Adding behavioral data to a customer profile

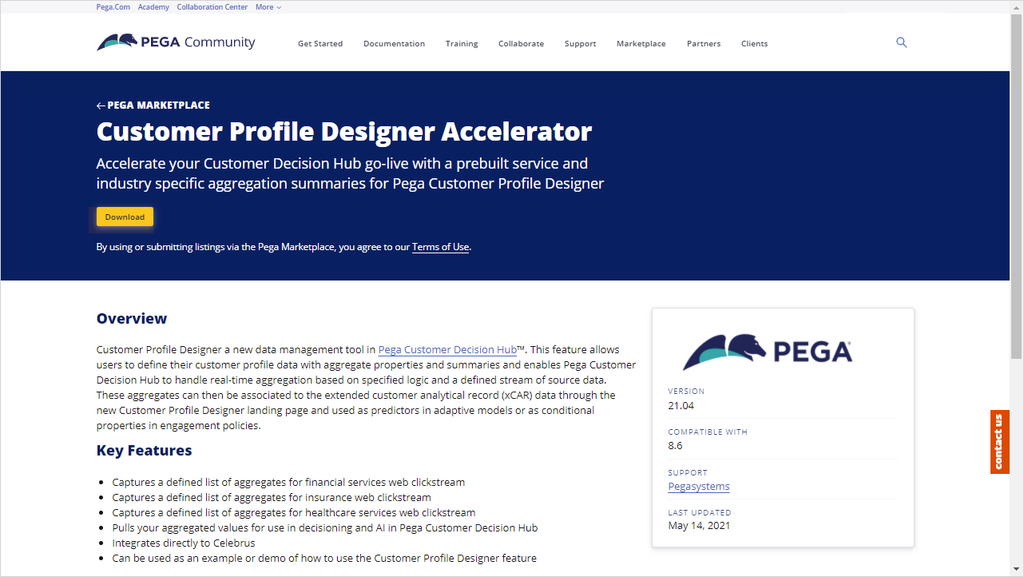

A Pega Customer Profile Designer accelerator component is available for download on Pega Marketplace. This component contains all the necessary artifacts to leverage industry-specific best practice clickstream summaries quickly.

Video

Challenge

Tip: To practice what you have learned in this topic, consider taking the Adding clickstream data to a customer profile challenge.

Transcript

This demo shows you how to use the accelerator component to leverage industry-specific best practice clickstream summaries and extend the customer profile with behavioral data to improve the performance of the predictive models.

The U+ Bank technical team wants to leverage out-of-the-box best practices to capture clickstream data to extend the customer's profile and introduce powerful predictors to their existing adaptive models.

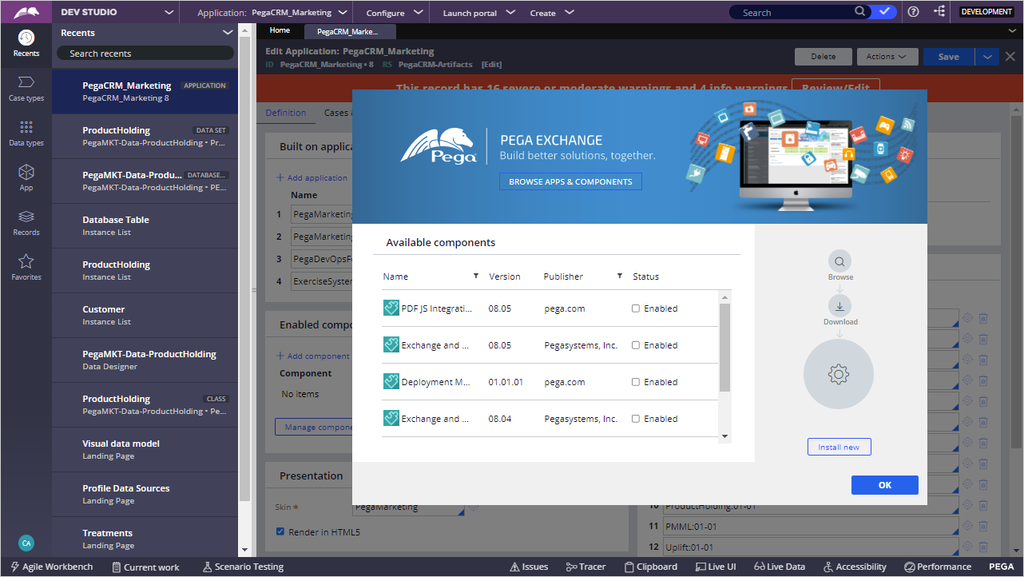

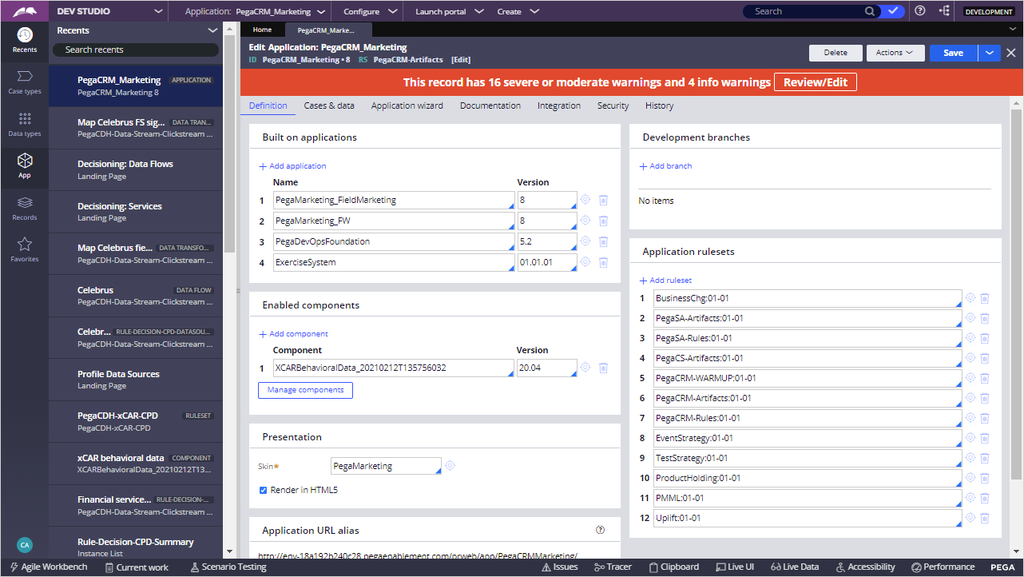

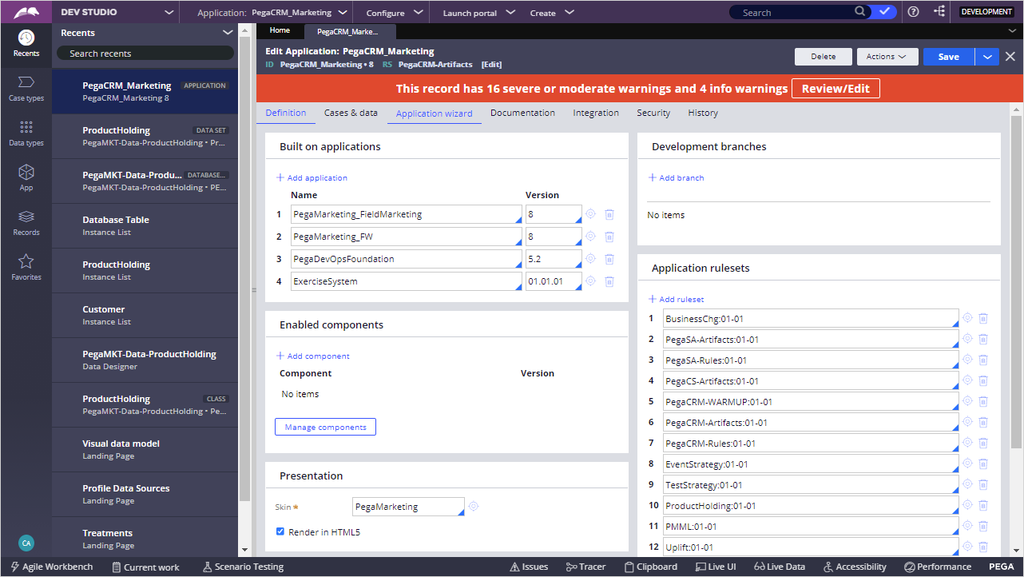

To capture clickstream data, start by installing the Customer Profile Designer Accelerator component from Pega Marketplace. In Dev Studio, navigate to the application definition. Here, you can start the installation of the new component.

