Configuring an adaptive model

Introduction

Explore how AI-based arbitration works. Use adaptive models to leverage a website as a marketing channel by recommending more relevant banner ads to customers when they visit their personal portal. Use the Pega Prediction Studio to configure the out-of-the-box adaptive model for the web treatment.

Video

Transcript

This demo will explore how AI-based arbitration works and show you how to configure an adaptive model.

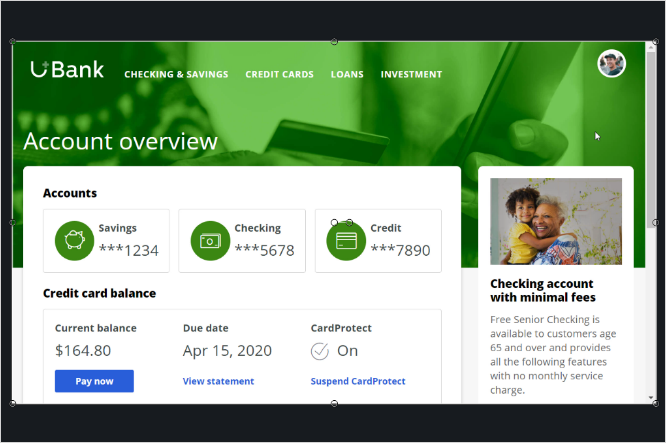

Currently, the U+Bank website shows a banner containing the running marketing offer that all customers see when they log in to the U+Bank website.

The bank would like to move forward and display more relevant offers to customers based on their behavior. To that end, the bank will use Pega Customer Decision Hub™ to display personalized marketing offers on the website.

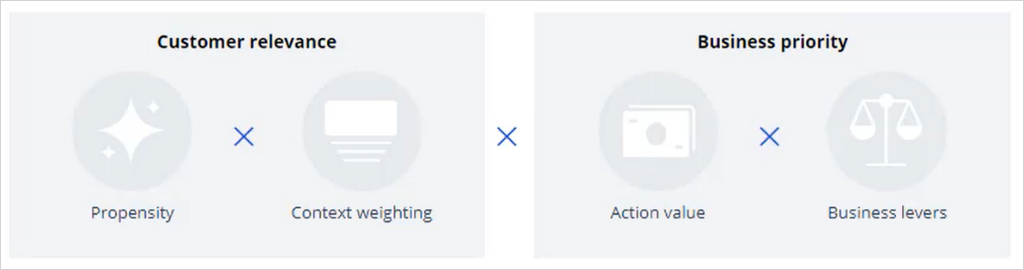

These are the arbitration settings defined in Pega Customer Decision Hub's Next-Best-Action Designer.

Arbitration aims to balance customer relevance with business priorities to decide which offer to show to the customer.

To achieve this balance, propensity (P), context weighting (C), action value (V), and business levers (L) are represented by numerical values and plugged into a simple formula, P * C * V * L.

This formula is used to arrive at a prioritization value, which is used to select the top actions.

Propensity is the predicted likelihood of positive behavior, such as the likelihood of a customer accepting an offer. The propensity value is calculated using AI.

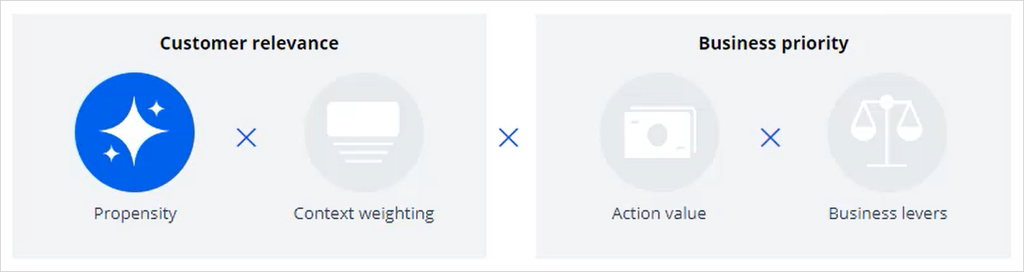

How is this AI configured? First, let's activate propensity in the arbitration formula to allow the AI to weigh in.

