Adding a group-level engagement policy

6 Tasks

20 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to its customers. Due to the credit limit of each card, the business intends to include an additional suitability criterion. The new criterion is that credit cards are suitable only for customers with a credit score higher than 800.

The credit score value is available in the data model. An external process populates the value in a nightly batch. However, the credit score is not computed for every customer.

As a result, the bank decides to use a scorecard that computes the credit score of a customer if the score is unavailable.

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Revision Manager | RevisionManager | rules |

| NBA Designer | NBADesigner | rules |

Your assignment consists of the following tasks:

Task 1: Verify offers on the U+ Bank website

On the U+ Bank website, verify that the customer, Barbara, receives one credit card among the Rewards Plus card and the Premier Rewards card offers according to her profile.

Task 2: As a Revision Manager, create a change request to implement the new suitability condition

Note:

1. As an NBA Designer, in order to create any changes, you need a revision. The revision manager creates this revision. If there is a revision already created you can reuse the same revision.

2. The DetermineCreditScore scorecard and the CreditScore decision strategy are already created for you for the purpose of this challenge. As part of this challenge, you only slightly modify these artifacts.

1. As an NBA Designer, in order to create any changes, you need a revision. The revision manager creates this revision. If there is a revision already created you can reuse the same revision.

2. The DetermineCreditScore scorecard and the CreditScore decision strategy are already created for you for the purpose of this challenge. As part of this challenge, you only slightly modify these artifacts.

As a Revision Manager, create a revision and a change request to change the scorecard (Determine credit score) and the strategy (Credit Score), define the engagement policy with the changed strategy as a group-level suitability rule, and assign the change request to the NBA Designer.

Task 3: As an NBA Designer, change the scorecard, decision strategy, and define the engagement policy

As an NBA Designer change the DetermineCreditScore scorecard. In the DebtToIncomeRatio row, change the condition If debt-to-income ratio is 40, assign a score of 100 to If debt-to-income ratio is 32, assign a score of 100.

Task 4: As an NBA Designer, change the strategy according to the change request

As an NBA Designer:

- Change the Credit Score decision strategy to filter the actions according to the new criterion: credit cards are suitable only for customers with a credit score higher than 800.

- Mark the strategy as a relevant record and ensure it is usable as a suitability condition.

Task 5: As an NBA Designer, define the engagement policy

As an NBA Designer:

- Implement the new engagement policy condition by using the Credit Score strategy.

- Submit the change request for approval to the Revision Manager.

Task 6: As a Revision Manager, approve the change request submitted by the NBA Designer

As a Revision Manager, verify and approve the change request that the NBA Designer submits, and then deploy the revision.

Task 7: Confirm your work

Log in to the U+ Bank website as Barbara to confirm that she is in eligible for any credit card offer.

Challenge Walkthrough

Detailed Tasks

1 Verify offers on the U+ website

- On the exercise system landing page, click U+ Bank to open the website.

- On the main page of the website, in the upper right, click Log in to access as Barbara.

- Confirm that she gets a credit card offer.

Note: When you log in for the first time, the system takes a few minutes to display the offer. On subsequent logins, the offer loads immediately.

2 As a Revision Manager, create a change request to change the scorecard, strategy, and add the engagement policy

- On the exercise system landing page, click Pega CRM suite to log in to Pega Customer Decision Hub

- Log in as a Revision Manager with User name RevisionManager and Password rules.

- In the navigation pane of Customer Decision Hub, click Revision Management to open the Revision Management landing page.

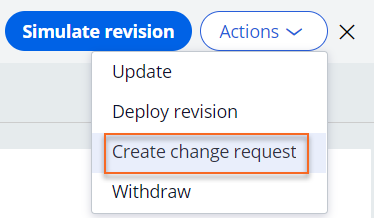

- On the Revision Management landing page, if you see a Revision already existing:

- Click it to open it. .

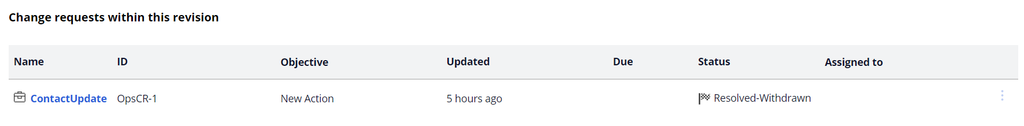

- On the top right corner, click Actions > Create change request.