You can browse through the predefined components from Pega Marketplace to download the accelerator component.

Search for the Customer Profile Designer Accelerator component and download it to your local drive.

Now, install the downloaded component and view the underlying rules.

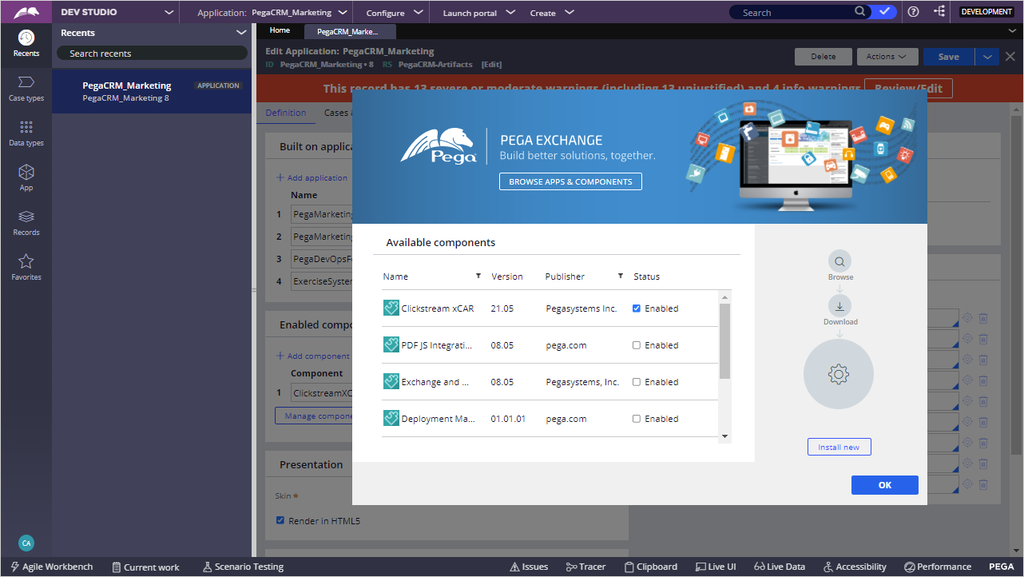

After the component is installed successfully, confirm that the status is set to enabled.

Confirm that the component is visible in the Enabled components section of the application rule, and then save your changes.

The component is shipped with several important artifacts:

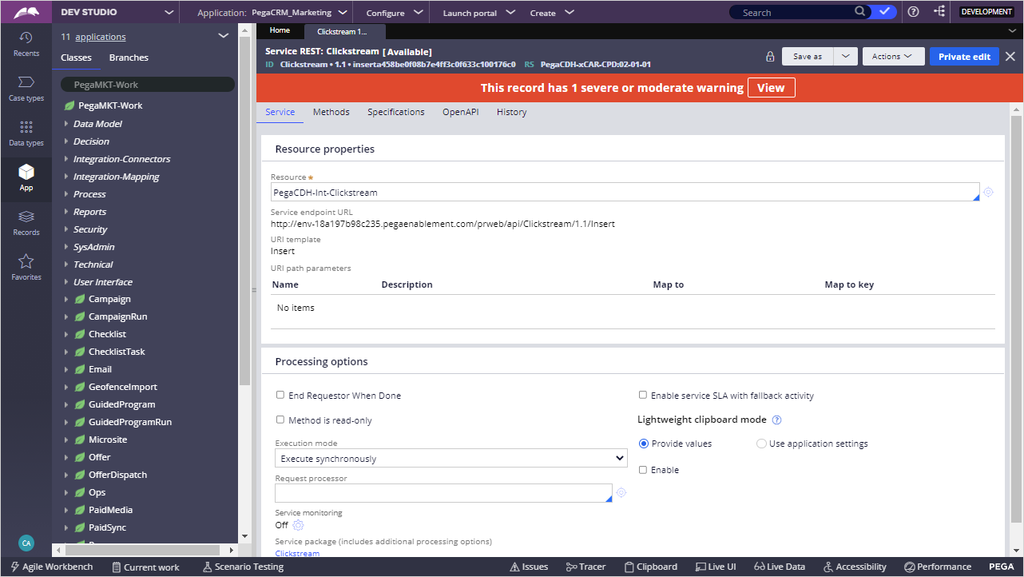

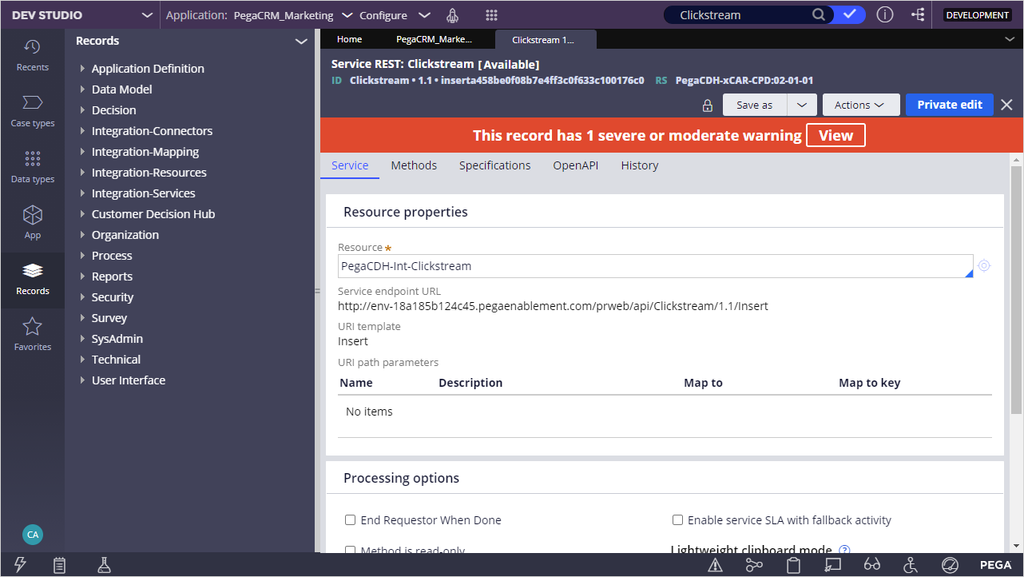

a sample Clickstream Rest service that can be invoked from a website;

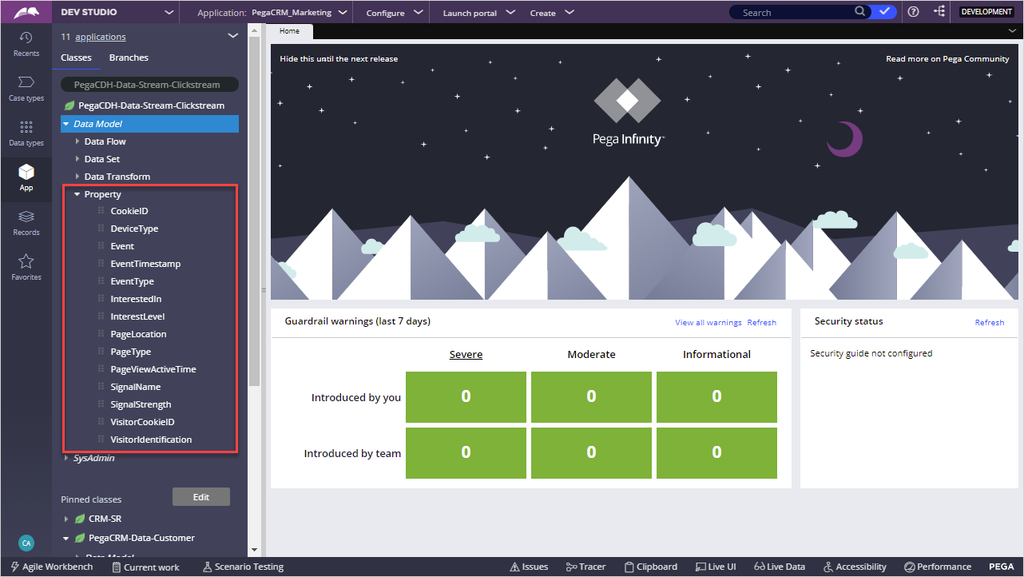

a data structure to support the service payload;

