Using a scorecard for action-level suitability

3 Tasks

25 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to its customers. Due to the credit limits of each card, the business wants to include an additional suitability criterion:

- Rewards Plus and Premier Rewards are suitable only if Credit score > = 700.

The credit score value is available in the data model. An external process populates the value in a nightly batch. However, the credit score is not computed for every customer.

As a result, the business already implemented a scorecard rule, Determine Credit Score, which computes the credit score of a customer in case the score is not available.

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Decisioning Architect | DecisioningArchitect | rules |

Your assignment consists of the following tasks:

Task 1: Create a new suitability strategy to implement the action-level suitability criterion

Rewards Plus and Premier Rewards are suitable only if Credit score > = 700.

The credit score value is present as a customer property. But it is not computed for every customer. Use an existing scorecard rule, Determine Credit Score, which computes a customer's credit score if the score is unavailable.

Note: You can use the Credit Score decision strategy as a starting point for the new strategy, which imports the correct scorecard.

Caution: To check if a customer property is set, you can use the PropertyHasValue() function.

Task 2: Test the decision strategy

Test the decision strategy to see that Barbara is suitable for getting the credit card and Robert is not suitable for getting the credit card.

Task 3: Define the engagement policy with the newly created strategy

Define the engagement policy with the newly created strategy as an action-level suitability rule.

Task 4: Confirm your work

Log in to the U+ Bank website as Barbara and Robert and verify the offers.

Use the information in the following table for verification.

|

Customer |

Credit Score |

Results |

|

|

Rewards Plus Card |

Premier Rewards card |

||

|

Barbara |

750 |

Y |

Y |

|

Robert |

550 |

N |

N |

Note: When testing the strategy, use the RewardsPlusAndPremier strategy for external inputs. This strategy outputs both the Rewards Plus and Premier Rewards actions.

Challenge Walkthrough

Detailed Tasks

1 Create a new suitability strategy to implement the action-level suitability criterion

- On the exercise system landing page, click Pega CRM suite to log in to Pega Customer Decision Hub™.

- Log in as a decisioning architect:

- In the User name field, enter DecisioningArchitect.

- In the Password field, enter rules.

- In the navigation pane of Customer Decision Hub, click Intelligence > Strategies to open the Strategies landing page.

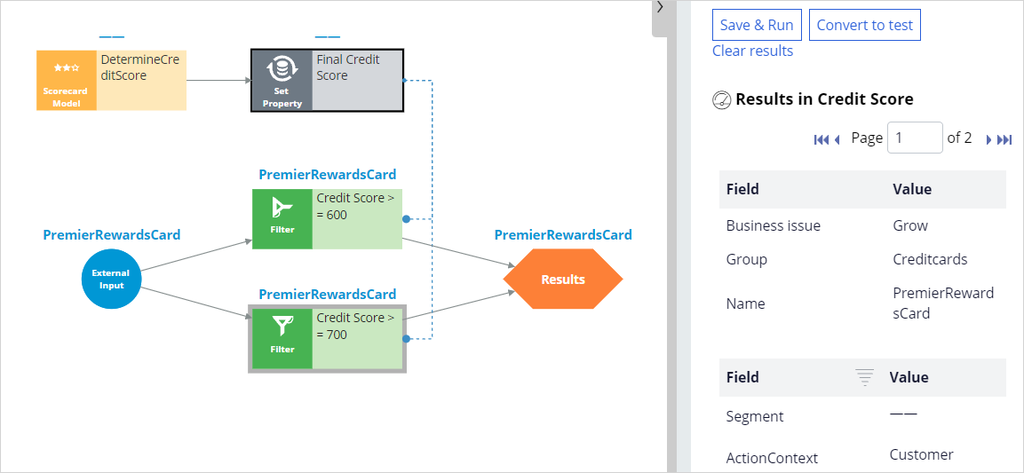

- On the Strategies landing page, double click Credit Score to open the decision strategy.

- In the upper right, click Check out to edit the Credit Score strategy.

- On the canvas, right-click the DetermineCreditScore component, and then select Properties to enable the score calculation.