- Proceed to step 6.

- Click it to open it. .

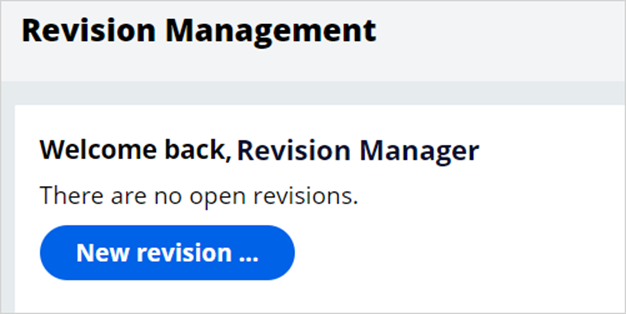

- If there is no revision, create a new revision:

- On the Revision Management landing page, in the Welcome back, Revision Manager section, click New Revision to create the new revision.

- In the Define the Objectives for this Revision section, make sure that Create new revision is selected.

- In the Name field, enter Change credit score strategy.

- In the objectives field, enter Add suitability rules to credit cards.

- Click Continue to create the revision.

- On the Revision Management landing page, in the Welcome back, Revision Manager section, click New Revision to create the new revision.

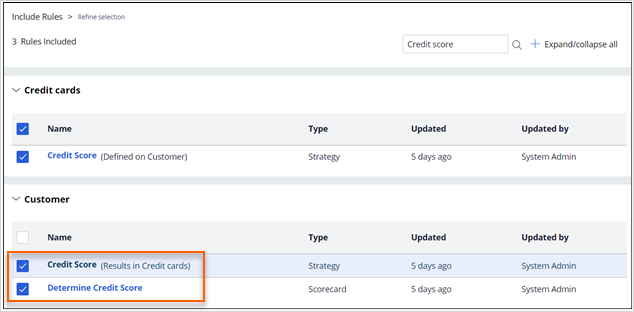

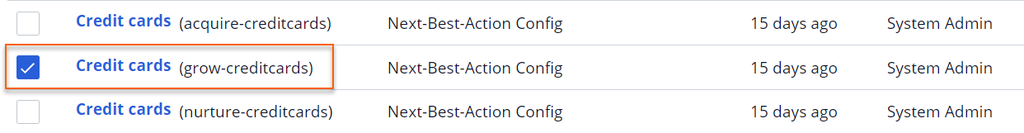

- On the Include Rules page, in the customer section, select the following options:

- In the search text box, enter Credit score.

- In the Customer section, select the two following checkboxes:

- The Credit Score strategy

- The DetermineCreditScore scorecard

- In the search text box, enter Credit cards.

- In the Customer section, select Credit Cards (grow-creditcards) Next-Best-Action Config checkbox.

- In the header of the Include Rules page, click Next.

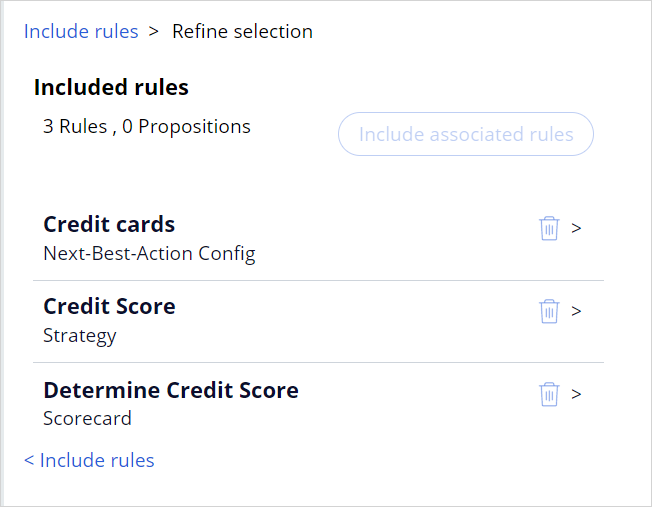

- On the Refine selection page, in the Included rules section, observe the newly added rules.