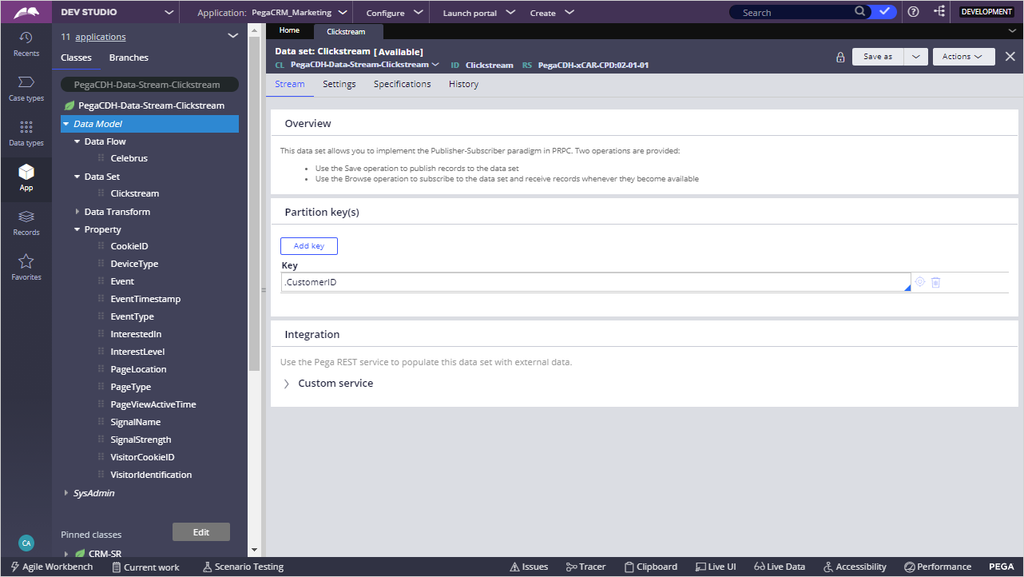

a Clickstream data set for generic clickstream data;

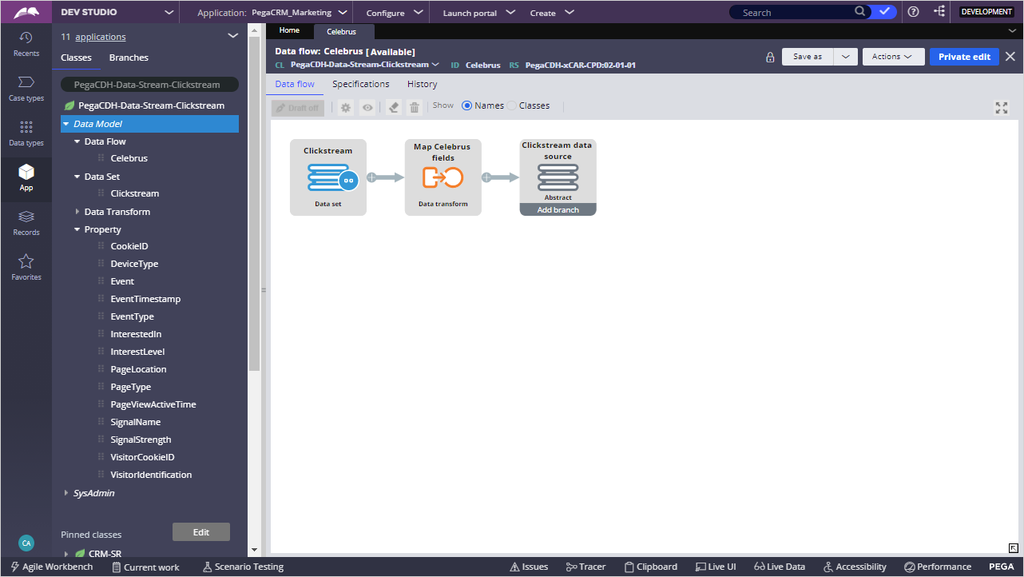

a Celebrus data flow for integrating with Celebrus (third-party software that captures granular customer experience data across all digital channels);

and three example summaries for aggregating clickstreams on industry-specific web pages.

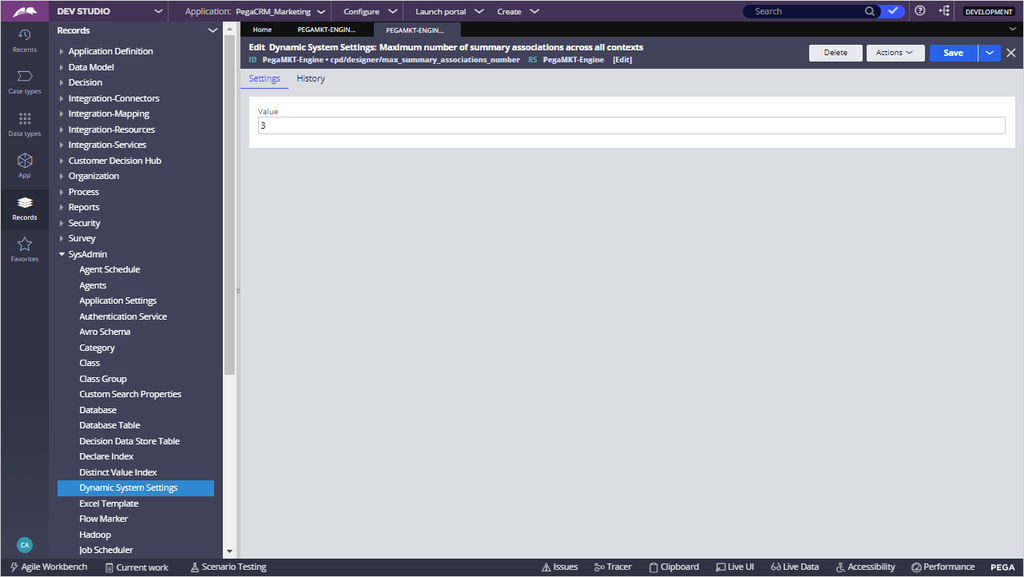

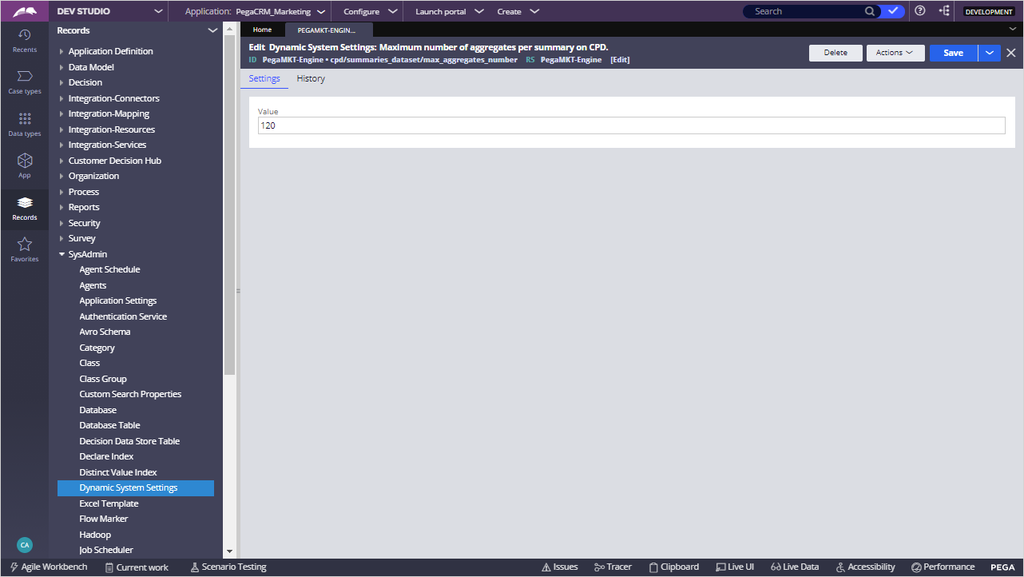

To ensure that there is no impact on system performance, there is a limitation on the number of summaries and aggregate conditions allowed. These limits are applied through Dynamic System Settings.

