Customer credit score using a scorecard

Introduction

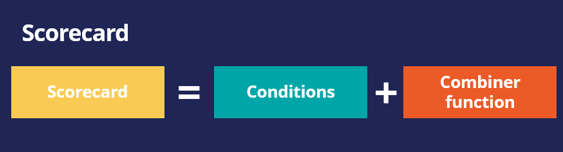

A scorecard is a mathematical model that determines a score value based on a set of conditions and a combiner function. These conditions can either use customer properties directly, or an expression based on them. The output of a scorecard is the raw score and a segment, which is obtained by defining a set of cut-off values that create a set of score ranges.

Video

Transcript

This video explains how a scorecard can be used to determine the customer credit score.

Let’s consider a typical loan application scenario for U+ Bank.

The bank wants to automate the home loan requests process by analyzing a customer's credit score based on customer profile information and categorizing it into the right credit score level using a scorecard.

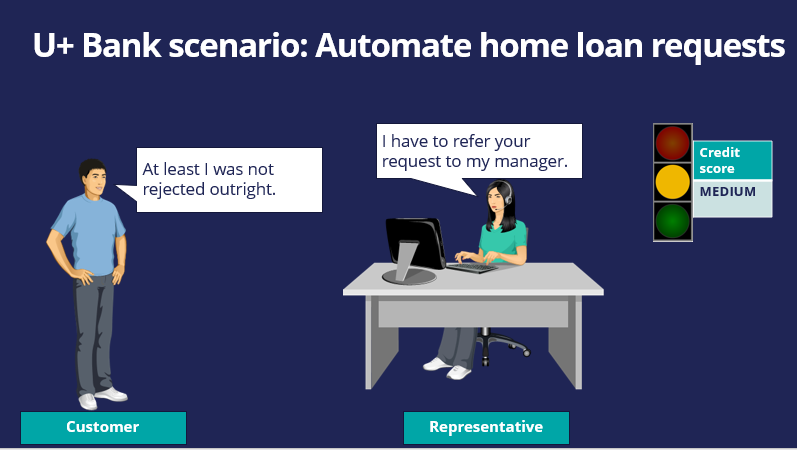

Tom is a U+ Bank customer who visits the bank to apply for a home loan. Iris is a U+ bank loan representative who is responsible for processing loan requests.

Iris gets Tom’s profile information. Based on his customer data, Iris calculates his credit score using a scorecard.

Depending on Tom’s credit score, a decision is made on his loan application.

The bank has already defined three credit score levels: Low, Medium and High.

For example, if Tom’s credit score is LOW, he is not qualified to get a loan, and his application is automatically refused.

If Tom’s credit score is MEDIUM, then his application needs to be reviewed further by manager.

If Tom’s credit score is HIGH, then he is automatically eligible to get the loan right away.

Let’s now learn about the scorecard and how it works by considering the U+ Bank loan application scenario.

A scorecard is a mathematical model that computes a score and outputs a segmentation result based on one or more conditions and a combiner function.

Let’s take a look at an example of a scorecard U+ bank could use. Assume that in order to process home loan requests, the bank has identified three predictors that can be used in the scorecard calculation. The predictors are Customer lifetime value, Age, and Account.

Each predictor has some conditions and scores associated with those conditions.

The scorecard enables the bank to assign a score to a value or a range of values the predictor can have.

For example, If the Customer lifetime value is less than 100, a score of 83 is assigned. If the value is between 100 and 399, a score of 221 is assigned; otherwise a score of 350 is assigned.

If the customers’ Age is less than 20, a score of 21 is assigned. If their Age is between 20 and 39, a score of 217 is assigned; otherwise a score of 55 is assigned.

In a similar way, if a customer has an account with U+ bank, a score of 82 is assigned. Otherwise, a score of 10 is assigned.

The combiner function is used to combine the total sum of score values between conditions.

Now that the bank has identified predictors and assigned a score to a range of values the predictor has, let’s see the results of the scorecard.

The output of a scorecard is a score and a segment result.

First, you will see how to calculate a customer’s credit score using the scorecard.

Let’s consider an example in which the customer lifetime value is 350, the customer’s age is 35, and the customer has a U+ Bank account.

Since the customer lifetime value is 350, he gets a score of 221. For his age, he gets a score of 217, and since he has a U+ bank account, he gets a score of 82. The sum of these three individual scores is 520, representing his final credit score.

The scorecard outputs a score as well as a segment result.

To process loan requests, the bank has defined three result values. If the credit score is less than or equal to 400, the result is Not Approved. If the credit score value is between 401 and 600, the result is Refer to Manager. If the credit score is higher than 600, the result is Approved. So, the higher a customer’s credit score, the better his/her chances of getting a loan approved.

Let’s consider the profiles of three customers applying for home loans.

Customer A has a customer lifetime value of 150, their age is 18, and they don’t have a U+ Bank account. Therefore, their credit score is 252, and the segment result is Not Approved, because their credit score value is less than 400. This means they do not qualify for a loan.

Customer B has a different profile, and their credit score is 415, so the segment result is Refer to Manager, because their credit score value is between 401 and 600. This means their application needs further review.

Customer C has a credit score of 649, which is higher than 600, so he is eligible to get a loan right away.

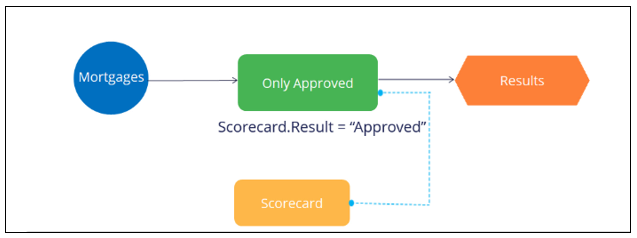

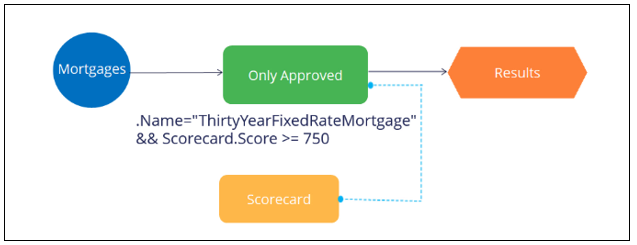

Now that you learned about the scorecard and its results, let’s see how to use the scorecard segmentation in a decision strategy.

To use a Scorecard in a decision strategy, use the Scorecard component. The Scorecard component outputs the result, in this case Not Approved, Refer to Manager, or Approved, which you can use in your decision strategy.

The scorecard also outputs the raw score value, this score value can be used directly in the decision strategy.

In summary, the scorecard is a mathematical model that computes a score and outputs a segmentation result based on a set of conditions and a combiner function. The scorecard’s score and segmentation result can be used directly in a decision strategy using the Scorecard decision component.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?