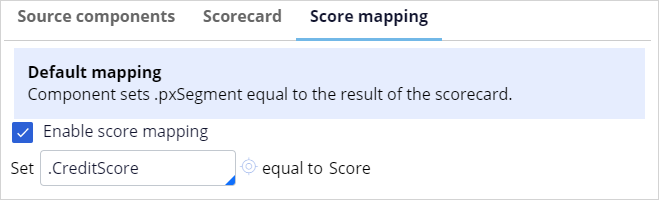

- In the Scorecard model properties dialog box, click the Score mapping tab.

- Select the Enable score mapping checkbox.

- In the mapping field, enter or select .CreditScore.

- Click Submit to close the dialog box.

Note: Only use the Credit Score decision strategy if the CreditScore property is not set.

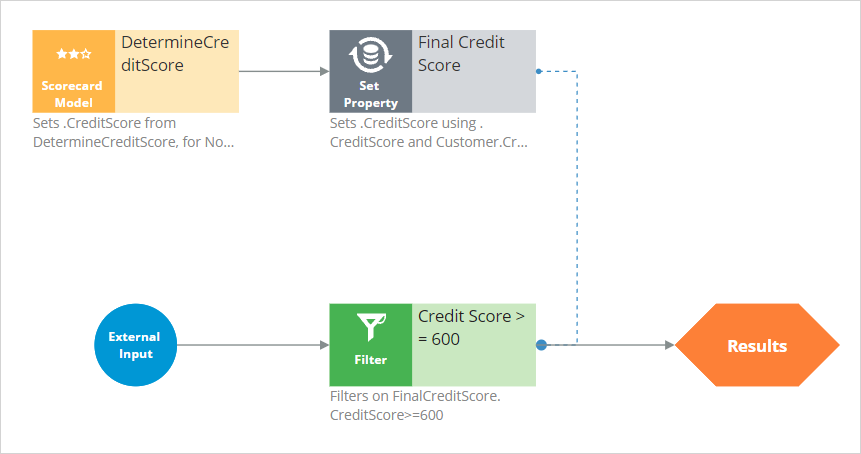

- On the canvas, right-click, and then select Enrichment > Set property to add the component.

- Right-click the Set Property component, and then select Properties to set the CreditScore.

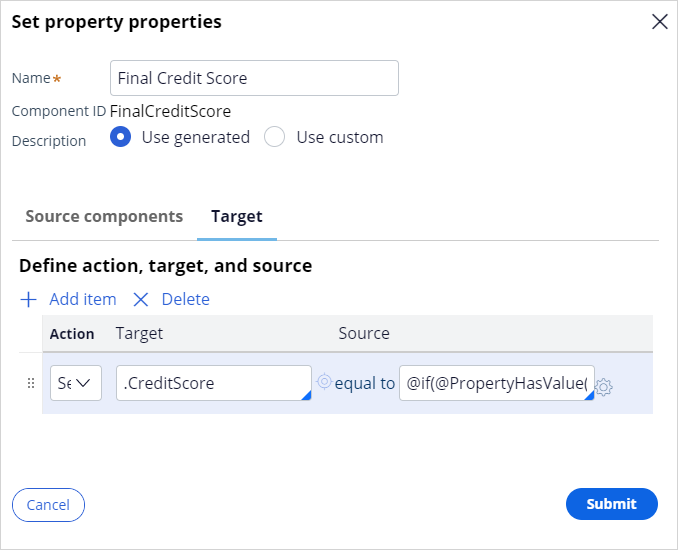

- In the Set property properties dialog box, in the Name field, enter Final Credit Score.

- In the Define action, target, and source section, click Add item to add an action.

- In the Action list, select Set.

- In the Target field, enter or select .CreditScore.

- Next to the Source field, click the Open icon to open the Expression builder to define the condition.

- In the Expression builder, enter if(PropertyHasValue(Customer.CreditScore), Customer.CreditScore, .CreditScore), and then click Submit.

Note: Set the CreditScore to either the CreditScore value that is available from the data model of the customer data or the value that the scorecard computes.

- Click Submit to close the Set property properties dialog box.

- On the canvas, right-click the Filter component, and then select Properties to modify the filter condition.

- In the Filter properties dialog box, next to the Filter Condition field, click the Open icon to open the Expression builder to define the condition.

- In the Expression builder, enter FinalCreditScore.CreditScore>=600, and then click Submit.

A blue dotted line is displayed on the canvas that connects the Filter and Set property components. The existing Filter condition change is required to make it compatible with the Set property component introduced in step 7.

- On the canvas, hover over the Scorecard Model component, and then click and drag the arrow to connect it to the Set property component.