- On the right, in the Change request pane, click Edit to assign an operator to the change request.

- In the Edit Change Request Details window, in the Assign to section, select Operator.

- In the field that is displayed under the Assign to section, enter or select NBADesigner.

- In the Name field, enter Add suitability condition to credit cards.

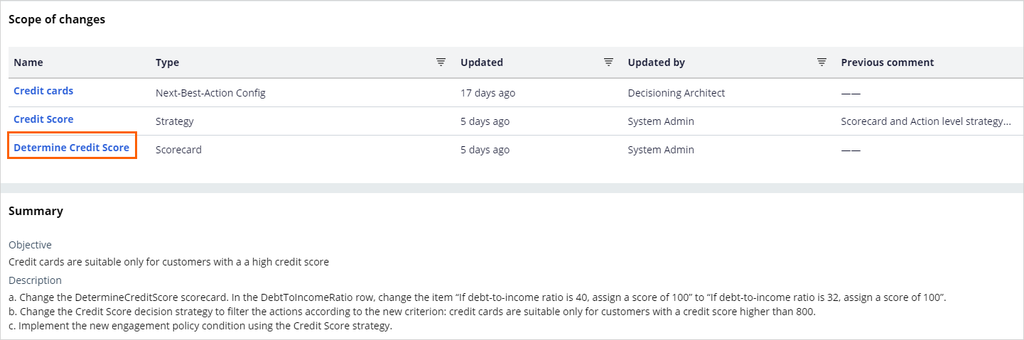

- In the Description field, enter the following information:

- Change the DetermineCreditScore scorecard. In the DebtToIncomeRatio row, change the item "If debt-to-income ratio is 40, assign a score of 100" to "If debt-to-income ratio is 32, assign a score of 100".

- Change the Credit Score decision strategy to filter the actions according to the new criterion: credit cards are suitable only for customers with a credit score higher than 800.

- Implement the new engagement policy condition using the Credit Score strategy.

- Click Submit to save the changes made to the change request.

- In the header of the Refine selection page, click Submit to send the change request to the assigned operator.

- In the upper-right corner of Customer Decision Hub, click the user icon, and then select Log off to return to the login screen.

3 As an NBA Designer, change the scorecard according to the change request

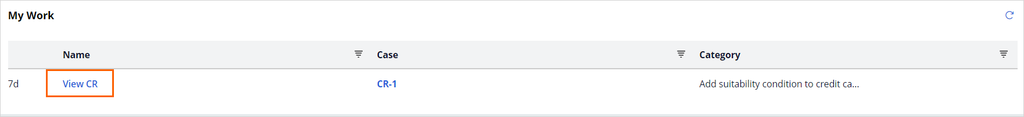

- Log in to Customer Decision Hub as an NBA Designer with User name NBADesigner and Password rules.

- In the My work section, click View CR to to open the new change request.

