Defining eligibility, applicability, and suitability rules

Introduction

Engagement policies are defined in Next-Best-Action Designer. Engagement policies specify the conditions under which an action or group of actions is available for a customer. These policies should be defined in the following categories: eligibility, applicability, and suitability, which represent the true nature of the associated conditions.

Video

Transcript

This demo will show you how to define engagement policy conditions such as Eligibility, Applicability, and Suitability using Next-Best-Action Designer.

U+, a retail bank, has introduced two new credit cards and would like to offer them to customers based on certain criteria.

First, all credit cards are eligible only for existing U+ customers who are at least 18 years old.

In addition, the business wants to ensure that these two new credit cards will be available for new customers who do not yet have a credit card.

Last, the business understands that not all credit cards are suitable for everyone.

Due to the credit limits of each card, the business wants to offer the Rewards Card to customers with a credit score higher than 500 and the Rewards Plus Card to customers with a credit score higher than 750.

This is the Pega Customer Decision Hub™ portal. You define engagement policies in Next-Best-Action Designer. Engagement policies specify the conditions under which an action or group of actions is available for a customer.

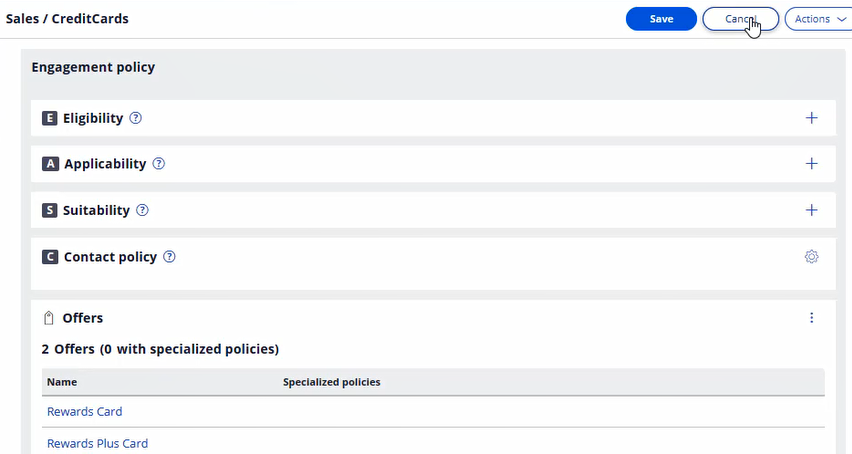

Now, you will set up the engagement policies to reflect U+ bank’s requirements. The engagement policies can be defined for a specific group within an issue and/or for individual actions.

Edit to configure the engagement policies. Notice that the two actions are listed under this group.

As a best practice, engagement policies should be defined in the following categories: Eligibility, Applicability and Suitability, which represent the true nature of the associated conditions.

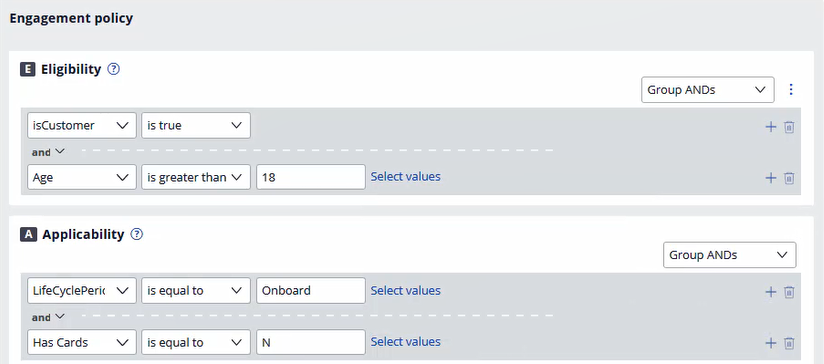

First, define the Eligibility condition to ensure that only current customers are considered for the action, and that the customers are at least 18 years old.

Then, define the Applicability condition so that only new customers, who currently do not have a credit card, qualify for the actions. These criteria are also being defined at the group level.

The "new customer" check is done using the LifeCyclePeriod property. Add a condition to check if the customer already has a credit card.

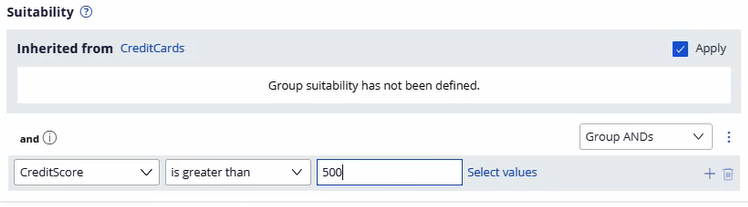

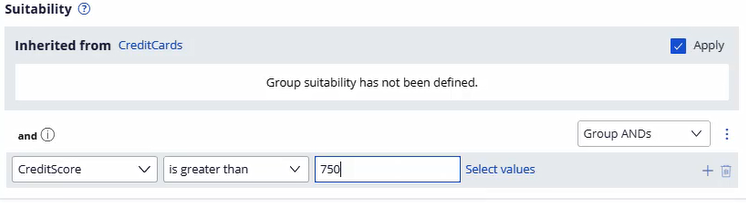

Lastly, business wants a different Suitability condition for individual cards depending on the card’s limit. Since the conditions are specific to each credit card, the Suitability condition for each must be defined at the Action level.

Open the Rewards Card Action. This card comes with a certain credit limit. Therefore, U+ believes this card is only suitable for customers with a credit score higher than 500, even though customers may satisfy the Eligibility and Applicability conditions. Thus, define the Suitability condition accordingly.

Next, open the Rewards Plus Card action. This card has an even higher credit limit than the Rewards card. Thus, this card is suitable for customers with credit score higher than 750. To complete the configuration, save the changes.

Log in as Troy, a 25-year-old Chef, who became a customer of U+ bank 3 months ago, and his credit score is 600. Notice that the Rewards Card offer is displayed, as Troy satisfies all Eligibility and Applicability conditions. Troy will only be offered this card because his credit score is higher than 500 but lower than 750.

Now, login as Barbara, a 40-year-old Engineer, who became a customer of U+ bank a month ago, and her credit score is 800. Notice that the Rewards Plus Card offer is displayed, as Barbara also satisfies all Eligibility and Applicability conditions. Barbara on the other hand will be offered both cards, as her credit score is higher than 750.