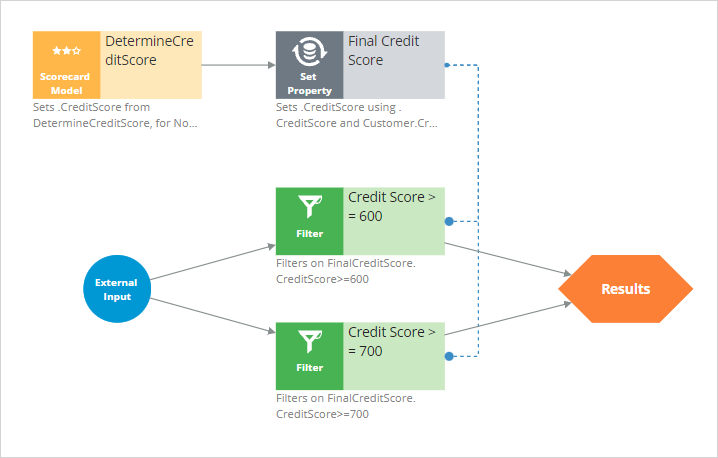

- On the canvas, right-click, and then select Arbitration > Filter to add the component.

- Right-click the Filter component, and then select Properties to modify the filter.

- In the Filter properties dialog box, in the Name field, enter Credit Score >= 700.

- Next to the Filter Condition field, click the Open icon to the Expression builder to define the condition.

- In the Expression builder enter FinalCreditScore.CreditScore>=700, and then click Submit.

- Click Submit.

- On the canvas, hover over the External Input shape, and then click and drag the arrow to connect it to the Filter component.

- Repeat step 13 to connect the Filter component to the Results shape.

- In the header of the strategy, click Check in to complete your strategy modifications.

- Enter the check-in comment, and then click Check in.

2 Test the decision strategy

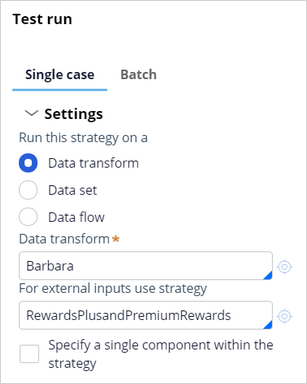

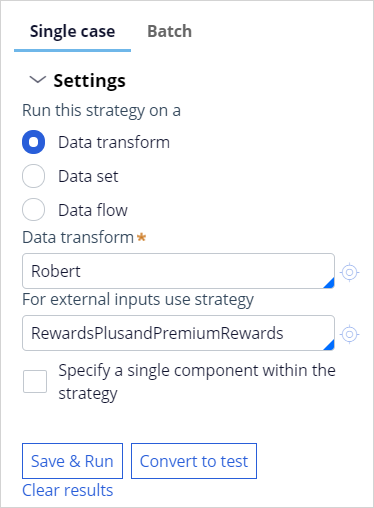

- On the right, expand the Test run pane.

- Expand Settings.

- On the canvas, select the Set Property component, and then, in the Test run pane, enter the following information to test the strategy:

- Data transform: Barbara

- For external inputs use strategy: RewardsPlusandPremiumRewards

- Click Run to verify the results of the scorecard.

- On the canvas, click Filter (Credit Score > = 700), and then, in the Test run pane, confirm that Barbara is suitable for both the Rewards Plus and Premier Rewards card offers.

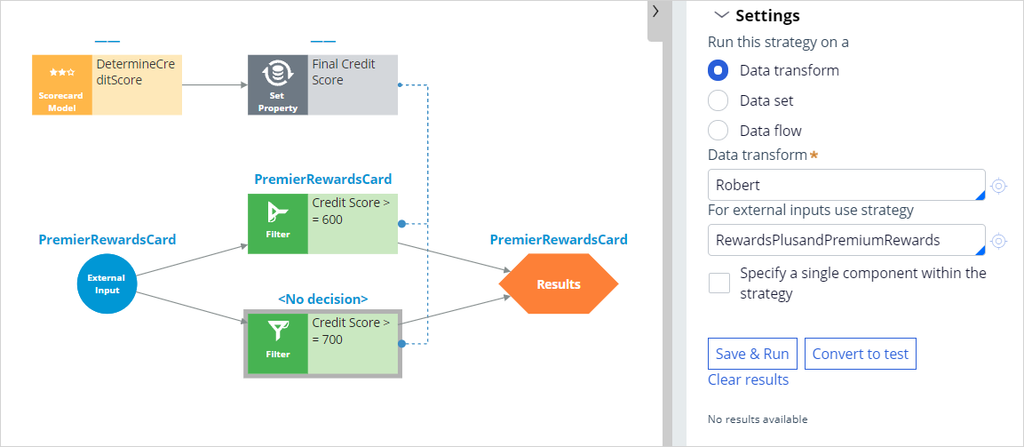

- Repeat steps 2 and 3 and check the results for the Robert data transform.