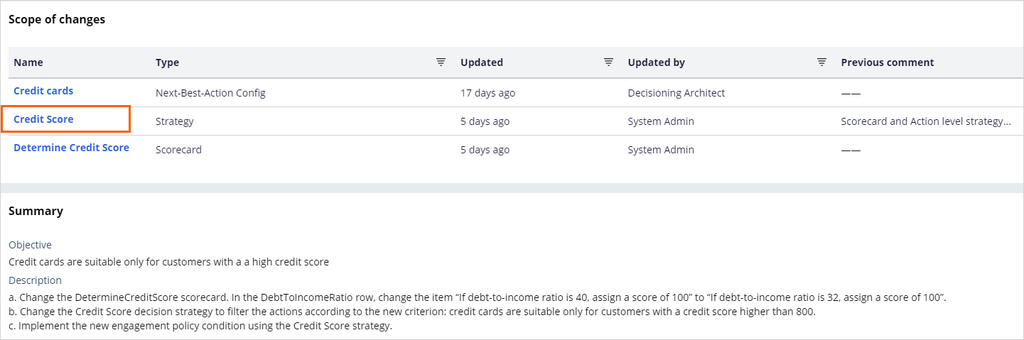

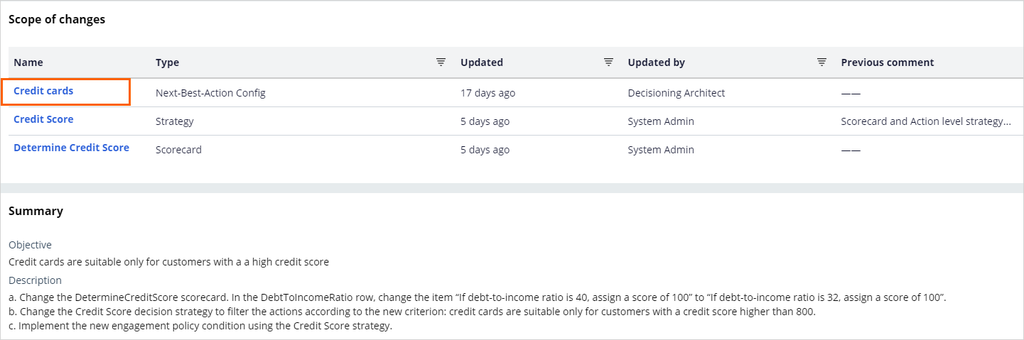

- In the change request, in the Summary section, review the content from the Revision Manager to understand the requirement clearly.

- In the Scope of changes section, click DetermineCreditScore to modify the scorecard.

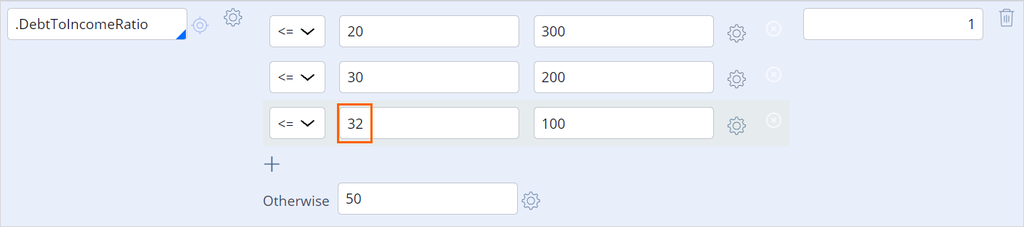

- On the Scorecard rule form, in the .DebtToIncomeRatio row of the predictor expression, enter 32 to replace the default value of 40.

- In the header of the ruleform, click Save to save the changes made to the scorecard.

- Close the DetermineCreditScore scorecard to return to the change request.

- On the Scorecard rule form, in the .DebtToIncomeRatio row of the predictor expression, enter 32 to replace the default value of 40.

4 As an NBA Designer, change the strategy as per the change request

- In the Scope of changes section, click the Credit Score to modify the strategy in the strategy canvas.

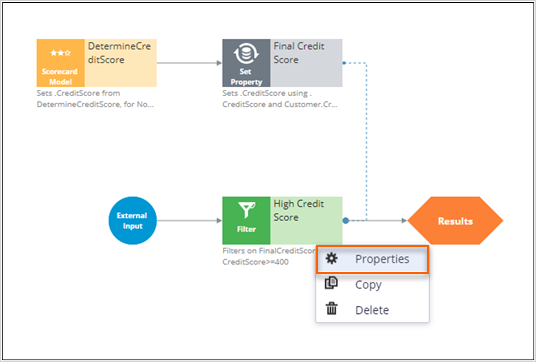

For this challenge, the DetermineCreditScore scorecard and the CreditScore decision strategy are already created for you. If you want to create a new scorecard or a strategy, you can create them by clicking the Create in the Scope of changes section. - On the strategy canvas for the Credit Score, on the High Credit Score filter component, right-click, and then select Properties to edit the filter properties.

