Exploring Next-Best-Action decisions

Next-Best-Action Designer organizes the high-level sequence of steps needed to customize the next-best-action strategy to suit the business requirements. Pega Customer Decision Hub™ uses these settings to generate an underlying next-best-action strategy framework and the enterprise-level strategies that come with it.

These decision strategies determine the personalized set of next best actions for each customer. To observe the decisions made for a specific customer, explore the Customer Profile Viewer.

Video

Transcript

Next-Best-Action Designer guides the decisioning architect by creating a next-best-action strategy that delivers personalized customer experiences across all channels. The tabs across the top of the user interface represent the steps to define the next best actions:

- Use the Taxonomy component to define the business structure for your organization.

- Use the Constraints component to implement channel limits and constraints.

- Use the Engagement policy component to define the rules that control for which actions customers qualify for.

- Use the Arbitration component to configure the prioritization of actions.

- Use the Channels component to configure when and where the next best actions initiate.

The system uses these definitions to create an underlying Next-Best-Action Strategy framework. These decision strategies are a combination of the business rules and AI models that form the core of Customer Decision Hub, which determines the personalized set of next best actions for each customer.

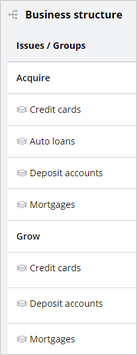

Use the Taxonomy tab to define the hierarchy of business issues and groups to which an action belongs.

A business issue is the purpose behind the actions that you offer to customers. For example, actions to acquire new customers belong to the Acquire business issue. The Grow business issue groups the actions to cross-sell to existing customers. Business groups organize customer actions into categories. You can create groups for products, such as credit cards, mortgages, or auto loans, to offer these to potential customers.

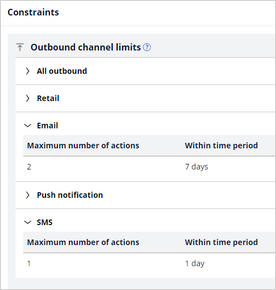

Use Constraints to specify contact limits and limit overexposure to a specific action or group of actions. For example, you do not want your customers to receive more than two emails per week or one SMS message daily.

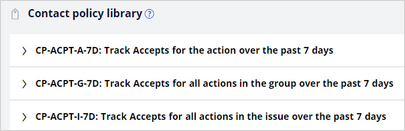

You can define more extensive suppression rules by creating Contact Policy rules in the library. Contact Policy rules are reusable across all business issues and groups. For example, you suppress an action for a customer for seven days after the customer has seen an ad for that action five times.

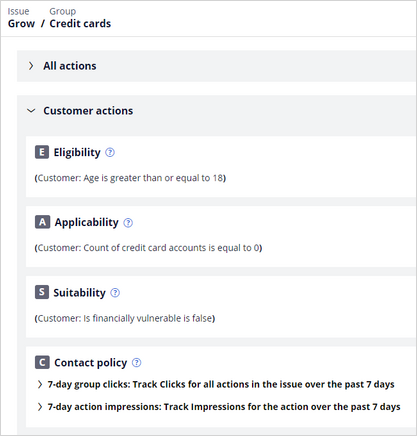

Use Engagement policies to define when specific actions or groups of actions are appropriate for customers. There are four types of engagement policies:

- Eligibility determines whether a customer qualifies for an action or group of actions. For example, an action might only be available for customers over a specific age or who live in a specific geographic location.

- Applicability determines whether an action or group of actions is relevant for a customer at a particular point in time. For example, a discount on a specific credit card might not be relevant for a customer who already owns a card.

- Suitability determines whether an action or group of actions is appropriate for a customer for ethical or empathetic reasons. For example, a credit card offer might not be appropriate for a customer who is financially vulnerable, even though it might be profitable for the bank.

- Contact Policies determine when to suppress an action or group of actions and for how long. For example, you can suppress an action after the customer receives a specific number of promotional messages.

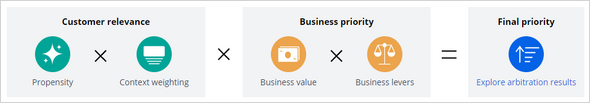

Arbitration determines how Customer Decision Hub prioritizes the list of eligible and appropriate actions from each group.