The max_summary_associations_number dynamic system setting shows the number of summaries that you can create in Customer Profile Designer, which is set to 3 by default.

The max_aggregates_number dynamic system setting is the number of Aggregate conditions each summary can hold, which is set to 120. You can change these limits if necessary, as long as the performance impact is analyzed.

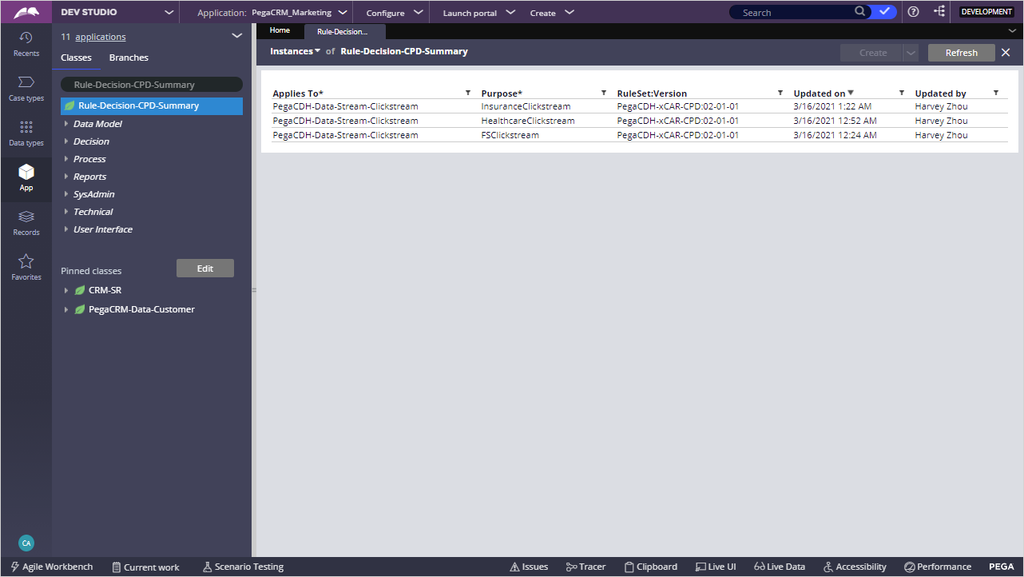

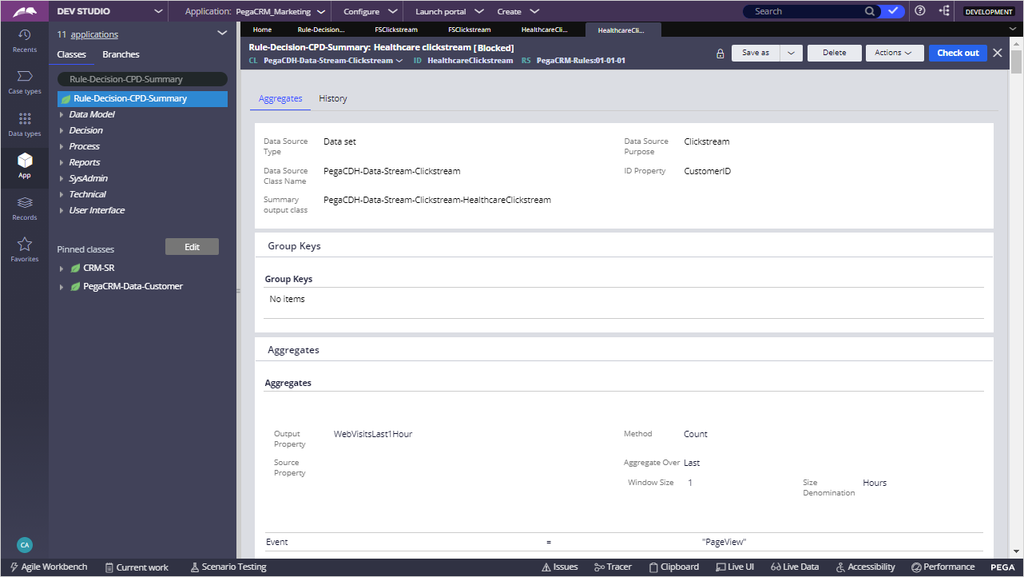

Because the limit of summaries is set to 3, as a best practice, it is important to block the summary rules that you do not intend to use. In this case, you can block the Insurance and Healthcare summaries. Save the HealthcareClickstream summary to your Rules ruleset and mark it as Blocked. Save your changes.

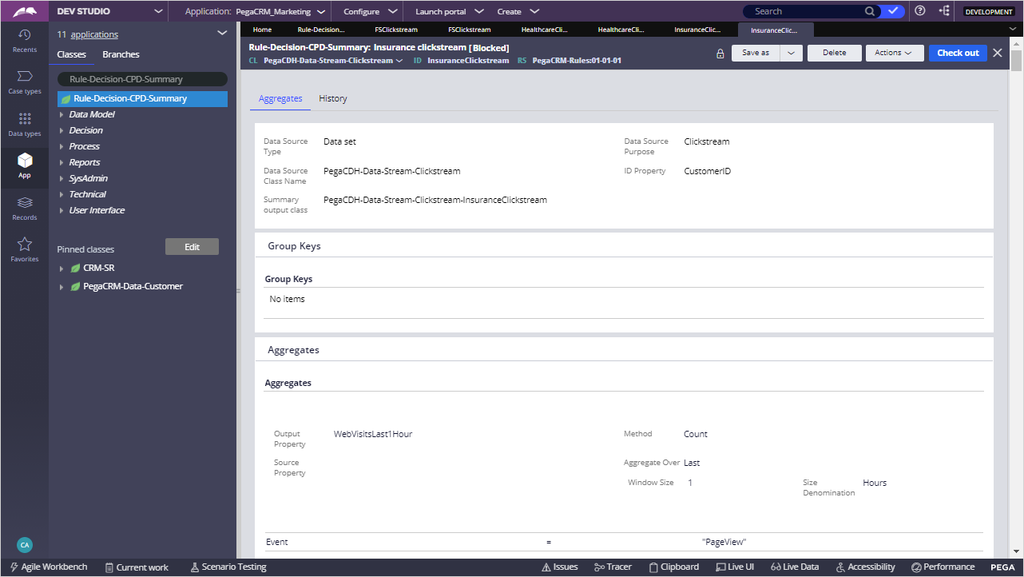

Follow the same steps to block the Insurance Clickstream summary.