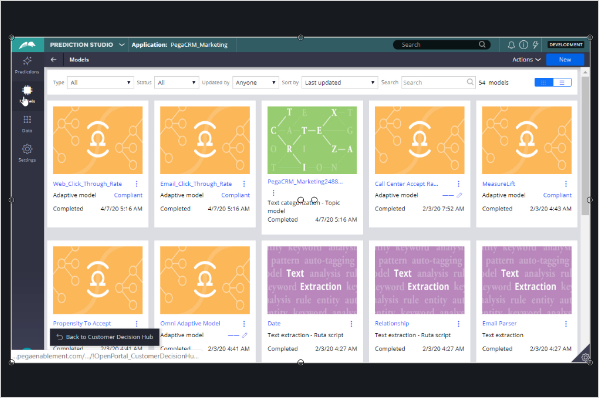

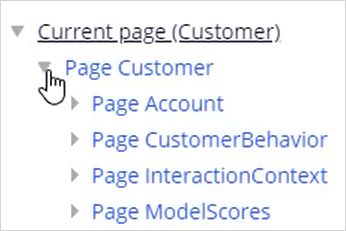

The AI is driven by an adaptive model. All predictive models in the system are available on the Model landing page of Prediction Studio.

An adaptive model is a self-learning predictive model that uses machine learning to calculate propensity scores. It automatically determines the factors that help in predicting customer behavior.

The Customer Decision Hub is configured to calculate the propensity for each treatment. For the web treatment, Web_Click_Through_Rate is the out-of-the-box adaptive model. It predicts the likelihood of positive customer behavior, such as clicking on a banner.

The model is used by the NBA Designer-generated decision strategy to determine a propensity for each treatment. After the initial application setup by a decisioning architect, the Web_Click_Through_Rate model is automatically generated.

All customer fields are set up as potential predictors by default. The model can be enhanced by adding additional fields.

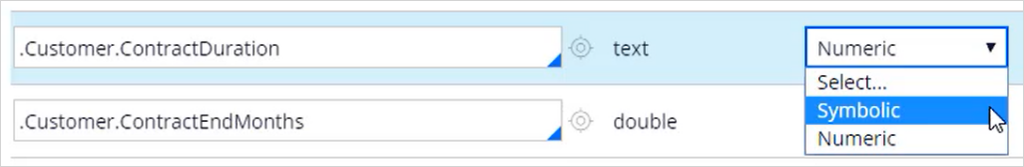

Predictors can be one of two types: numeric or symbolic. The system will default the predictor type to the property type during the initial set-up, but you can change this.

When you know a numeric predictor has a small number of distinct values, for example, when the contract duration is either 12 or 24 months, change the predictor type from numeric to symbolic.

Bear in mind that changing the predictor type effectively means removing and adding a predictor. Therefore, best practice is to make these changes early in the process, as there is no way to retain previous responses. Pega only stores binned aggregates.

However, this usually has little impact, as models typically learn quickly given the response rates in most applications.

It is highly recommended to add many uncorrelated predictors, as the models will figure out which ones to use. Additional predictors may include customer behavior, contextual information, past interactions with the bank, and even scores from external models.

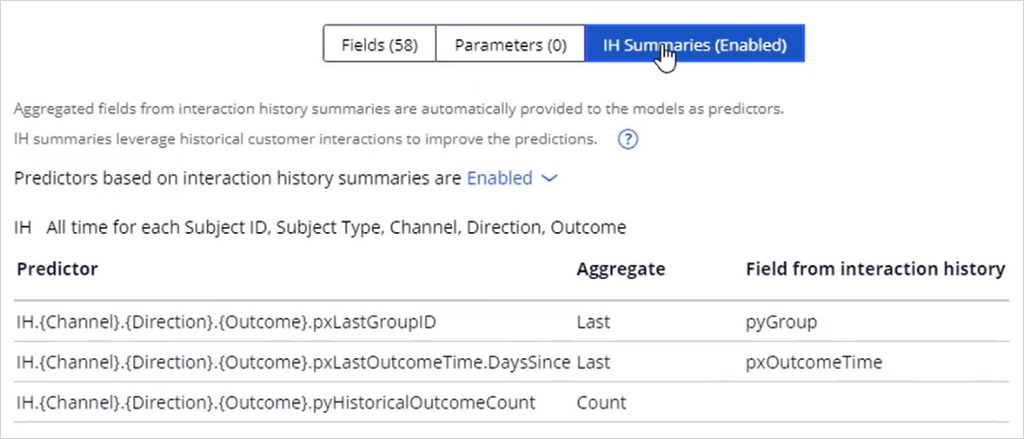

Customer responses are recorded in the Interaction History dataset. Aggregated fields are automatically provided to the models as predictors. An example of such a predictor is the group to which the most recently accepted web offer belongs.

By default, the action group, the time since the last accept, and the number of accepted actions from that group are available as predictor information.

