Action prioritization with AI

Introduction

Explore how AI-based arbitration works and how AI predicts customer behavior. Arbitration aims to balance customer relevance with business priorities. To select the top actions, a formula is used to arrive at a prioritization value. The formula uses the propensity value, which is calculated using AI. Propensity is the predicted likelihood of positive behavior, such as the likelihood of a customer accepting an offer.

Video

Transcript

This video will explore how AI-based arbitration works and explain how AI predicts customer behavior.

U+, a retail bank, uses the Pega Customer Decision Hub™, to display marketing offers to customers on its website. The bank would like to display more relevant offers to customers based on their behavior.

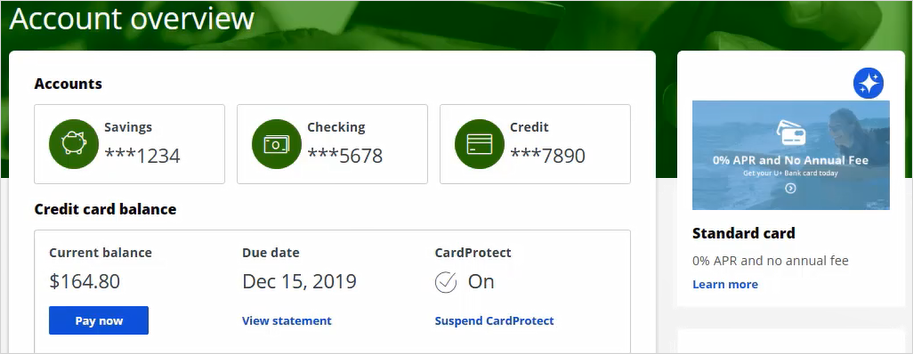

Troy, a customer, qualifies for two credit card offers. When he logs into the bank's website, he sees the top offer for him, the Standard Card.

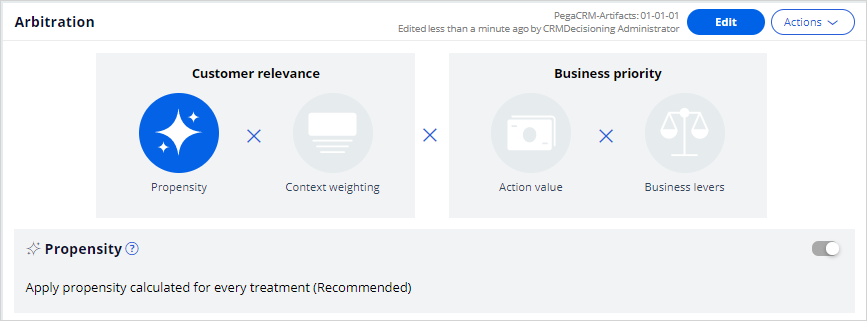

These are the Arbitration settings defined in Pega Customer Decision Hub's Next-Best-Action Designer. Arbitration aims to balance customer relevance with business priorities. To achieve this balance, Propensity (P), Context weighting (C), Action value (V), and Business levers (L) are represented by numerical values and plugged into a simple formula, P * C * V * L. This formula is used to arrive at a prioritization value, which is used to select the top actions.

Notice that only Propensity is currently enabled. Propensity is the predicted likelihood of positive behavior, such as the likelihood of a customer accepting an offer. The value of Propensity is calculated using AI.

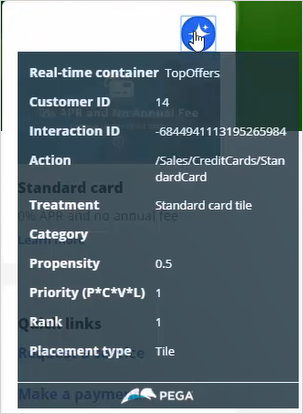

Note the Propensity and Priority values of the Standard Card. The Propensity for every action starts at 0.5 or 50%, the same as the flip of a coin. This is because in the beginning, the AI has no past customer behavior on which to base its predictions. Propensity is one of the factors used to arbitrate between relevant offers and select the top offer for a customer.

