Business use case: Cross-sell on the web extended

Introduction

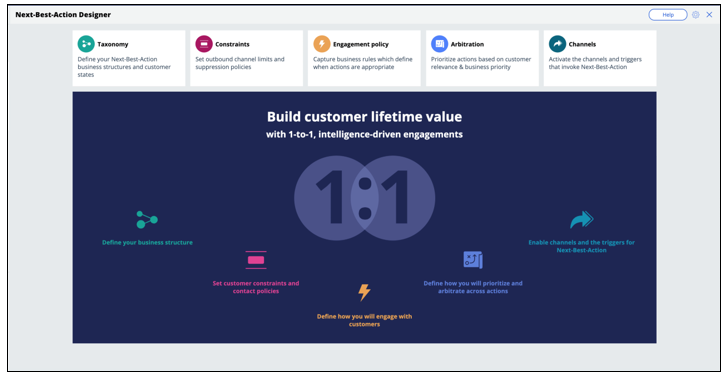

Next-Best-Action Designer guides you through the creation of a core Next-Best-Action strategy for your business. Learn how to customize the core strategy by creating decision strategies from scratch that extend Next-Best-Action Designer capabilities.

Video

Transcript

This video describes several use cases where decision strategies are used to extend Next-Best-Action Designer capabilities.

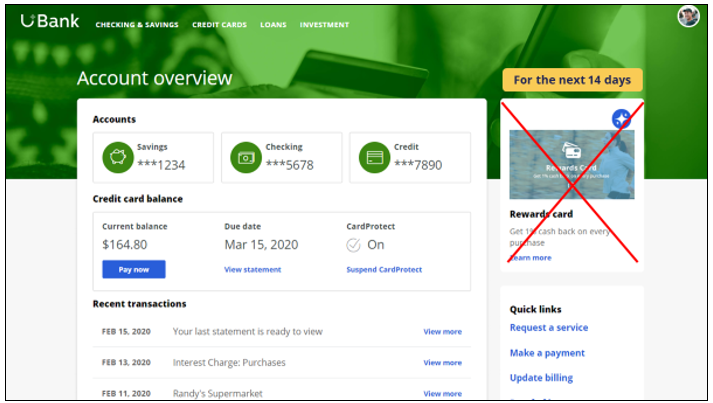

U+ is a retail bank. The bank is leveraging its website as a marketing channel to improve 1-to-1 customer engagement, drive sales, and deliver Next-Best-Actions in real-time.

The bank is using the Pega Customer Decision Hub™ to recommend more relevant banner ads to its customers when they visit their personal portal. In the start-up phase, U+ successfully implemented all their use cases using Next-Best-Action Designer.

Next-Best-Action Designer guides you through the creation of a Next-Best-Action strategy for your business.

With the Next-Best-Action Designer user interface you define high-level business rules and AI controls, which the system uses to configure the underlying Next-Best-Action strategy framework.

This framework leverages best practices to automatically generate Next-Best-Action decision strategies at the enterprise level.

These decision strategies are a combination of the business rules and AI models that form the core of the Pega Customer Decision Hub, which determines the personalized set of Next-Best-Actions for each customer.

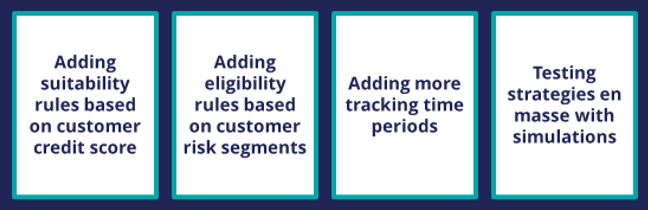

U+ Bank wants to implement additional use cases to meet new business requirements. These use cases require U+ bank to extend Next-Best-Action Designer capabilities.

The first use case is to create suitability rules based on a customer’s credit score. The bank wants to determine whether or not a customer is suitable for an offer based on their credit score. In this scenario, the credit score is not available, it needs to be computed in real-time based on customer profile information.

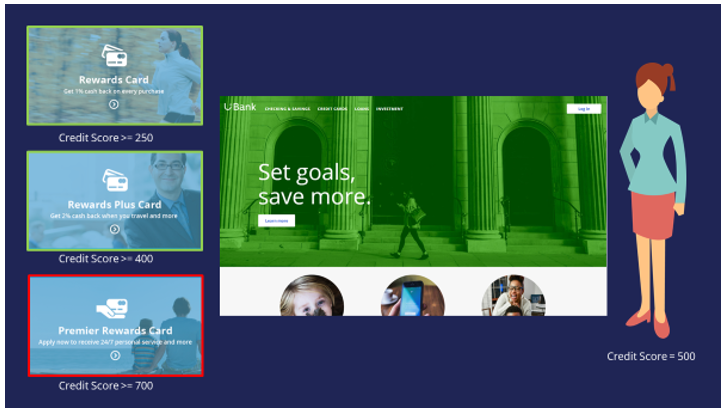

For example, when customer Barbara logs in, U+ bank only wants to present her with the Rewards and Rewards Plus offers, not the Premier Rewards offer. Barbara’s credit score is 500. This makes her unsuitable for Premier Rewards, which is only suitable for customers with a credit score over 700.