The factors that the system weighs in arbitration are Propensity, Context weighting, Business value, and Business levers. Numerical values represent the factors.

Propensity is the likelihood that a customer responds positively to an action, and AI calculates the propensity. For example, clicking an offer banner or accepting an offer in the contact center are considered positive behaviors.

Context weighting allows you to assign a weighting to a specific context value for all actions within an issue or group. For example, if a customer contacts the bank to change the home address, the weight of the Service context increases, and the highest priority action is to ensure that the system delivers the relevant service to the customer.

Business value enables you to assign a financial value to an action and prioritize high-value actions over low-value ones. For example, promoting an unlimited data plan might be more profitable for the company than a limited data plan.

Business levers enable you to accommodate urgent business priorities by specifying a weight for an action, group, or business issue. A simple formula determines a prioritization value, which is used to select the top actions.

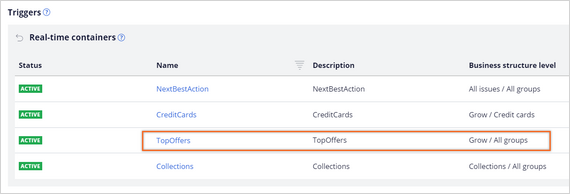

Next-Best-Action Designer enables the delivery of next best actions through inbound, outbound, and paid channels. A trigger is a mechanism where an external channel, for example, a website, invokes the execution of a Next-Best-Action decisioning process for specific issues and groups. The result returns to the invoking channel. A real-time container is a placeholder for content in an external real-time channel. For example, a website invokes a real-time container, TopOffers, before loading the account landing page.

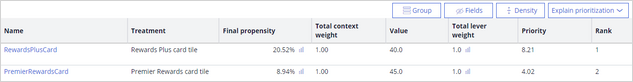

You can explore the arbitration matrix in the Customer Profile Viewer report to understand what actions the system offers to customers. For example, U+ Bank uses Customer Decision Hub to decide which credit card offer to show when customers log in to the bank's website. Joanna is a U+ Bank customer.

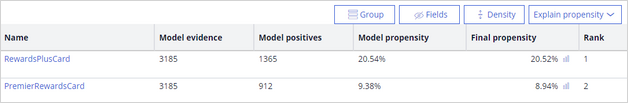

For this use case, the direction is inbound, the channel is the web, and TopOffers is the real-time container service that manages communication between Customer Decision Hub and the website. Joanna meets all criteria for two credit card offers: the Rewards Plus card, and the Premium Rewards card.

The Explain prioritization view shows the values for the arbitration formula components: propensity, context weight, business value, and lever weight. The business value of the Premier Rewards card is higher than the value of the Rewards Plus card. But the likelihood that Joanna is interested in a credit card offer is highest for the Rewards Plus card, which is the top offer.

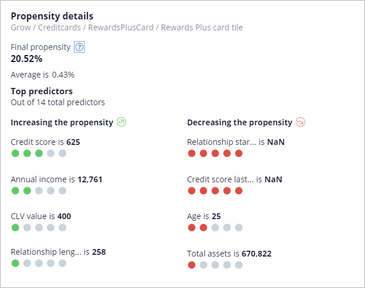

To aid the transparency of the AI, you can view the predictors that are most influential in the calculation of the propensity.

To understand how the computation for the action propensity works, inspect the Explain propensity view, where you can see the model evidence, the number of positive responses, the initial model raw propensity and the final propensity that Customer Decision Hub uses in arbitration.

You have reached the end of this video. You have learned:

- How Next-Best-Action Designer is organized according to the following high-level sequence of steps that are necessary to configure the next-best-action strategy:

- Defining the business structure for your organization.

- Implementing the channel limits and constraints.

- Defining the contact policies that control for which actions a customer qualifies.

- Configuring the prioritization of actions.

- Configuring when and where to initiate the next best actions.

- How you can analyze the decisions for a specific customer in Customer Profile Viewer to aid model transparency.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?