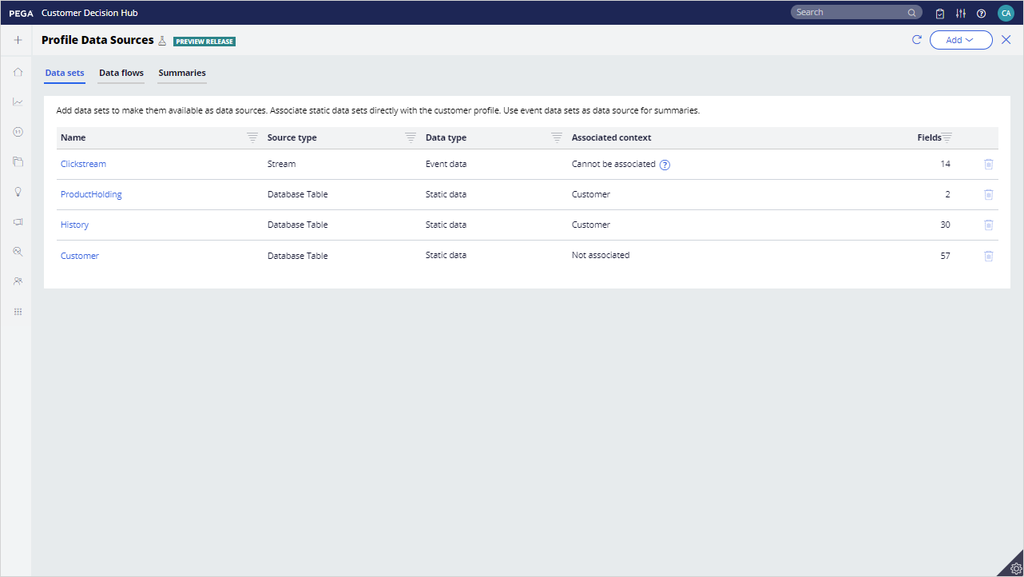

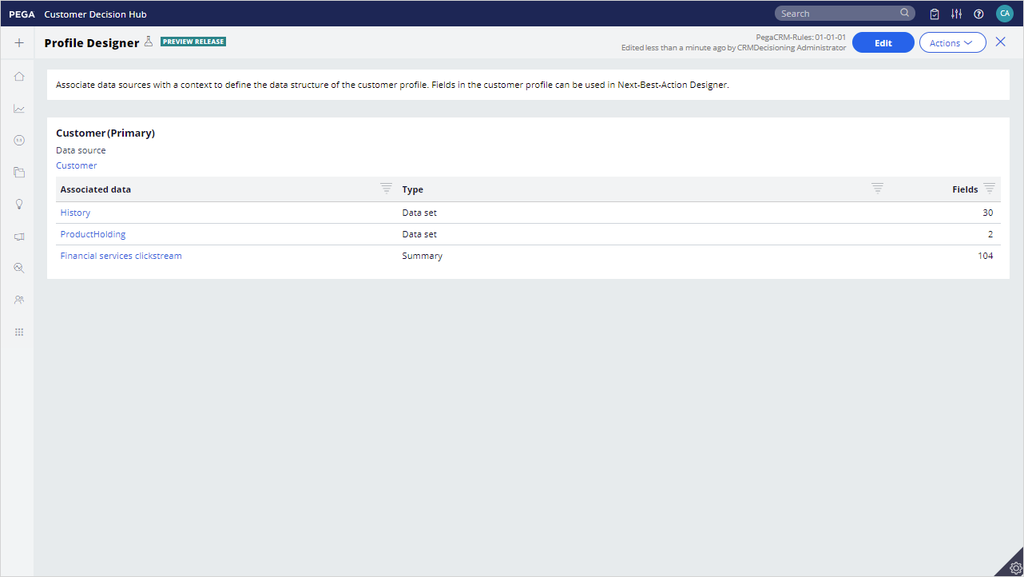

Navigate to the Profile Data Sources landing page in the Customer Decision Hub portal. The Clickstream data set that ships with the component that stores customer web click activity is now available as a data source. It is important to note that streaming data cannot be directly associated with the primary context and needs to summarize into meaningful aggregations.

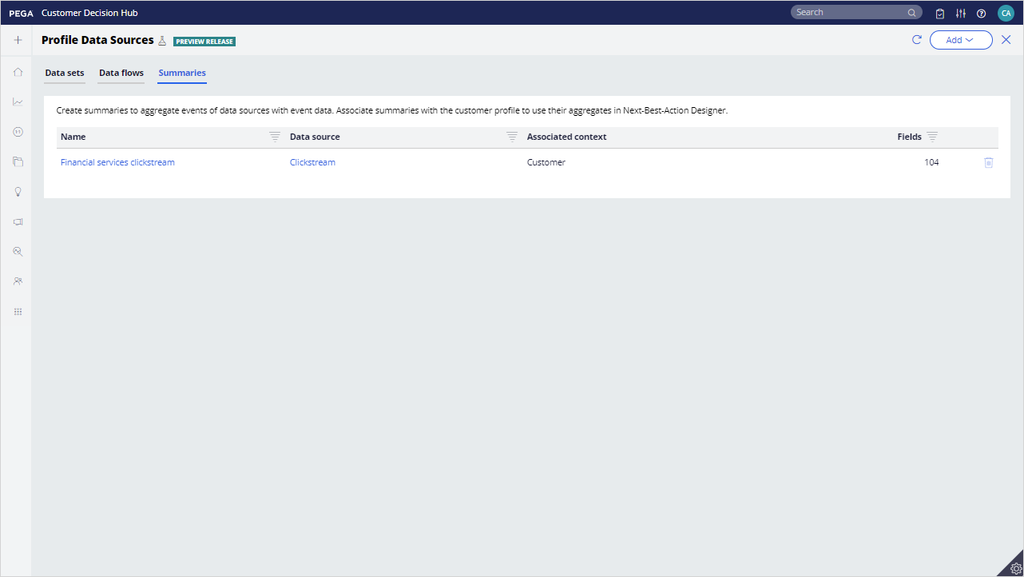

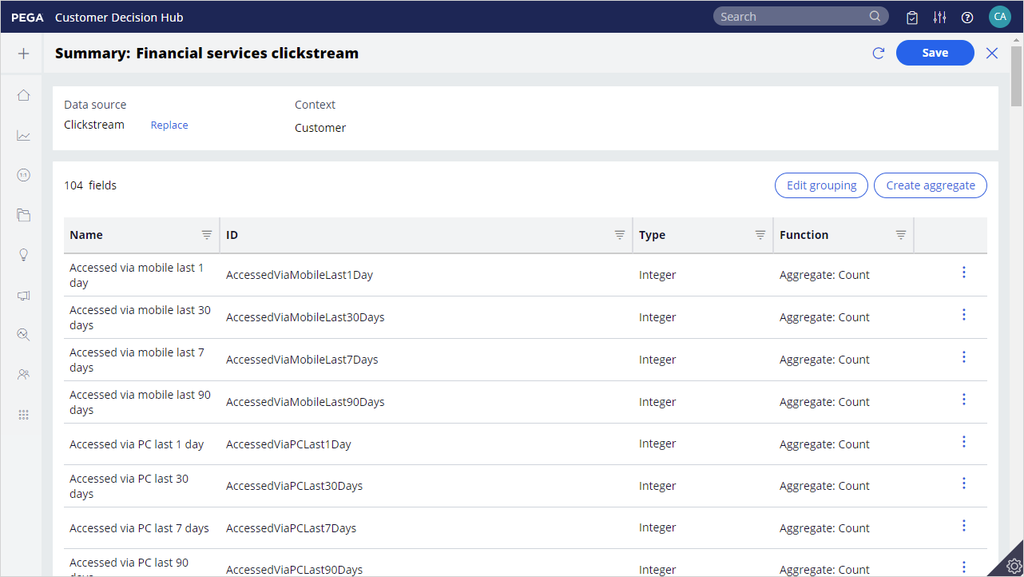

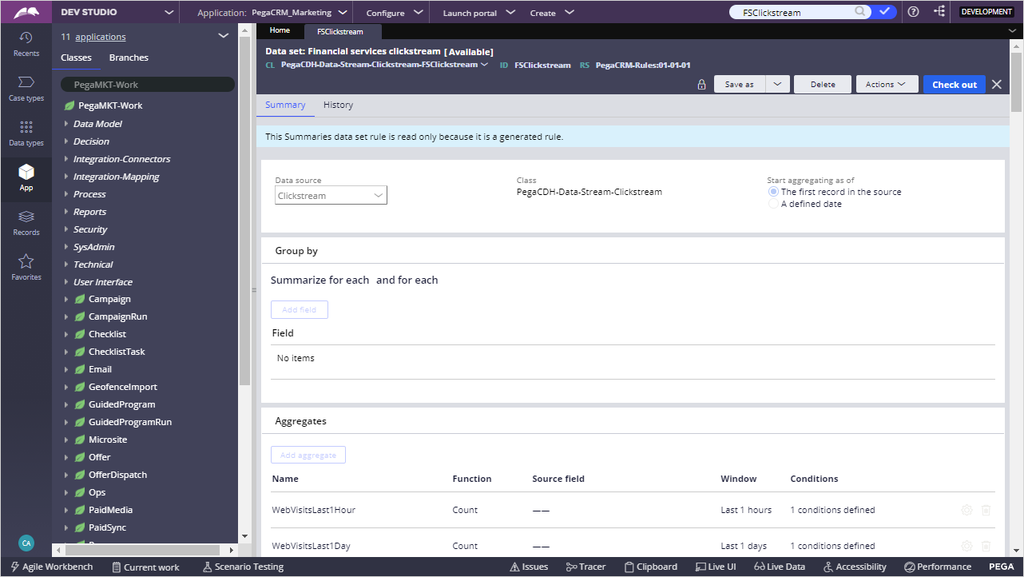

On the Summaries tab, the Financial services clickstream summary that you previously saved in your Rules ruleset is available. Note that the data source for this summary is set to the Clickstream dataset. This setting means that every event that flows through the Clickstream data set calculates the aggregations in the Financial services clickstream summary rule.

