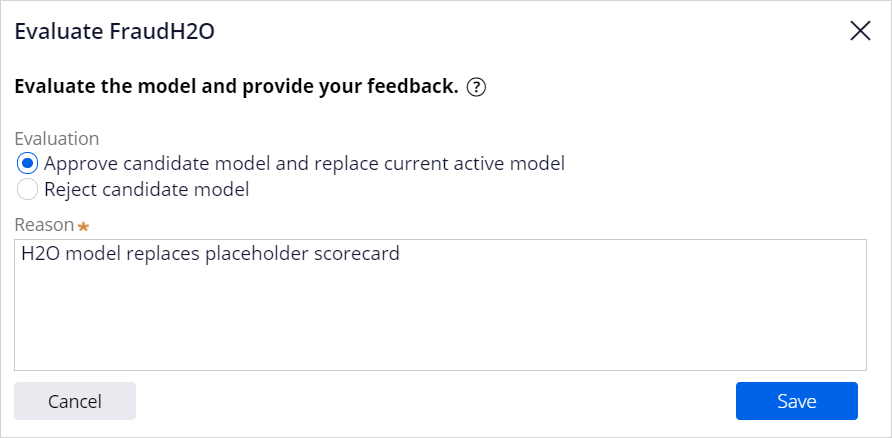

You can select predictive models that are available in the application in the model list. When the model is ready for review, approve the model to replace the scorecard.

The fraud model now drives the prediction.

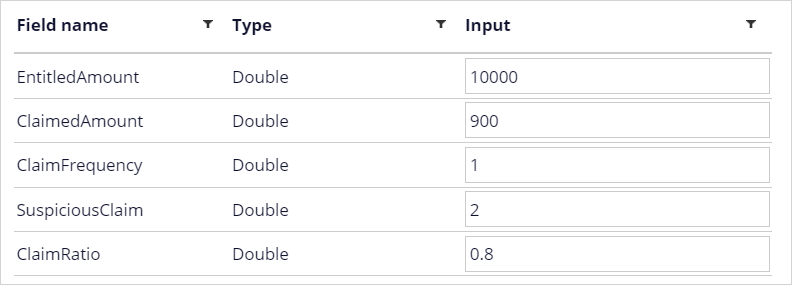

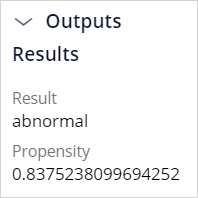

When you run the model with these input values, the model qualifies the claim as abnormal.

The model predicts the claim to be abnormal because the propensity value is above the threshold.

Predictors of the model include the claim data, such as location and claimed amount, but can also cover customer behavior data, such as the number of recent claims.

As an application developer, you can implement the fraud prediction to route claims based on the fraud risk calculated by the model. To use your fraud prediction, add the prediction to the case type.

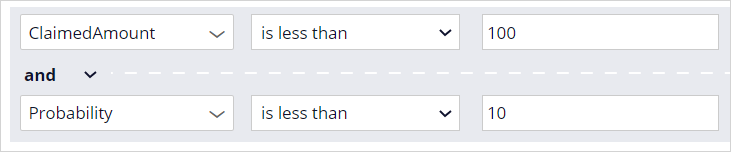

Next, in the Decision step in the Detect fraud stage of the life cycle, implement the prediction. Add the condition that only claims with a very low predicted fraud risk qualify for straight-through processing.

Replace the condition that routes a claim to a fraud expert based on the claimed amount with a condition that is based on the outcome of the fraud model and change the logical operator to generate the control group.

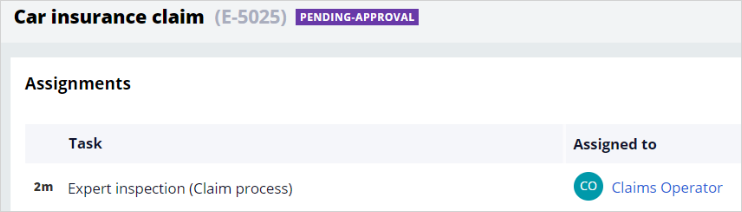

When you run the same claim that previously qualified for straight-through the claim now disqualifies because the condition that fraud risk is very low is not met and the system consequently routes the case for regular processing.

When a claim with the same predictor values as previously tested in Prediction Studio is run, the system routes the case to the fraud expert.

This demo has concluded. What did it show you?

- How to create a case management prediction driven by a predictive model.

- How to use a prediction in a case type.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?