Though only the Propensity is enabled for arbitration, the value of Priority, which is currently based on Propensity only, does not match the Propensity value. This difference occurs because the Priority calculation does not use the raw model Propensity value directly. Instead, the calculation uses an adjusted Propensity. The adjusted Propensity value helps to equalize the sudden changes in Propensity values that the AI calculates during the initial phase of its learning when it has yet to gather enough customer behavior data to make accurate predictions.

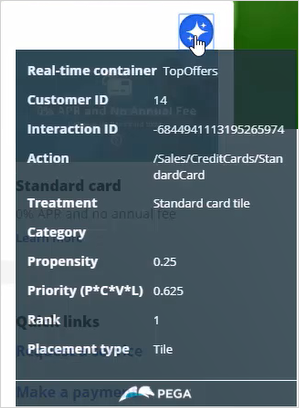

If Troy doesn't click on the current offer this time, a different offer will be shown the next time he visits the website. The next offer Troy is eligible for, the Rewards Card, is then selected for display. If Troy ignores this card as well, by not clicking on it, then the next time he logs in, the Standard Card offer will be displayed again. Why this behavior? First, Troy only qualifies for these two credit card offers. Second, the AI model behind these offers is configured to treat an impression not followed by a click as a negative behavior. In other words, when a customer is presented with an offer but doesn't click on it, the AI records this as a negative behavior. As a result, the Propensity, and therefore the Priority, of the not-clicked-on offer decreases. Notice that the Propensity value of the Standard Card offer dropped from 0.5 to 0.25.

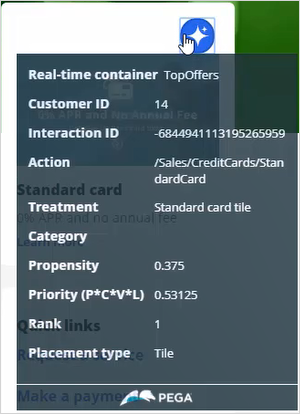

Now, if Troy clicks on the 'Learn more' link for the Standard Card offer, a positive response is recorded, and thus the Propensity value of the Standard Card increases.

The Customer Decision Hub is configured to calculate the Propensity for each Treatment. To understand how this works, let's examine the AI behind a Treatment. This pop-up window provides a summary of the AI behind this Treatment. In the Pega Customer Decision Hub, the AI that determines the Propensity for positive behavior towards an action or Treatment is called an adaptive model. From here, you can navigate to the adaptive model itself.

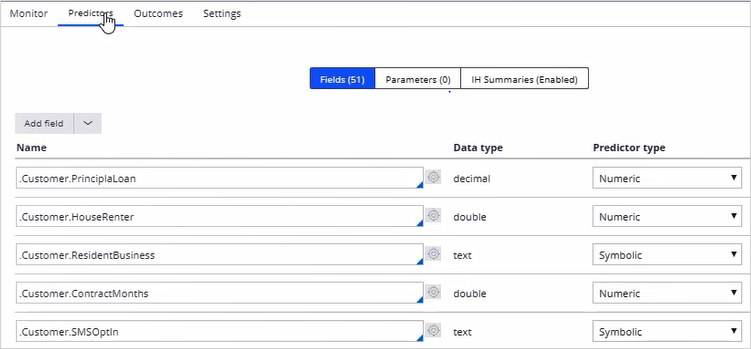

An adaptive model is a self-learning predictive model that uses machine learning to calculate Propensity scores. It automatically determines the factors that help in predicting customer behavior. These predictors can include a customer's demographic details, product and service usage, past interactions with the bank, and even contextual information such as the current channel of interaction.

This adaptive model considers an impression not followed by a click, when a marketing offer is displayed on a website, a negative behavior. It considers a Click a positive behavior.

Therefore, when a customer sees an offer message but doesn't click on it, the model records a negative behavior.

