Building a scorecard to calculate the credit score

Introduction

Scorecard rules are referenced in decision strategies through the scorecard component. Learn how to create scorecard-specific rules to derive decision results from several factors.

Get detailed insight into how scores are calculated by testing scorecard logic using the rule form. Use the test results to view score explanations for all predictors used in the calculation so you can validate and refine the current scorecard design or troubleshoot potential issues.

Video

Transcript

This demo will show you how to build a scorecard.

U+ bank wants to build a scorecard that calculates the credit score of a customer to determine if the customer is suitable for a mortgage or not.

The bank has identified three customer properties to use in the scorecard calculation. These are the HasCards (a property that indicates if a customer already has a credit card or not), Income, and Age.

To build a scorecard, navigate to the scorecards landing page and create a scorecard.

Enter a short description for the scorecard.

The Combiner function enables you to select a method for combining scores.

In this scenario, the credit score is the sum of scores attributed to each customer property, so use the Sum method.

The scorecard enables you to assign a score to a value or a range of values the property can have.

For example, the credit card indicator, HasCards property can have the values “Y” or “N”.

If a customer has a credit card with U+ bank, assign a score of 100. Otherwise, assign a score of 0.

You may also sub-divide values of numeric properties into ranges and assign a score to each range.

The next property is Income. In this case you want to split the values for yearly income into three ranges and assign a score to each range.

The data model contains an Income property, which contains the monthly income of the customer. The scorecard allows you to use this property to build the expression to compute the customer’s yearly income.

Once the expression is created, you can start assigning scores to each range. If the customer's yearly income is less than or equal to 25,000, assign a score of 50.

If their yearly income is between 25,001 and 50,000, assign a score of 100; and if their income is between 50,001 and 75,000, assign a score of 150.

If their income is higher than 75,000, assign a score of 200, using the Otherwise setting.

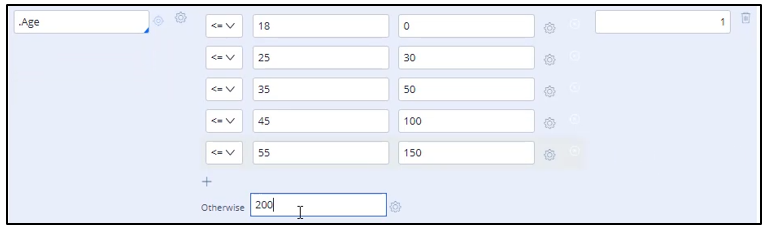

In a similar way, split the values for Age into five ranges and assign a score to each range. The higher the range, the higher the score you assign.

Once the Scorecard is defined, you can define the results of the scorecard calculation.

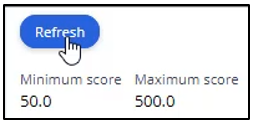

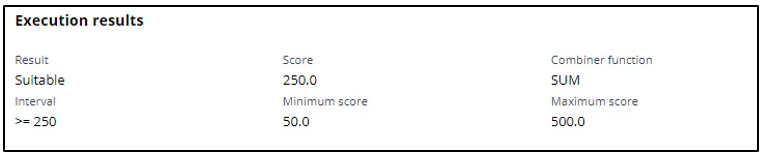

When you refresh, the scorecard calculates the Minimum and Maximum scores.

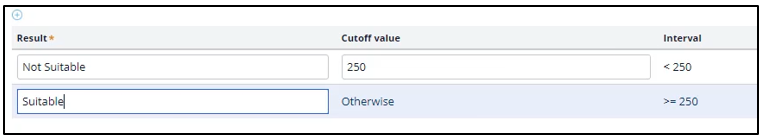

You may define two or more Result values based on the score. In this scenario, you want the scorecard to return a Result value of ‘Not Suitable’ if the score is less than 250. Otherwise, the Result value is ‘Suitable’.

Save the configuration.

Now, run the scorecard and verify the results.

You can either fill in the property values, or you can test the result for a predefined test case using a data transform. For example, select the customer Troy.

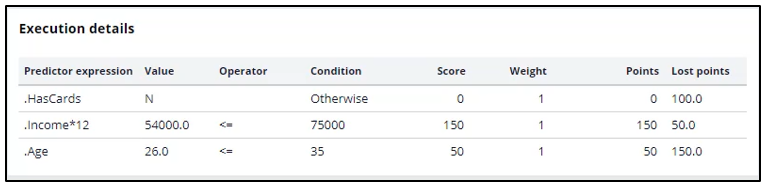

The end result for Troy is that he is Not Suitable for a mortgage, as his credit score is 200, which is lower than the set threshold.

You can see the Execution details for Troy, which show how his credit score is computed. Since he has no cards, he gets a score of 0; for his income, he gets a score of 150; and for his age, he gets a score of 50. That’s 200 in total.

Now, test the results for customer Robert.

Robert is suitable for a mortgage, as his credit score is 250.

The newly created scorecard is now available on the Scorecards landing page.

This demo has concluded. What did it show you?

- How to create a scorecard.

- How to assign a score to categorical and numerical property values.

- How to use expressions in scorecards.

- How to define scorecard outputs.

- How to test scorecards.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?