Action prioritization with AI

Introduction

Explore how AI-based arbitration works and how AI predicts customer behavior. Arbitration aims to balance customer relevance with business priorities. Pega Customer Decision Hub™ uses a formula to arrive at a prioritization value and select the top actions. The formula uses the propensity value that AI calculates. Propensity is the predicted likelihood of positive behavior, such as the likelihood of a customer accepting an offer.

Video

Transcript

This demo shows you how AI-based arbitration works and explains how AI predicts customer behavior.

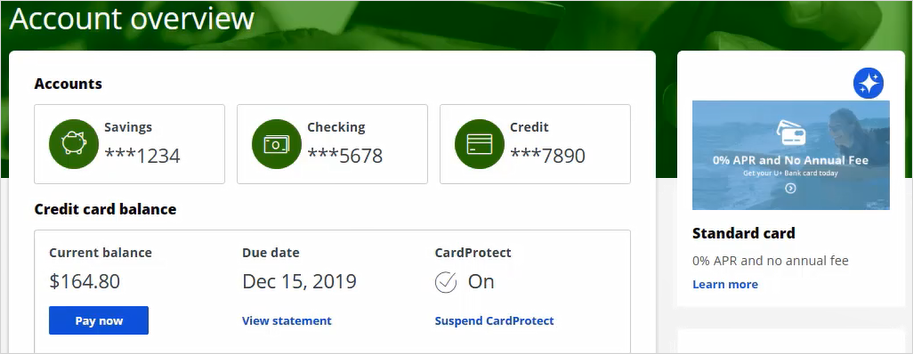

U+ Bank, a retail bank, uses Pega Customer Decision Hub to display marketing offers to customers on its website. The bank wants to display more relevant offers to customers based on their behavior.

Troy, a customer, qualifies for two credit card offers. When he logs into the bank's website, he sees the top offer for him, the Standard Card, and this offer is the top one that the system selects based on the arbitration settings.

These are the Arbitration settings defined in the Next-Best-Action Designer of Customer Decision Hub. Arbitration aims to balance customer relevance with business priorities. The system uses numerical values to represent Propensity (P), Context weighting (C), Business value (V), and Business levers (L), and Customer Decision Hub uses a simple formula, P * C * V * L, to achieve this balance. With this formula, Customer Decision Hub arrives at a prioritization value, which the system uses to select the top actions.

Propensity is the predicted likelihood of positive behavior, such as the likelihood of a customer accepting an offer. AI calculates the value of propensity.

Note the values of the propensity and priority for the Standard Card. Typically, the propensity for every action starts at 0.5 or 50 percent, the same as the flip of a coin. This value is the default because the AI has no past customer behavior on which to base its predictions. However, in this example, the propensity does not start at 0.5, as several interactions were captured before. Priority is the final value, which is based on all constituents from the arbitration setting.

In this example, Troy logs in multiple times and sees the same offer. On the first few visits, Troy ignores the offer, and then he clicks the offer to learn more.

In Customer Profile Viewer, you can examine the decision history and the next best actions for the customer, Troy.

First, load the decision history for the current use case to view the interactions recorded.

Note the values of the final propensity for the Standard Card.

The final propensity is the propensity value that the system uses in arbitration. You can add more fields to the decision history table.

Note that the final propensity that is used in the prioritization formula deviates from the original model propensity because it depends not only on the original model propensity but also on a mechanism that introduces noise while the evidence is low.

The noise decreases as the AI model learns from the target and alternative responses, and the original model propensity and the final propensity converge.

This mechanism assures that new actions receive exposure even when their models are still immature.

The original model propensity shows the effects of the negative and positive outcomes. The propensity of the Standard card action decreased each time Troy ignored the offer. Then, the propensity increased when Troy clicked the offer to learn more.

The configuration of the AI model behind these offers treats an impression that does not result in a click as a negative outcome. As a result, the propensity, and therefore the priority of that offer, decreases. The propensity and priority of the not-clicked offer keep decreasing until the model records a click (positive outcome). However, if Troy clicks the offer, the propensity and priority increase.

Next, view the next-best-action recommendations to learn more about the propensity details of the action for which Troy qualifies. For the current use case, the direction is Inbound, and the channel is the Web.

TopOffers is the real-time container service that manages communication between Customer Decision Hub and the website of the bank.

When you request a decision for Troy, the Customer Profile Viewer shows you the offers for which Troy is eligible.

Based on the engagement policy rules, Troy is eligible for two credit card offers: the Standard card and the Rewards card.

In the Explain propensity view, you can check the influencing factors of a specific action for which Troy qualifies. The factors are the best performing predictors that contribute positively to the propensity of the offer and the predictors that contribute negatively to the propensity of the offer.

Customer Decision Hub calculates the propensity for each treatment. To understand how this works, examine the AI behind a treatment. This pop-up window provides a summary of the AI behind this treatment. In Customer Decision Hub, the AI that determines the propensity for positive behavior towards an action or treatment is an adaptive model. From here, you can navigate to the adaptive model.

An adaptive model is a self-learning predictive model that uses machine learning to calculate propensity scores. It automatically determines the factors that help in predicting customer behavior. These predictors can include a customer's demographic details, product and service usage, past interactions with the bank, and even contextual information such as the current channel of interaction.

This adaptive model considers a click a positive outcome, and it considers no response a negative outcome. No response means that a click does not follow an impression (an offer displayed on the website).

Therefore, the model records a negative outcome when a customer sees an offer but does not click on it.

The Monitoring tab provides an overview of the model's performance. The business can use this information to assess the contribution of the model's predictions for the success of the actions.

The model report provides more insight into the AI model itself. The system automatically generates this AI model and adapts its prediction algorithm in real time based on incoming customer responses. The report shows more information about the predictors, such as grouping information and details a data scientist can use to analyze the current health of the model and diagnose any potential problems.

In the Predictor report, you can examine the performance of individual predictors. For example, you can see how the system automatically groups the values of a numeric predictor into bins and how the propensity to accept varies across the bins.

The behavior of one customer influences the propensity calculation for other customers with a similar profile.

This demo has concluded. What did it show you?

- How AI uses customer behavior to calculate propensity.

- How the system calculates the prioritization value by using the (P*C*V*L) formula.

- What adaptive models are.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?