- On the canvas, click Filter (Credit Score > = 700), and then, in the Test run pane, confirm that Robert is not suitable for both the Rewards Plus and Premier Rewards card offers.

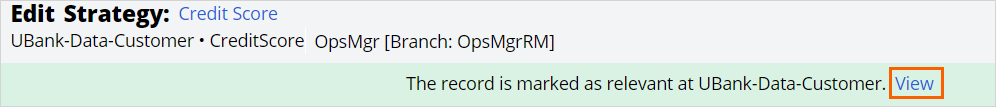

- In the header of the strategy, click Actions > Mark as relevant record.

Note: In case you are using the instance from the previous challenge, steps 7 to 11 are not necessary.

- In the Mark as relevant record success banner, click View to launch the Application: Inventory page.

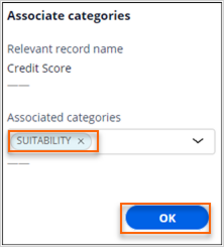

- On the Application: Inventory page, next to the Credit Score strategy, click the More icon, and then select Associate to categories to open the Associate categories dialog box.

- In the Associated categories list, select Suitability, and then click OK.

- Close the Application: Inventory page.

Note: Close the Strategy page.

Click OK if you see the Unsaved changes window.

3 Define the engagement policy with the newly created strategy

- In the navigation pane of Customer Decision Hub, click Next-Best-Action > Designer to open Next-Best-Action Designer.

- In Next-Best-Action Designer, click Engagement policy to access the engagement policies.

- In the Business structure pane, in the Grow section, click Credit cards to open the group.

- Click Edit to modify the group.

- Expand the Customer actions section.

- In the Actions area, click the Rewards Plus card to define the action-level suitability condition.

- Click the Engagement policy tab.

- Click Check out.

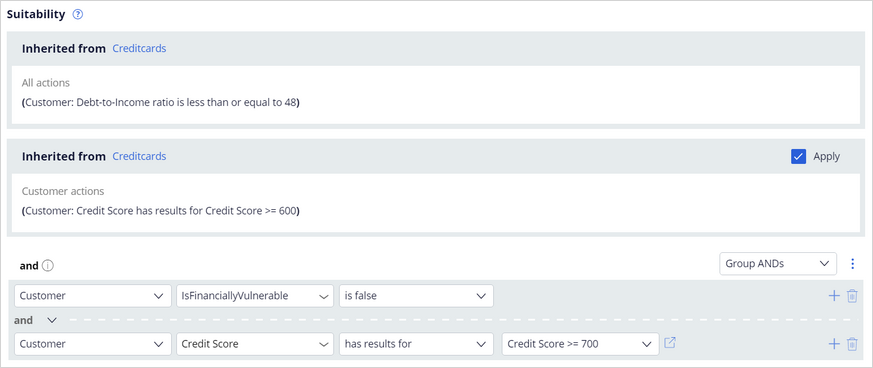

- In the Suitability section of the engagement policy, click the Add icon to add the suitability rule:

- In the first list, ensure that Customer is selected.

- In the second list, select the Strategy > Credit Score.

Note: If the strategy is not displayed, log out of Pega Customer Decision Hub, and then log back in.

- Ensure that has results for Credit Score >= 700 is selected.

- Click Check in to save the action-level suitability rule.

- Enter check-in comments, and then click Check in.

- Close the action.

- Repeat steps 6 through 12 for the Premier Rewards card.

- Click Save.

Confirm your work

- On the exercise system landing page, click U+ Bank to open the website.

- On the main page of the website, in the upper right, click Log in to log in as a customer.

- Log in as Barbara, and then verify that she is suitable for a credit card.

- Log out.

- Log in as Robert, and then verify that he is not suitable for credit card offers.

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?