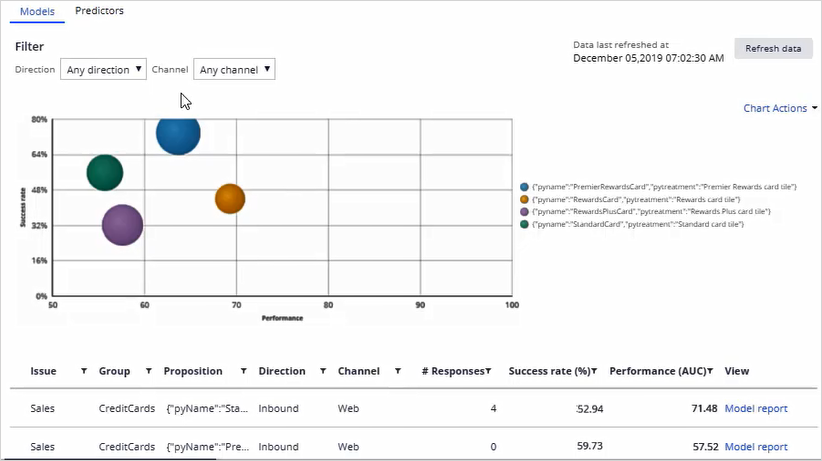

The monitoring tab provides an overview of the model's performance. The business can use this information to assess the contribution of the model's predictions with respect to the success of the actions.

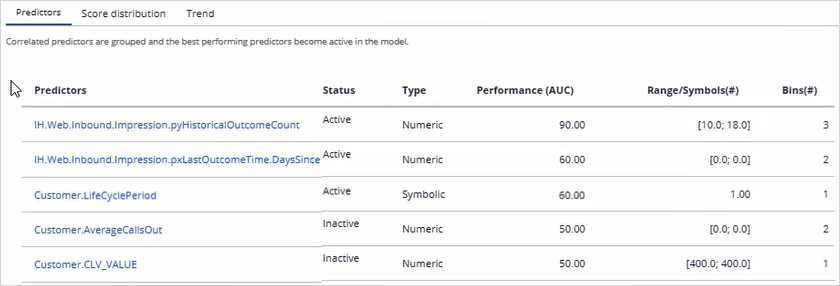

The model report provides more insight into the AI model itself. This AI model is automatically generated by the system, and it adapts its prediction algorithm in real-time, based on incoming customer responses. The report shows more information about the predictors, such as how they are grouped and details a data scientist can use to analyze the current health of the model and diagnose any potential problems.

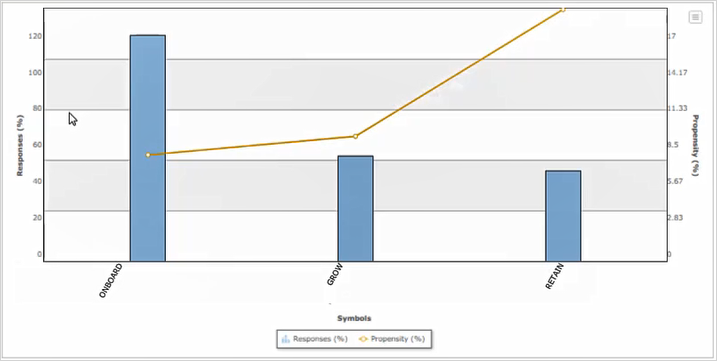

In the Predictor report, you can examine the performance of individual predictors. Let's examine the LifeCyclePeriod predictor.

This a predictor of type Symbolic. The individual Predictor report shows that a customer whose lifecycle stage is RETAIN is most likely to accept the Standard Card action in the web channel.

The behavior of one customer can influence the Propensity calculation for other customers with a similar profile. For example, when Robert, a customer with a profile similar to Troy, logs in, he is shown the same offer as Troy. The same AI model is behind the Treatments for both customers, so Robert's action will influence Troy's Propensity score.

This demo has concluded. What did it show you?

- How AI uses customer behavior to calculate Propensity.

- How Propensity smoothing is used to help jump-start the process of AI learning.

- How the Prioritization value is calculated using the (P*C*V*L) formula.

- What adaptive models are and how to monitor them.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?