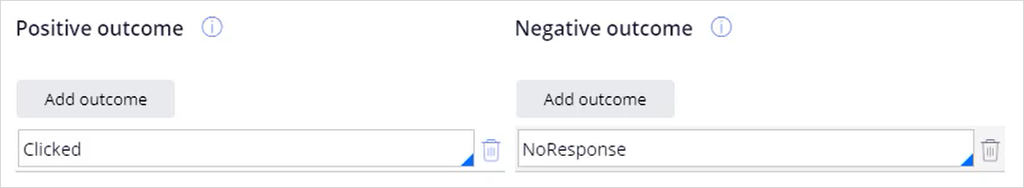

Next, check the positive and negative outcomes of the adaptive model.

When a customer clicks the web banner, it is recorded as Clicked and considered positive behavior, because the customer has shown interest in the offer.

If the banner is shown, but the customer does not click it within a given time period, it is recorded as NoResponse, which is considered negative behavior.

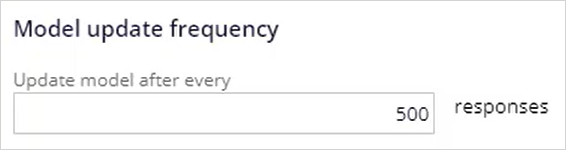

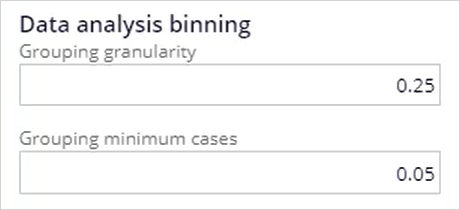

The default values for the advanced settings in an adaptive model are based on best practices and should only be changed by a highly experienced data scientist.

The model update frequency represents the number of responses an adaptive model will accumulate before it starts updating the model.

There are additional parameters used for binning responses.

You can now save the model.

Now that the AI is configured, when Troy logs into the U+Bank website the Standard Card credit card offer is presented instead of the generic offer.

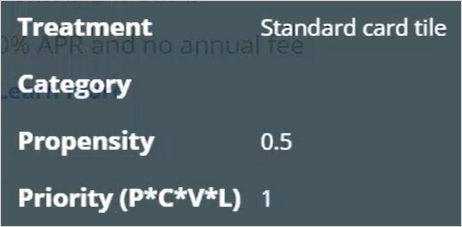

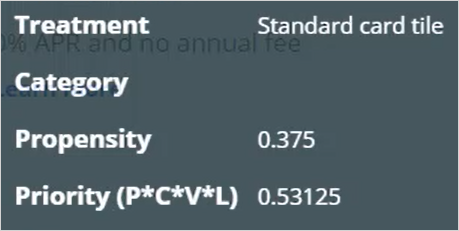

Note the propensity and priority values for the Standard Card. The propensity for every action starts at 0.5 or 50%, the same as the flip of a coin. This is because in the beginning, the AI has no past customer behavior on which to base its predictions.

Notice also that although only propensity is currently enabled for arbitration, the priority value does not match the propensity value.

The AI uses Thompson sampling to add some noise to the propensity values. If the models have received very few responses, a lot of noise is added.

When the number of responses received increases, less noise is added and therefore the propensities returned are very close to the raw model propensity.

If Troy doesn't click on the current offer this time, a different offer will be shown the next time he visits the website. The next offer Troy is eligible for, the Rewards Card, is then selected for display.

If Troy ignores this offer as well (by not clicking on it) then the next time he logs in, the Standard Card offer will be displayed again.

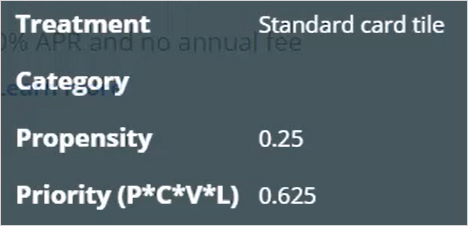

Why this behavior? First, Troy only qualifies for two credit card offers. Second, the AI model is configured to record an impression when a customer is presented with an offer but doesn't click on it. This is considered negative behavior.

As a result, the propensity, and therefore the priority, of the not-clicked-on offer decreases. Notice that the propensity value of the Standard Card offer dropped from 0.5 to 0.25.

Now, if Troy clicks on the Learn more link for the Standard Card offer, a positive response is recorded, and thus the propensity value of the Standard Card increases.

This demo has concluded. What did it show you?

- How AI uses customer behavior to calculate propensity.

- How propensity smoothing is used to jump-start AI learning.

- How the prioritization value is calculated using the (P*C*V*L) formula.

- How to enable AI on the web channel.

- How to configure additional potential predictors for an adaptive model.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?