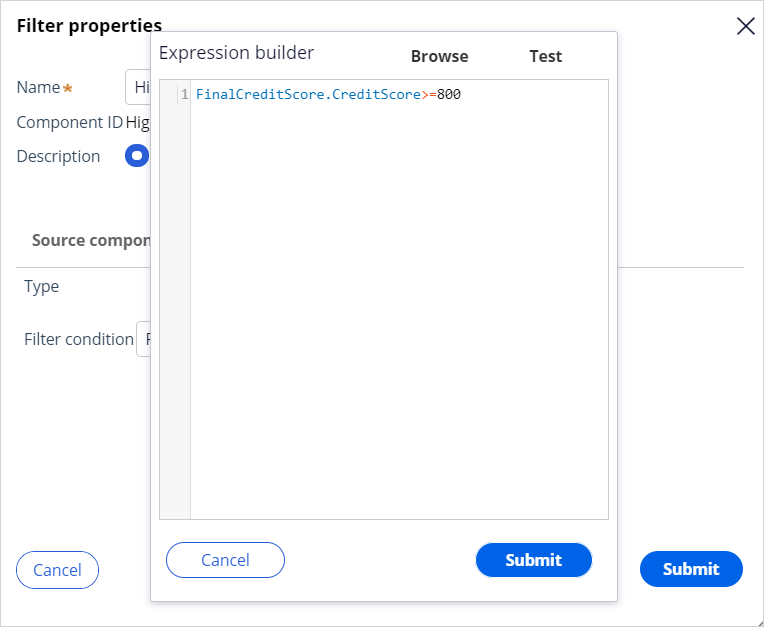

- In the Filter properties dialog box, to the right of the Filter condition field, click the gear icon to open the filter condition.

- In the the Expression builder window, change the filter condition to FinalCreditScore.CreditScore>=800.

- Click Submit to close the Expression builder window.

- Click Submit to close the Filter properties dialog box.

- On the upper right, click Save to save the changes made to the strategy.

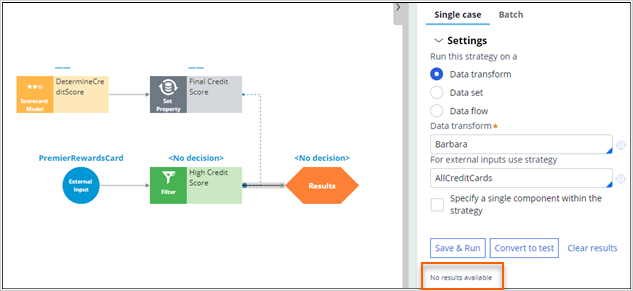

- On the right, expand the Test run pane.

- In the Test run pane, enter the following information:

- In the Data transform field, enter or select Barbara.

- In the For external inputs use strategy field, enter or select AllCreditCards.

- Click Save & run to verify the results of the scorecard and confirm that Barbara is unsuitable to receive the credit card offers.

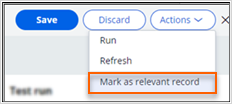

- In the header of the strategy canvas, click Actions > Mark as relevant record to use the decision strategy in an engagement policy in Next-Best-Action Designer.

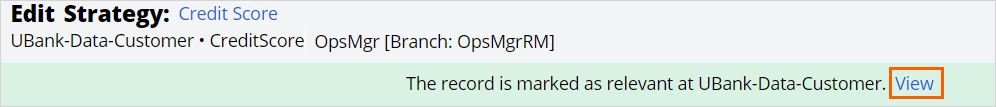

- In the Mark as relevant record success banner, click View to launch the Application: Inventory page.

- Scroll to find the Credit Score strategy.

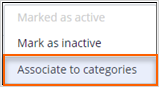

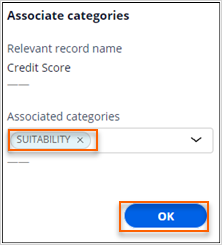

- Click the More icon, and then select Associate to categories.

- In the Associated categories list, select Suitability, and then click OK.

- Close the Application Inventory page.

- Close the Strategy page.

If you see the Unsaved changes window, click OK.

5 As an NBA Designer, define the engagement policy and submit the change request for approval

- On the change request page, in the Scope of changes section, click Credit cards of Type Next-Best-Action Config, to define the suitability rule for the strategy.

- Expand Customer actions.

- In the Suitability section of the engagement policy, click the Add icon to define the group-level suitability condition.