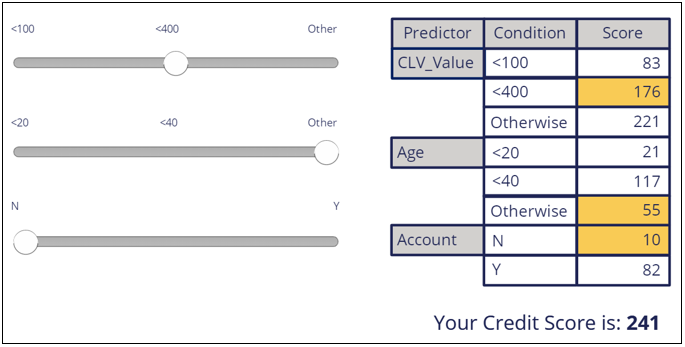

To determine suitability, the bank wants to calculate a customer’s credit score using a scorecard. A scorecard is used to assign importance to pieces of data for use in a calculation. A scorecard uses a subset of customer property values divided into ranges and assigns scores to each range to compute a final score.

To implement this, you use a special Suitability condition in Next-Best-Action Designer. The Suitability condition uses a decision strategy that references a Scorecard rule. The Scorecard rule is used to determine the customer’s credit score.

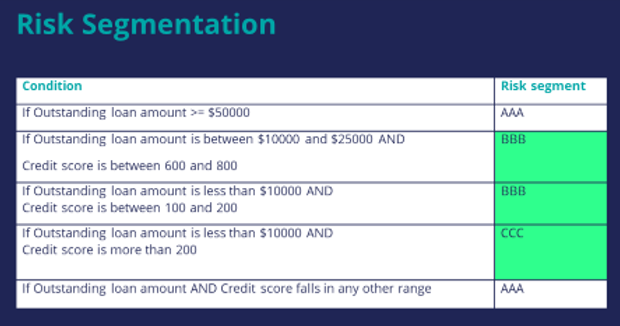

In the next use case, the bank has introduced some strict regulations for which they need new eligibility rules. U+ does not want to offer credit cards to customers whom they classify as ‘high risk’. Customers are divided into risk segments from AAA to CCC based on their outstanding loan amount and credit score. In the beginning, only customers in the risk segments BBB and CCC will be eligible for credit cards.

To implement this, you use a special Eligibility condition in Next-Best-Action Designer. The Eligibility condition leverages a decision strategy that uses the scorecard to determine the customer’s credit score, which it passes as an argument to a decision table. The decision table then determines which risk segment the customer is in.

The next use case is about adding more time periods for tracking customer behavior.

In this use case, the bank does not want to show the same offer to customers who have clicked on it three times in the last 14 days. By default, the Pega Customer Decision Hub tracks customer responses for a period of 7 or 30 days.

This use case requires an additional tracking time period of 14 days.

To add a new tracking time period you have to extend the decision strategies that are used to implement contact policies. This requires creating a new Interaction History Summary rule which tracks customer responses for 14 days.

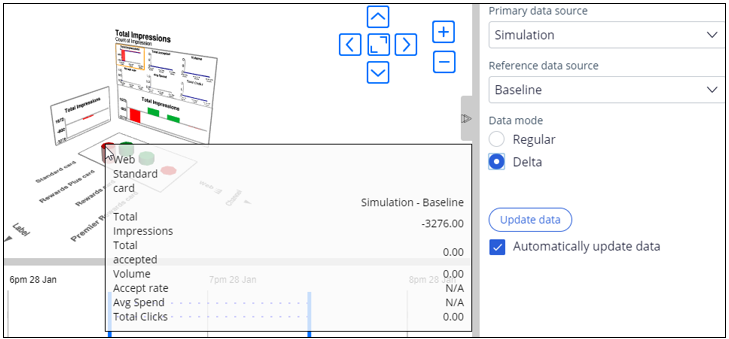

Finally, while the bank is implementing these various changes, they want to understand what the impact will be on their Next-Best-Actions. Therefore, U+ Bank would like to run some simulations to test the effects of the changes. The results of the simulations can be analyzed using Visual Business Director.

In summary, this video has shown you the various use cases U+ Bank would like to implement by extending Next-Best-Action Designer capabilities in this phase of the project.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?