Launch the Financial services clickstream summary rule, and then click Save. Doing so triggers a background process for creating the aggregate properties, dataflow scheduler, the corresponding class structure for the generated artifacts, and marking the properties as relevant for usage in Next-Best-Action Designer.

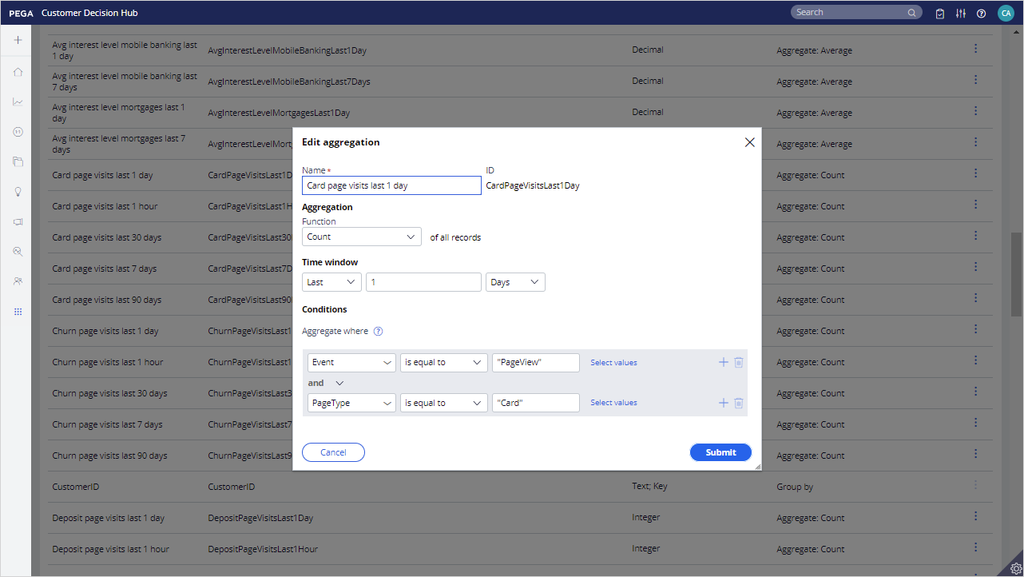

This Financial industry best practice summary is shipped with 104 aggregates, each with a unique aggregation condition. For example, select the Card page visits last 1 day aggregate to browse its condition. You can see that this aggregation counts the number of PageView events with a PageType of Card that occurred in the last 1 day.

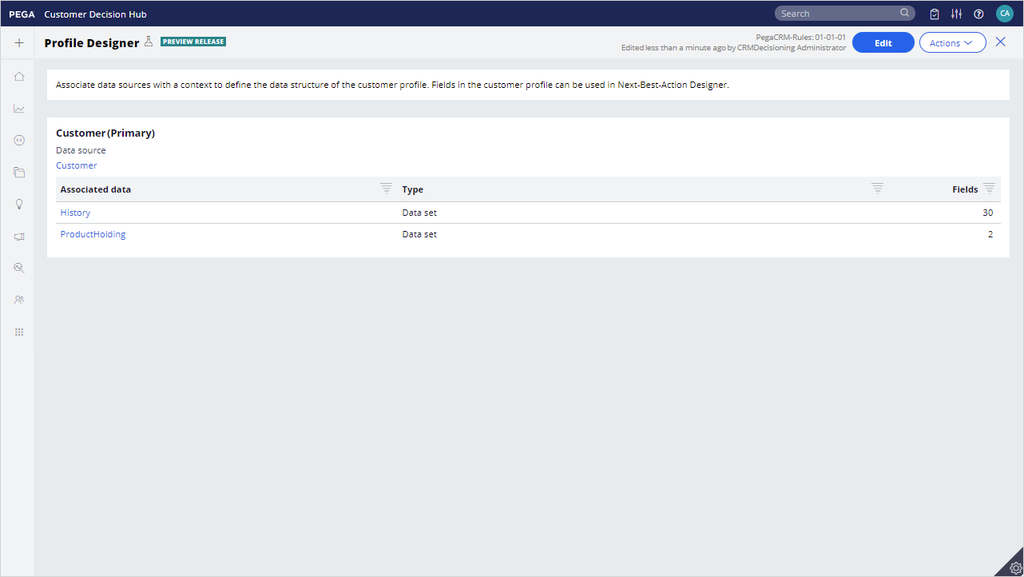

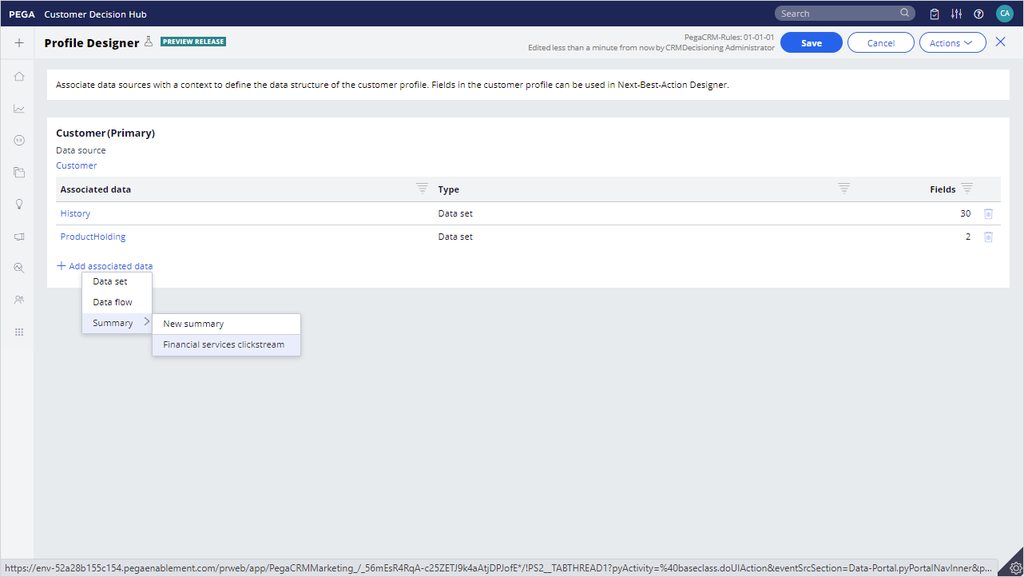

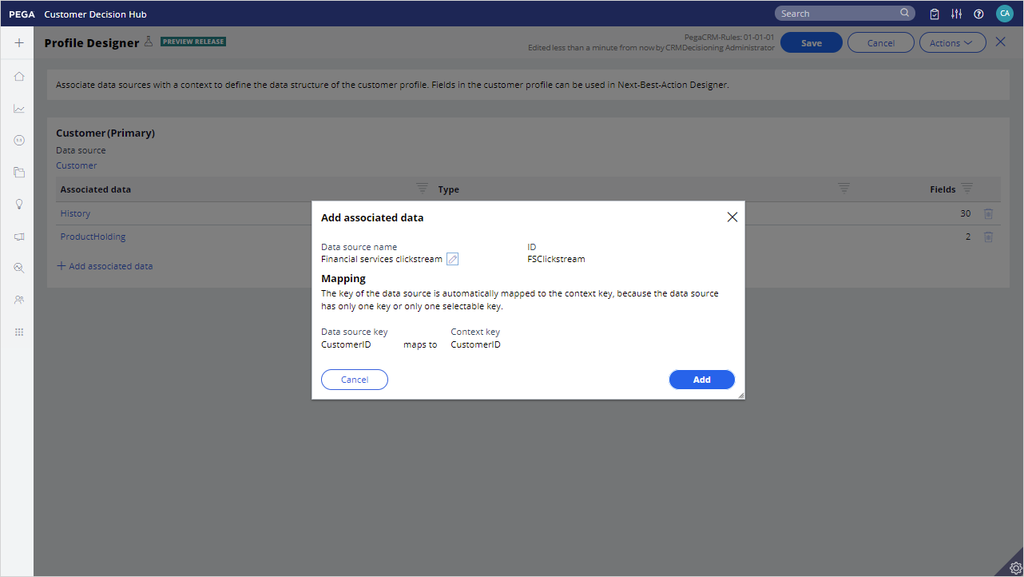

With everything in place, associate this summary with your Primary context in the Profile Designer.

