Creating a churn prediction using a scorecard

Predicting customer churn is a crucial challenge, as losing customers can significantly impact profitability. To address this requirement, you can use a scorecard. A scorecard is a transparent predictive model that can drive a churn prediction.

Video

Transcript

In this video, you will explore the use of scorecards to drive predictions in Pega Customer Decision Hub™.

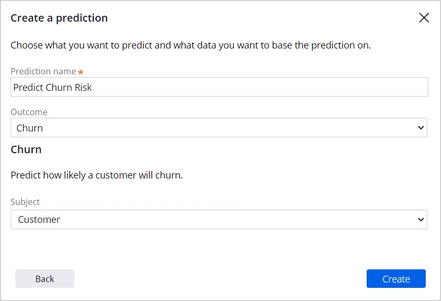

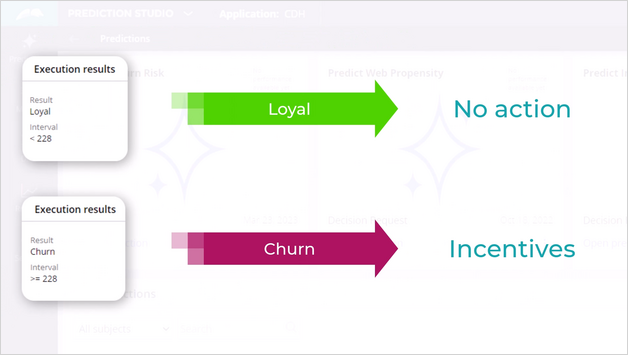

U+Bank implements Pega Customer Decision Hub to optimize customer engagement on the banks' website. The way they reduce the number of customers leaving the bank is through a churn prediction created by a data scientist in Prediction Studio. This prediction is then used in engagement policies, allowing the bank to proactively offer incentives to customers that are likely to leave.

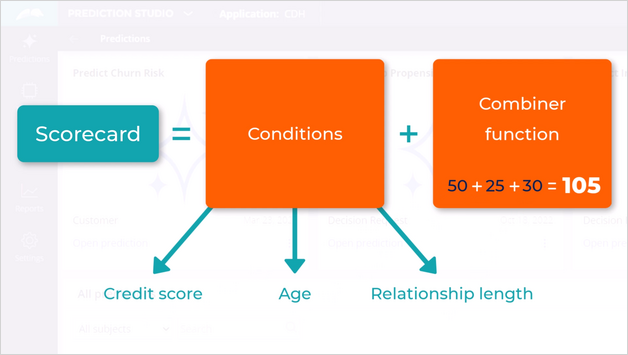

Predictive models, pre-calculated fields, and scorecards can all drive a prediction. A scorecard is a transparent predictive model that assigns a score to each customer based on specific conditions for each predictor. Customers receive points based on these conditions, and the score is calculated using a combiner function, for example, by summing up the points.

To use a scorecard, you create a Customer Decision Hub prediction in Prediction Studio.

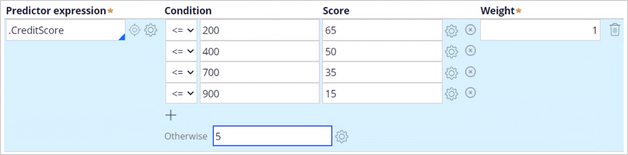

Default churn prediction includes an out-of-the-box template for a scorecard, that you can edit from the Models tab. Let's add the first predictor field - .CreditScore.

For the numerical predictor .CreditScore, customers with a credit score below or equal to 200 will get 65 score points, between 200 and 400, or equal to 400, will get 50 score points, and so on. Lower credit scores may indicate a higher risk of leaving, as customers may have more difficulty obtaining loans or other financial products from the bank.

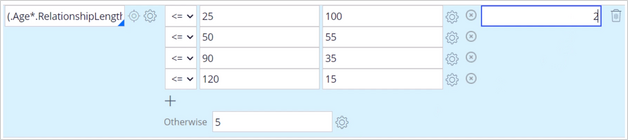

Age and length of the customer relationship are important factors in credit risk assessment. The scorecard allows for complex expressions that can involve multiple predictors and calculations. We use both the .Age and .RelationshipLengthDays predictors to create a predictor field expression. The score is calculated by multiplying the predictor values and dividing the result by 100. Younger customers and those with shorter relationships receive more points, as they may be less financially stable and more likely to churn. You can set a weight to this predictor to assign its relative importance.

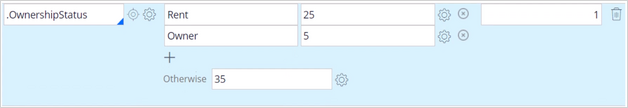

The scorecard also allows you to add categorical predictors, where you can assign a score for an individual value. For the categorical predictor .OwnershipStatus, a customer that meets the condition to be a house owner scores less points, as house ownership may indicate financial maturity, and a low propensity to churn.

The Combiner function enables you to select a method for combining scores, where in this scorecard, the points assigned for each predictor are summed.

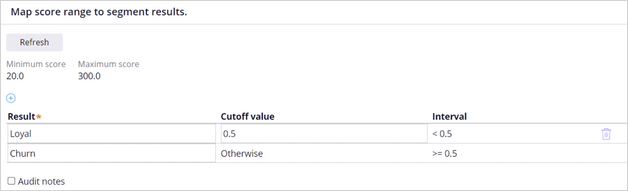

On the Results tab, you can map the Cutoff value to distinguish potential churners from loyal customers. In this case, the scorecard predicts that customers with less than 122 points are likely to remain loyal to U+Bank, while customers with higher points are likely to churn.

To test the scorecard, you can apply a data transform to run it for different customers. For example, Barbara. In the execution details section, you can see the points assigned for each predictor field. Note the .Age and .RelationshipLengthDays predictor expression. The final points double the score because of the weight value. The combiner function sums up the points to give Barbara a score of 50, indicating that she is a loyal customer.

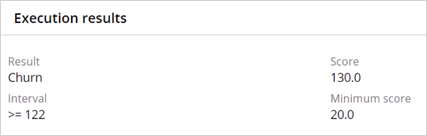

Next, we run the scorecard for Robert. Robert's score is 130, which suggests that he is likely to churn and should be targeted with retention offers.

You have reached the end of this video. You have learned:

- How to create a prediction in Pega Customer Decision Hub to predict the risk of churning.

- How to build a scorecard to drive the churn prediction in Prediction Studio.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?