Using a scorecard in a decision strategy

Introduction

Learn how to use the segmentation result and the score value from a scorecard in a decision strategy. Learn how suitability rules can be defined to reflect the bank’s requirements using a decision strategy.

Video

Transcript

This demo will show you how to use a Scorecard in a decision strategy to determine customer suitability for a credit card.

Currently, U+ Bank is doing cross-sell on the web by showing various credit cards to its customers.

The bank wants to implement a new requirement: All credit cards are suitable only for customers who have a credit score greater than or equal to 250.

To implement this requirement, use an Engagement Strategy.

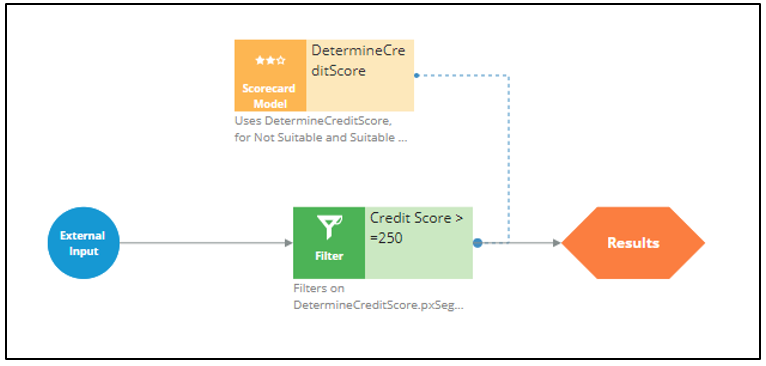

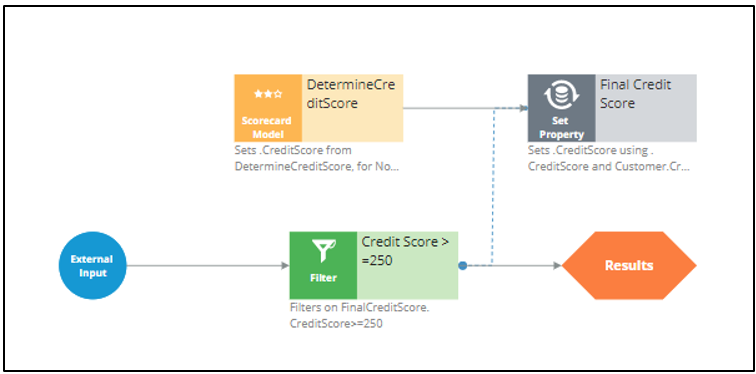

U+ already created a Scorecard that computes the customer credit score. To use the Scorecard in the decision strategy, add a Scorecard component to the canvas and configure it.

Select the Scorecard model DetermineCreditScore, which U+ already created.

If you open this Scorecard, you can see how the credit score is computed. Note that the 3 customer properties are used and a score is assigned to the value or range of values the property can have.

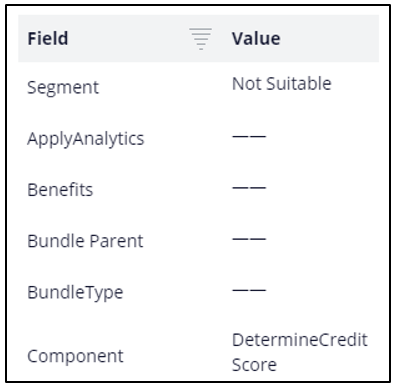

You can also see the segment results. The Scorecard returns value Not Suitable if the credit score is less than 250. Otherwise, it outputs the result Suitable.

To implement the new requirement, use a Filter component to express the condition under which the Actions are suitable.

You want this strategy to output something only if the result of the scorecard is “Suitable”. The result of the Scorecard is stored in the pxSegment property. Therefore, set the Filter condition to DetermineCreditScore.pxSegment==”Suitable”.

If the result of the Scorecard is Not Suitable, this strategy has no results.

Note that to reference a property from a component that is not connected to the Filter component, use the <ComponentName>.<PropertyName> construct.

Note that the usage of the External Inputs component also gives you the ability to create more complex conditions, where Action attributes are also used.

Save the configurations.

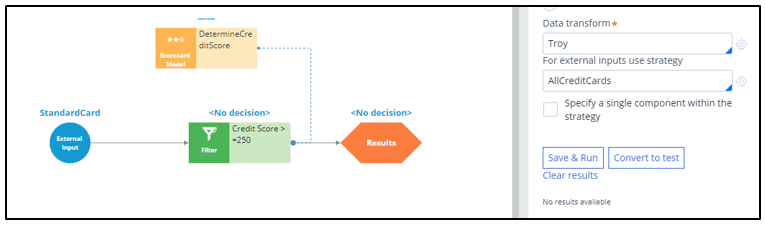

Now, test the strategy using the customer profiles, Troy and Robert.

For external inputs, consider all credit cards available.