Add a new summary to the associated data of the primary context. In this case, the only available data source is Financial services clickstream.

The Financial services clickstream summary has a single data source key, so it is automatically mapped to the context key of the primary class.

Once you have added the summary as a new association, save your changes.

You are ready to test the configuration. Navigate to Dev Studio and search for the Clickstream Service REST rule for testing.

Run the service with a sample JSON payload as if the web page has invoked the service for a customer who is viewing the Cards page.

{

"CustomerID":"14",

"InterestedIn":"",

"InterestLevel":"",

"Event":"PageView",

"PageType":"Card",

"DeviceType":"PC",

"PageViewActiveTime":"",

"CookieID":""

}

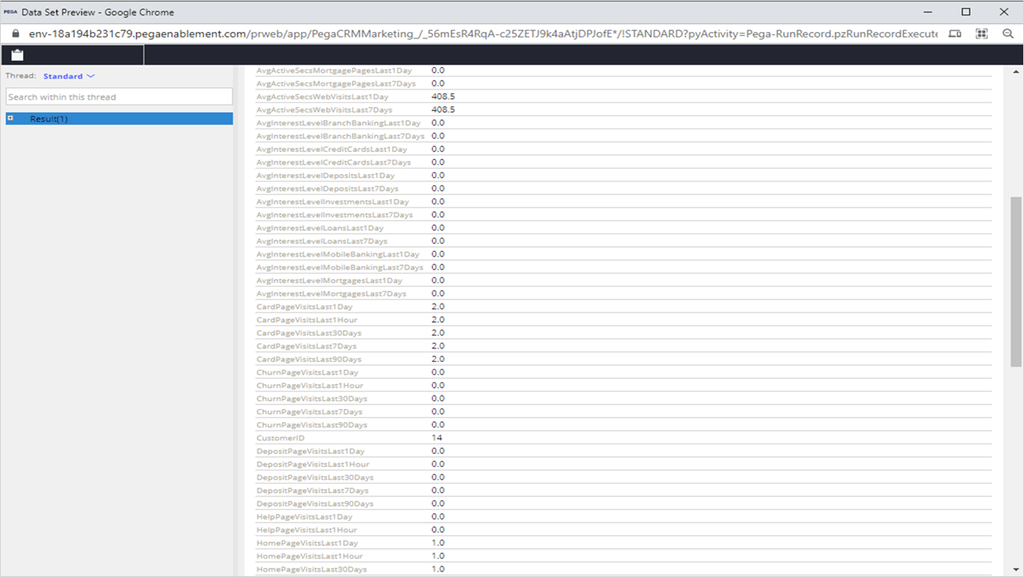

Now, search for the FSClickstream summary rule that you associated with the customer. Browse the data set to verify that the record was generated for the event.

You can now share the JSON structure and service endpoint with web developers.

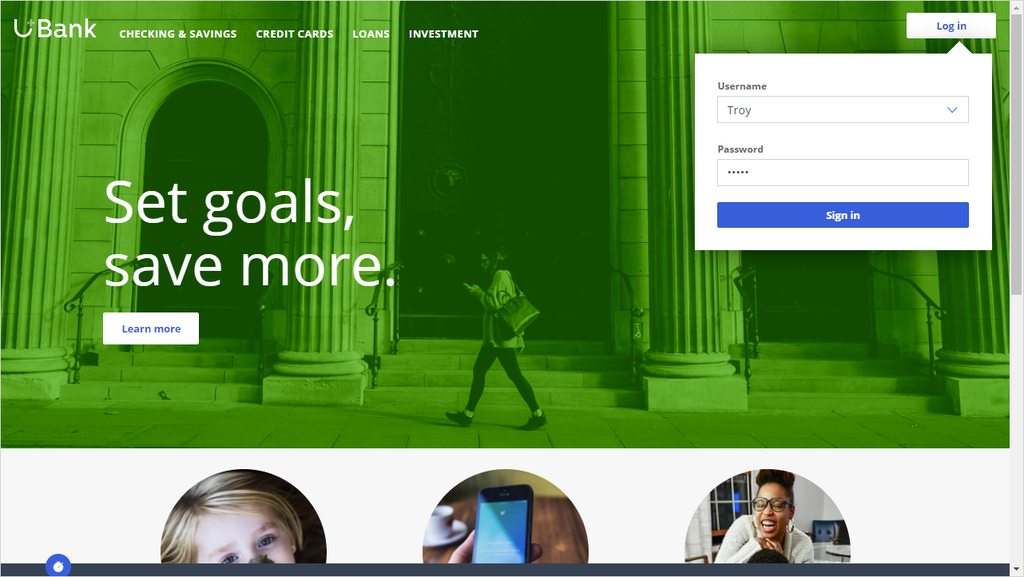

The U+ Bank technical team has developed the integration between the website and Customer Decision Hub. Now, the customer's web activity streams in through the Clickstream service you previously tested.

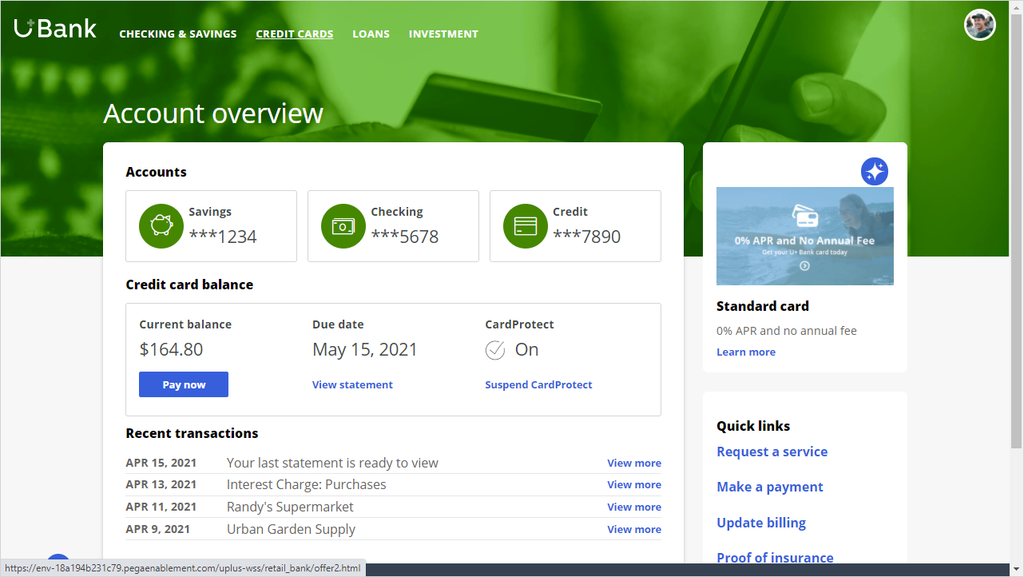

Launch the U+ website and log in as Troy.

At the top of the screen, click Credit Cards to navigate to the cards page.

By logging in to Troy's Account Overview and navigating to the Credit Cards page, you created some web activity for Troy.

Navigate back to Dev Studio and browse the FSClickstream data set to verify that the events have streamed and processed successfully.

Confirm that the aggregate CardPageVisitLast1Day has increased. Note that the system has already started calculating additional aggregates such as the average active seconds spent on the page. After reviewing the aggregates, launch Prediction Studio.