- To the right of the Customer list, in the empty drop-down list, click Strategy > Credit score.

- Ensure that the next field is autopopulated with has results for.In the next drop-down list, select High Credit Score.

- In the upper right, click Save to save the suitability condition.

- Close Next-Best-Action Designer to return to the change request.

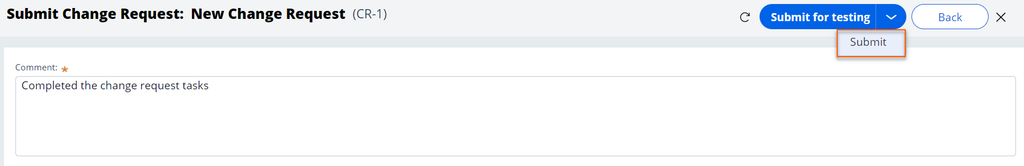

In case you see the 'You are about to discard changes" window, click Ok. - On the Change Request: Change Decision strategy page, click Submit.

- In the Comment text box, enter a comment for the Revision Manager.

- In the upper right, click Submit for testing > Submit.

- In the upper-right corner of Customer Decision Hub, click the user icon, and then select Log off to return to the login screen

6 As a Revision Manager, approve the change request submitted by the NBA Designer

- Log in to Customer Decision Hub as a Revision Manager with User name RevisionManager and Password rules.

- In the My Work section, and click CR-1 to open the change request.

- On the change request form, verify that the changes performed by the NBA Designer are displayed.

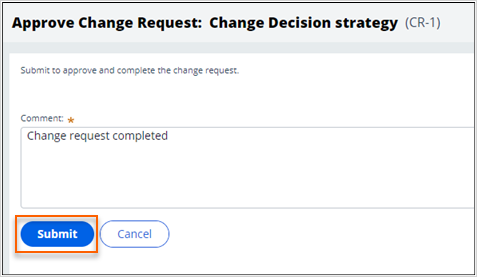

The Release Manager performs additional testing to verify that the change is correctly implemented in a typical project implementation. - In the upper right, click Approve.

- In the Comment text box, enter an appropriate comment, and then click Submit to approve and complete the change request.

- Close the change request to return to the Customer Decision Hub dashboard.

- In the Comment text box, enter an appropriate comment, and then click Submit to approve and complete the change request.

- In the navigation pane of Customer Decision Hub, click Revision management to open the Revision Management landing page.

- Click the current revision Change credit score strategy R-1 to begin deployment of the revision.

- On the revision, in the upper right, click Actions > Deploy revision to deploy the revision.

- Enter a comment, and then click Deploy to view the Merge status message and await deployment.

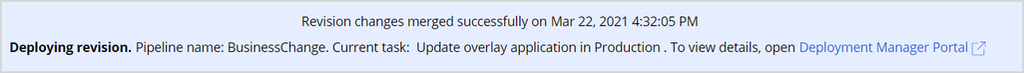

The status changes to Open-Inprogress, and deployment begins after the revision changes are merged successfully. - Wait for the revision to be merged to production through the BusinessChange pipeline.

- Enter a comment, and then click Deploy to view the Merge status message and await deployment.

- Observe that the screen refreshes itself and that the revision is in about to deploy but awaiting a test.

Note: If the status is not changing for a long time, refresh the browser. This process usually takes around 5 to 10 minutes.

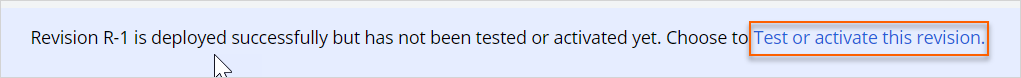

- Click Test or activate this revision to select the test users.

- In the Test or activate this revision window, select Activate for all operators.

- Click Submit to display the message that deployment is activated successfully.

- Click Complete revision to finish the revision.

Confirm your work

- On the Exercise System landing page, click U+ Bank to open the website.

- On the home page of the website, in the upper right, click Log in to log in as a customer.

- Log in as Barbara.

- On the home page, verify that Barbara is unsuitable for the Rewards Plus and Premier Rewards card offers.

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?