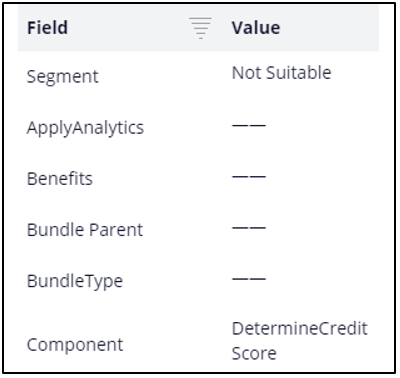

The result of the Scorecard is: Not Suitable. Therefore, the strategy did not output any results for Troy.

Now, repeat the test to verify results for the Robert data transform.

The strategy is also not outputting any results for Robert, as the Segment value is Not Suitable.

Now, assume the credit score value for customers is already computed and presented in the Customer data model. However, this value is not set for certain customers, in which case you want to use the credit score determined by the Scorecard itself.

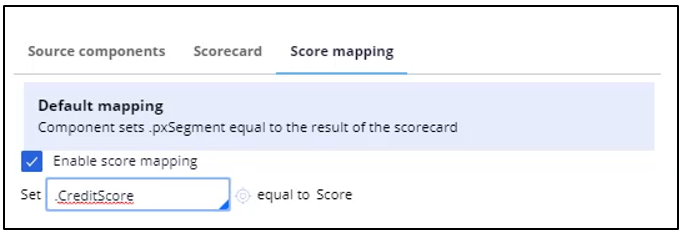

To make these adjustments, start by opening the Scorecard component and mapping the score computed by the Scorecard to the CreditScore property.

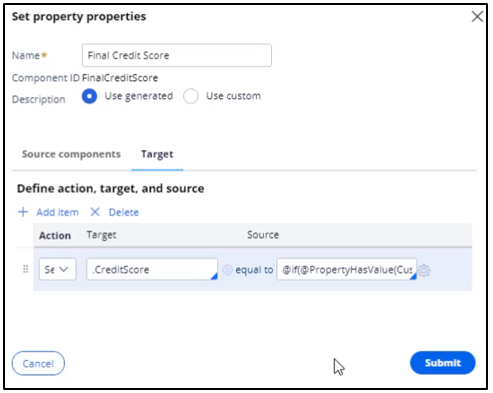

Then, add a Set Property component to determine the actual value of the credit score, given that the credit score is already available for certain customers.

Use ‘Add item’ to set the CreditScore to either the available credit score value from the Customer data model, or to the value computed by the Scorecard.

Define the Expression as if(@PropertyHasValue(Customer.CreditScore), Customer.CreditScore, .CreditScore).

If set, this Expression will result in the credit score from the Customer data model. If not, the credit score value will be computed by the Scorecard.

Once the Set Property component is configured, open the Filter component properties to modify the Filter condition. In this scenario, the bank has decided to present various credit cards to suitable customers who have credit scores greater than or equal to 250.

So, open the ‘Expression builder’ to modify the condition as FinalCreditScore.CreditScore>=250.

Now, connect the Scorecard Model component to the Set Property component to ensure the CreditScore value determined by the Scorecard is copied to the Set Property component.

Save the configurations.

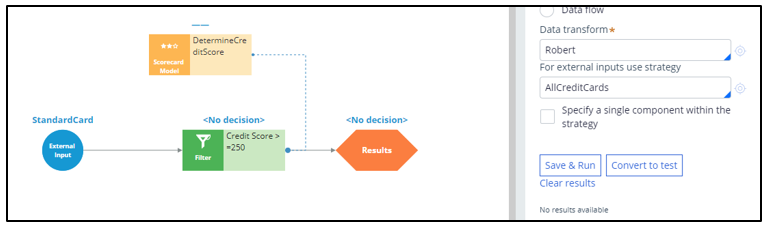

Re-test the strategy for the Troy and Robert data transforms.

Note that the strategy is not outputting any results for Troy, as his credit score, 200, is less than 250.

For Robert, the strategy is outputting results.

If you open the Robert data transform, note that the CreditScore in the data model is set to 600.

The Set Property component picks up the credit score value available in the data model (that is, CreditScore = 600) and not the value computed by the Scorecard (CreditScore = 200). That is why the strategy is outputting results for Robert.

Since you have completed configuring the strategy, check it in, so that the strategy will be available to the U+ bank website.

You can now configure this strategy in the Next-Best-Action Designer Engagement Policy as a suitability condition for the Group-level Suitability rules.

Select the strategy. The condition is: Credit Score has results for the Credit Score >=250.

Saving this completes all the required configurations.

On the U+ bank website, if you log in as Troy, notice that no credit card offer is displayed. This is because no credit cards are suitable for Troy.

Now, if you log in as Robert, notice that the credit card offer is displayed.

This is because credit cards are suitable for Robert.

This demo has concluded. What did it show you?

- How to use the segmentation result and the score value of a Scorecard in a decision strategy.

- How to use the PropertyHasValue function to check if a Customer property has value or not.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?