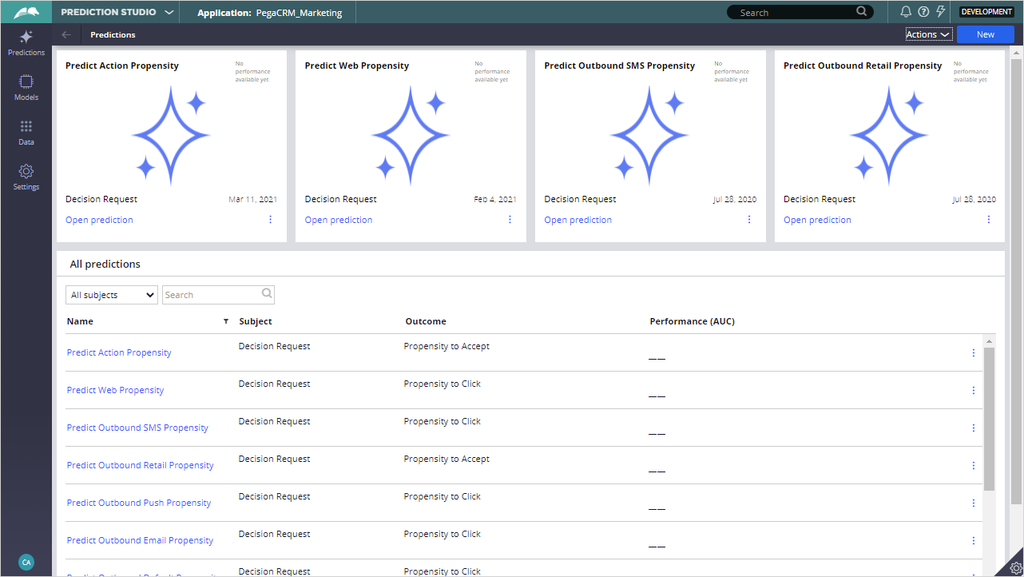

Now that you have completed the end-to-end testing, it is time to empower the adaptive models by leveraging the attributes that come with the summary rule. This task is a typical data scientist task, but it is being shown here to complete the use case.

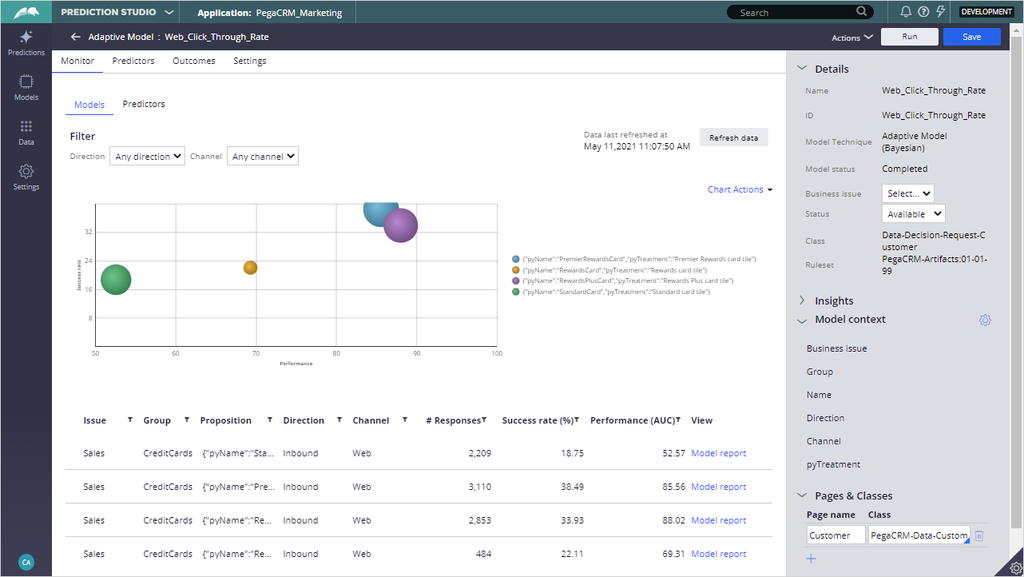

From the Predict Web Propensity prediction, launch the Web_Click_Through_Rate adaptive model.

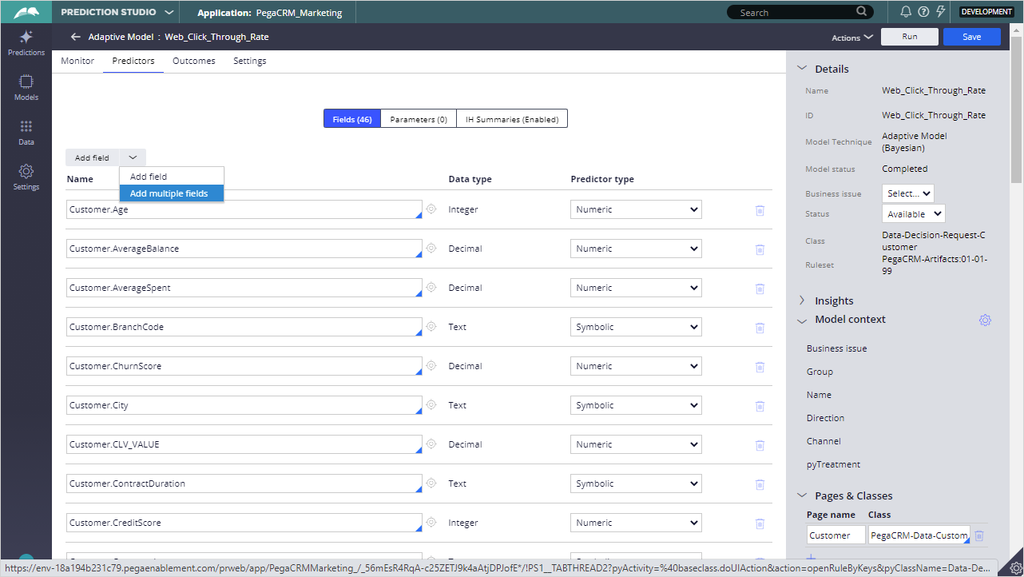

You can add new predictors on the Predictors tab of the adaptive model. To add more than one predictor, select the Add multiple fields from the drop-down list.

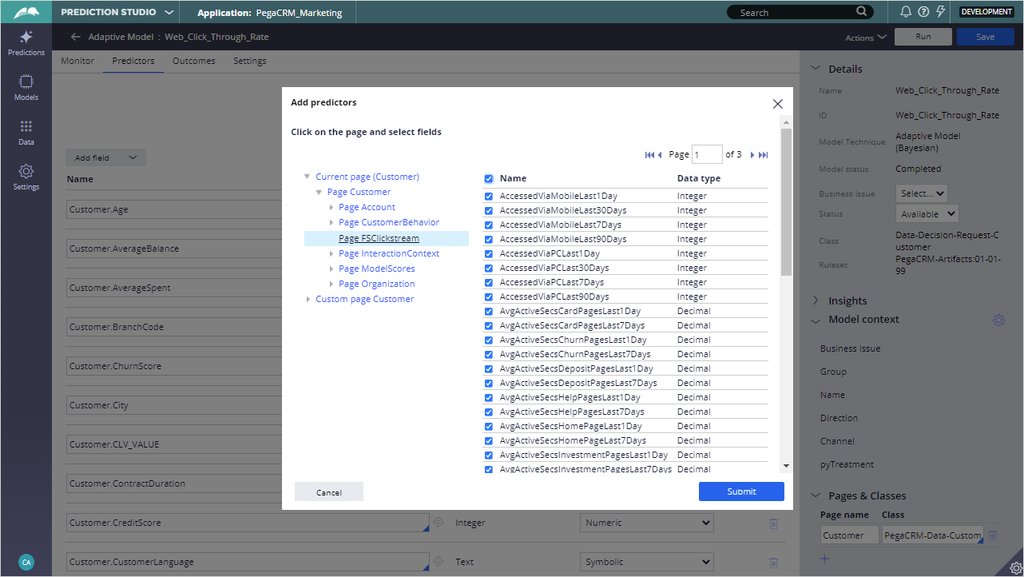

The FSClickstream page in the Customer class contains all of the predictors that are calculated in the FSClickstream summary rule. Select all the properties and save your progress.

This demo has concluded. What did it show you?

- How to install the Clickstream for Customer Analytical Data Model component

- How to associate the Summary rule with the primary context

- How to test the Clickstream service

- How to use the Behavioral data source as predictors

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?